GBP/USD Daily Outlook

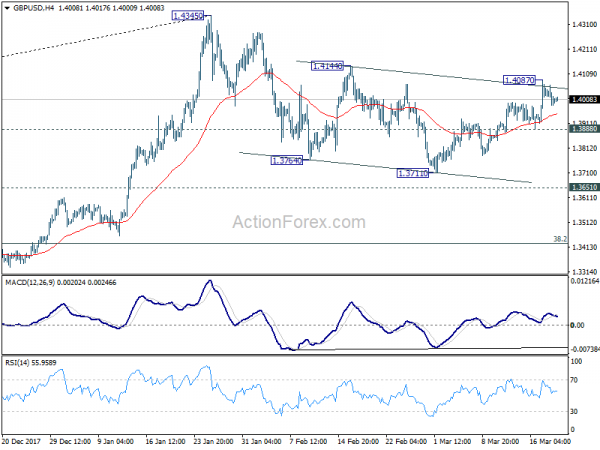

Daily Pivots: (S1) 1.3964; (P) 1.4015; (R1) 1.4048; .

Intraday bias in GBP/USD stays neutral for consolidation below 1.4087 temporary top. With 1.3888 minor support intact, further rise is expected in the pair. As noted before, correction from 1.4345 could have completed at 1.3711 already. Above 1.4087 will target 1.4144 resistance first. Firm break there should confirm this bullish view and target 1.4345 and above. On the downside, however, break of 1.3888 minor support will dampen this bullish view. Intraday bias would be turned back to the downside to extend the decline from 1.4345 through 1.3711 instead.

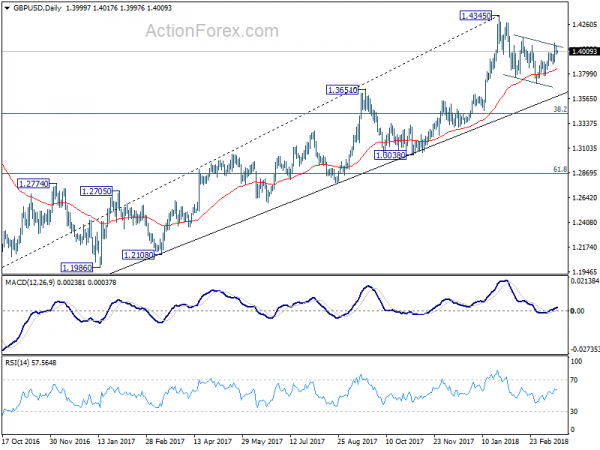

In the bigger picture, as long as 1.3038 support holds, medium term outlook in GBP/USD will remains bullish. Rise from 1.1946 is at least correcting the long term down from 2007 high at 2.1161. Further rally would be seen back to 38.2% retracement of 2.1161 (2007 high) to 1.1946 (2016 low) at 1.5466. However, GBP/USD fails to sustain above 55 month EMA (now at 1.4259) so far. Break of 1.3038 support, will suggest that rise from 1.1946 has completed and will turn outlook bearish for retesting this low.

USD/CHF Daily Outlook

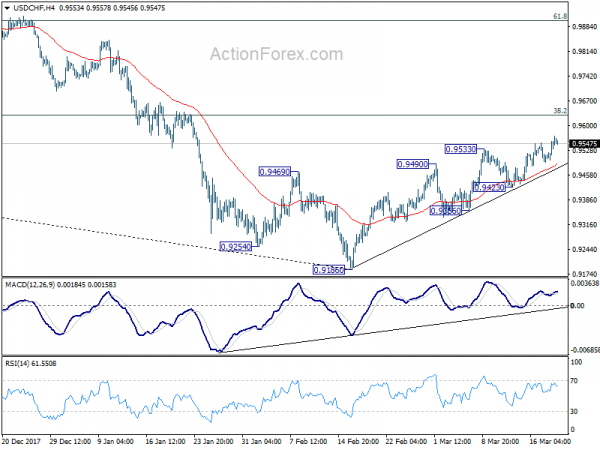

Daily Pivots: (S1) 0.9520; (P) 0.9544; (R1) 0.9588;

Intraday bias in USD/CHF remain son the upside as rebound from 0.9186 is in progress. Further rise should be see to 0.9626 fibonacci level. We’d be cautious on strong resistance from 0.9626 to limit upside. Nonetheless, sustained break of 0.9626 will carry larger bullish implications. On the downside, break of 0.9423 will indicate completion of the rebound from 0.9186. And intraday bias would then be turned back to the downside for 0.9356 support and below.

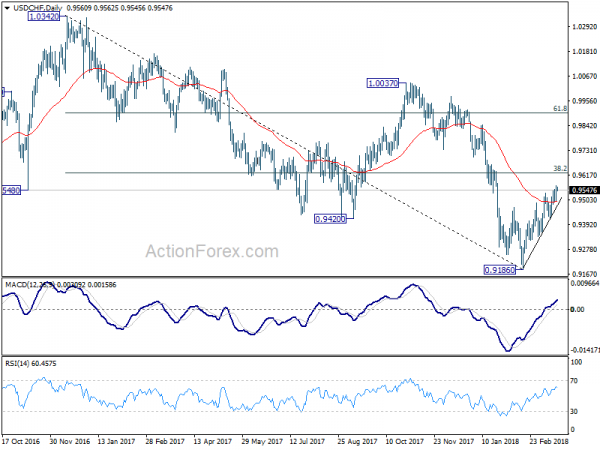

In the bigger picture, fall from 1.0342 is seen as a medium term down trend. Current development is raising the chance that it is completed. But there is no confirmation yet. Focus will now be back on 38.2% retracement of 1.0342 (2016 high) to 0.9186 (2018 low) at 0.9626. Sustained break there will add much credence to the case of trend reversal and target 61.8% retracement at 0.9900 and above. However, rejection from 0.9626 will maintain medium term bearishness for another low below 0.9186.