GBP/JPY Daily Outlook

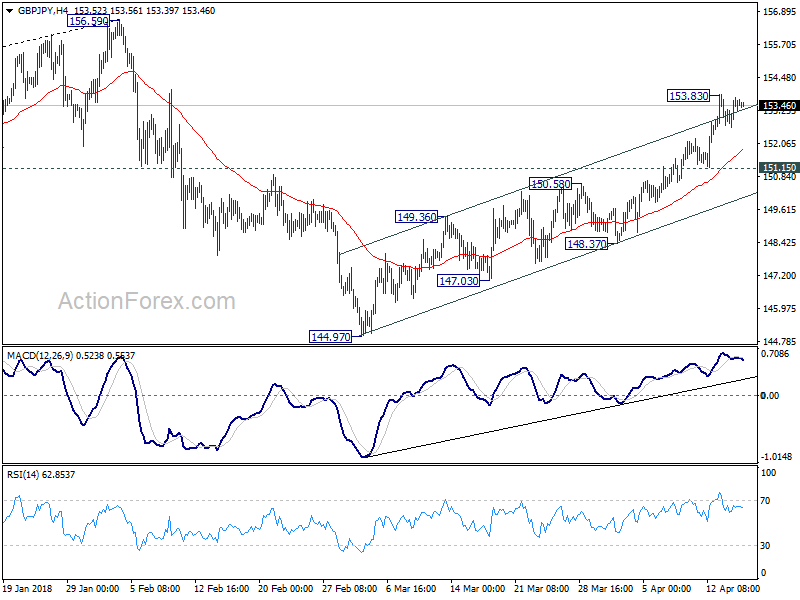

Daily Pivots: (S1) 152.89; (P) 153.32; (R1) 154.00

GBP/JPY is staying in consolidation below 153.83 temporary top and intraday bias remains neutral first. In case of another retreat, downside should be contained by 151.15 minor support to bring rise resumption. Above 153.83 will extend the rally from 144.97 and target to retest 156.96 high. However, break of 151.15 will suggest that such rebound from 144.97 has completed and bring retest of this support.

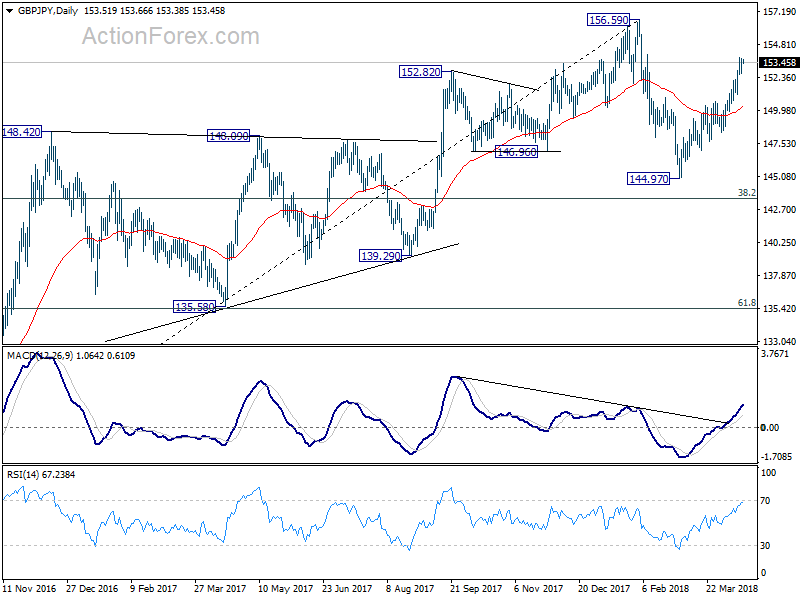

In the bigger picture, price actions from 156.59 are viewed as a corrective pattern. For now, we’d expect at least one more fall for 38.2% retracement of 122.36 to 156.59 at 143.51 before the consolidation completed. Though, firm break of 156.59 will resume whole up trend from 122.36 (2016 low) to 50% retracement of 195.86 (2015high) to 122.36 at 159.11 next.

EUR/JPY Daily Outlook

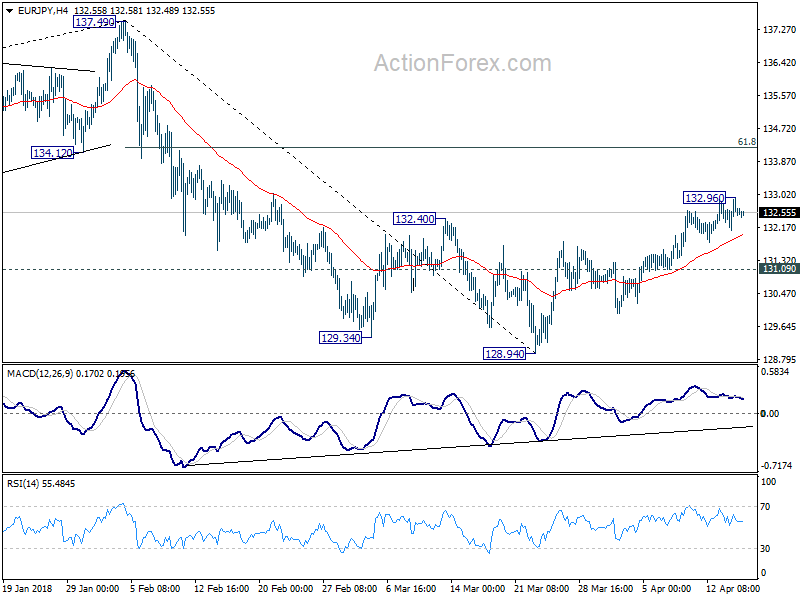

Daily Pivots: (S1) 132.14; (P) 132.56; (R1) 133.00

EUR/JPY edged higher to 132.96 but upside momentum is unconvincing as seen in 4 hour MACD. Intraday bias stays neutral first. In case of another retreat, downside should be contained by 131.09 minor support to bring rebound resumption. Above 132.96 will extend the rebound from 128.94 to 61.8% retracement of 137.49 to 128.94 at 134.22 and above. On the downside, below 131.09 will indicate that the rebound is completed and bring retest of 128.94 low instead.

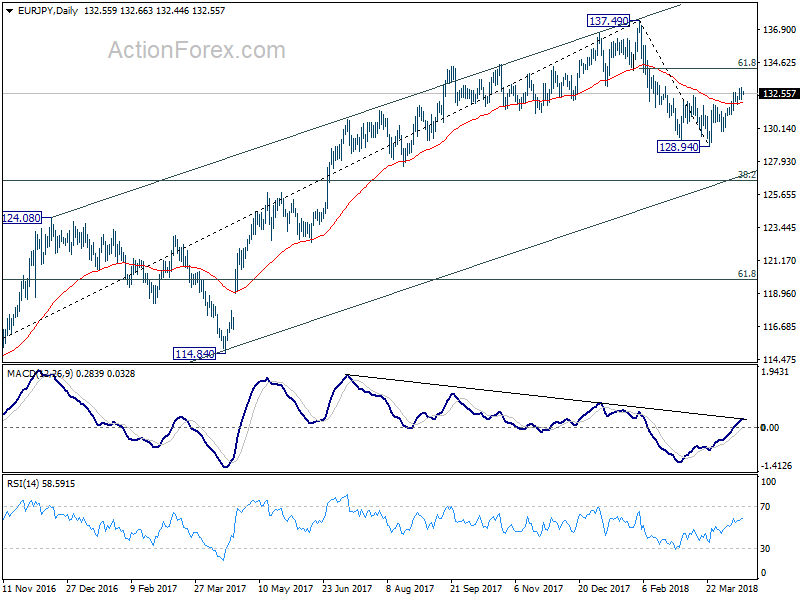

In the bigger picture, price action from 137.49 medium term top are developing into a corrective pattern. Strong support from 55 week EMA (now at 129.91) suggests that the first leg has completed at 128.94 already. Nonetheless, break of 137.49 is needed to confirm resumption of the rise from 109.03 (2016 low). Otherwise, we’d expect more corrective range trading, with risk of another fall to 38.2% retracement of 109.03 to 137.49 at 126.61 before completion.