GBP/JPY Daily Outlook

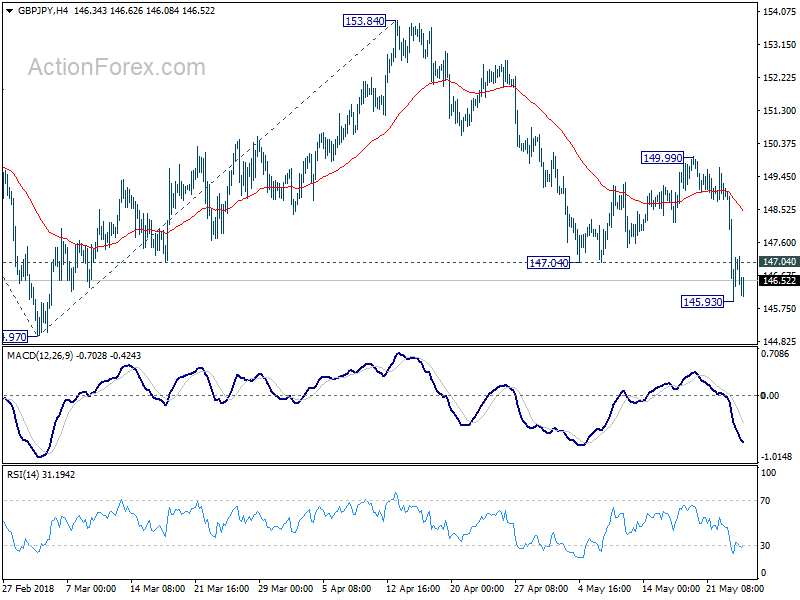

Daily Pivots: (S1) 145.59; (P) 147.31; (R1) 148.68;

A temporary low is in place at 145.93 after breaching 147.04 resistance. Intraday bias in GBP/JPY is turned neutral first, for some consolidations. but upside of recovery should be limited well below 149.99 resistance to bring fall resumption. Below 145.93 will target 144.97 low first. Break there will resume the fall from 156.59 and target 100% projection of 156.59 to 144.97 from 153.84 at 142.22 next.

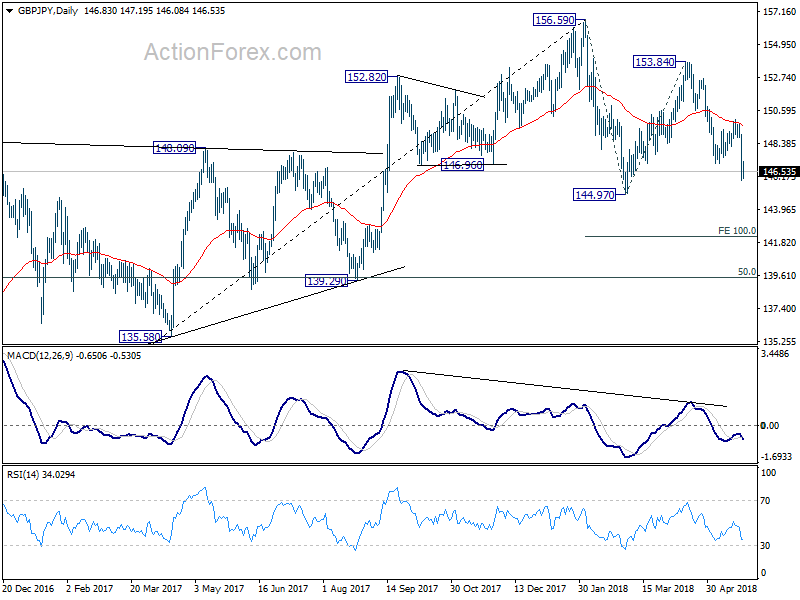

In the bigger picture, for now, we’re treating price actions from 156.59 as a corrective move. Therefore, while deeper fall is expected, strong support should be seen above 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) to contain downside and bring rebound. There is still prospect of extending the rise from 122.36. However, considering that GBP/JPY failed to sustain above 55 month EMA (now at 153.94), firm break of 139.29 will confirm trend reversal and turn outlook bearish.

EUR/CHF Daily Outlook

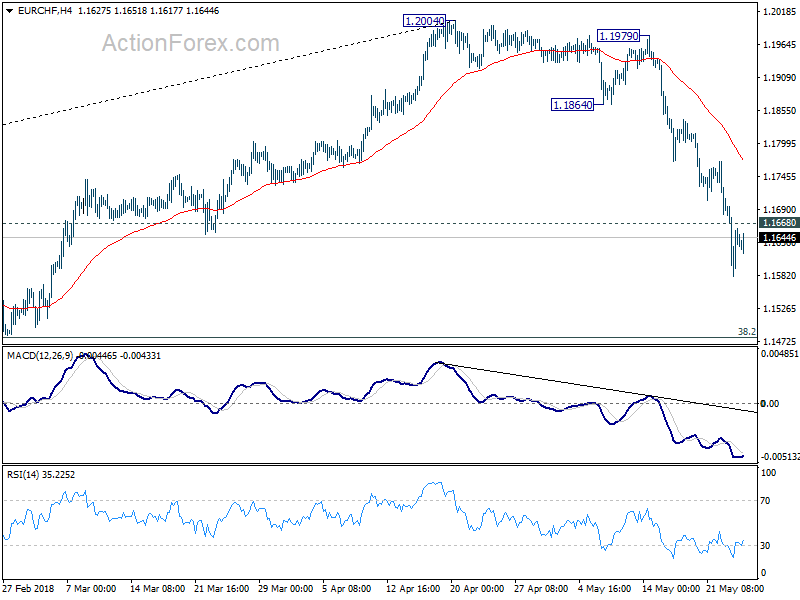

Daily Pivots: (S1) 1.1584; (P) 1.1644; (R1) 1.1706;

Intraday bias in EUR/CHF remains on the downside with 1.1668 minor resistance intact. Current fall from 1.2004 should target key support level at 1.1445. We’d expect strong support from here to bring rebound, at least, on first attempt. On the upside, above 1.1668 minor resistance will turn bias neutral and bring consolidations first, before staying another fall.

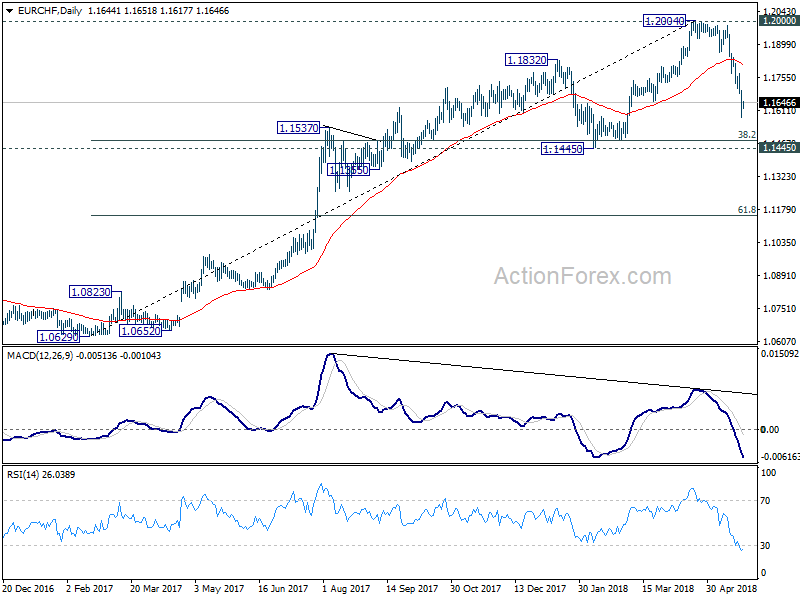

In the bigger picture, current development suggests solid rejection by prior SNB imposed floor at 1.2000. Considering bearish divergence condition in daily MACD, 1.2004 could be a medium term top. And price action from 1.2004 is correcting the up trend from 1.0629. Hence, for now, deeper fall could be seen back to 1.1445, which is close to 38.2% retracement of 1.0629 to 1.2004 at 1.1479. We’d expect strong support from there to bring rebound to extend the medium term corrective pattern.