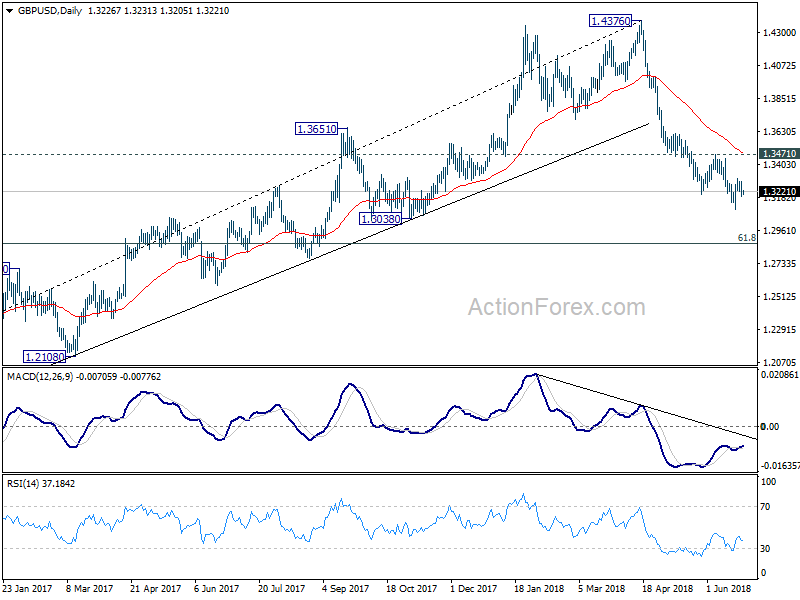

GBP/USD Daily Outlook

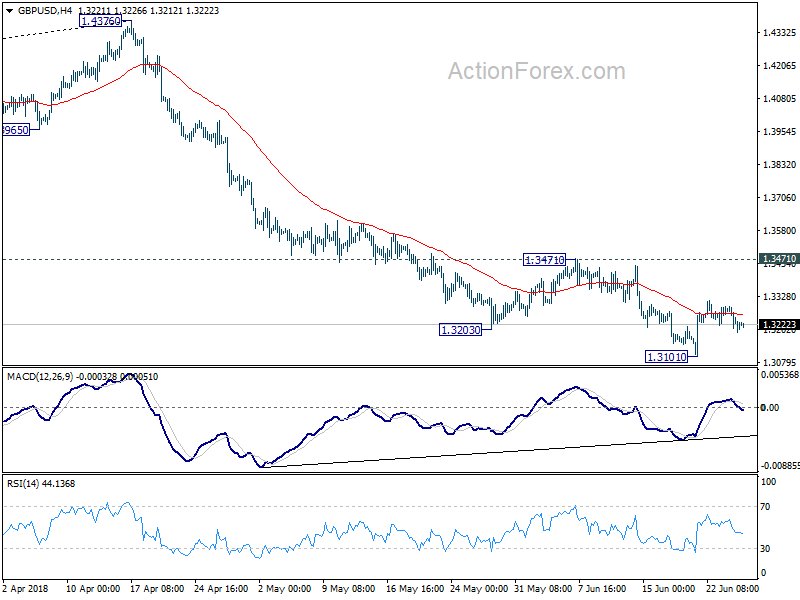

Daily Pivots: (S1) 1.3176; (P) 1.3240; (R1) 1.3287;

Intraday bias in GBP/USD remains neutral at this point. Correction from 1.3101 could extend with another rise. But we’d expect strong resistance from 1.3471 to limit upside. On the downside, break of 1.3101 will resume fall from 1.4376 and target 61.8% retracement of 1.1946 to 1.4376 at 1.2875 next.

In the bigger picture, current development suggests that whole medium term rebound from 1.1936 (2016 low) has completed at 1.4376 already, with trend line broken firmly, on bearish divergence condition in daily MACD, after rejection from 55 month EMA (now at 1.4177). 61.8% retracement of 1.1936 (2016 low) to 1.4376 at 1.2874 is the next target. We’ll pay attention to the reaction from there to asses the chance of long term down trend resumption. For now, outlook will stay bearish as long as 55 day EMA (now at 1.3490) holds, even in case of strong rebound.

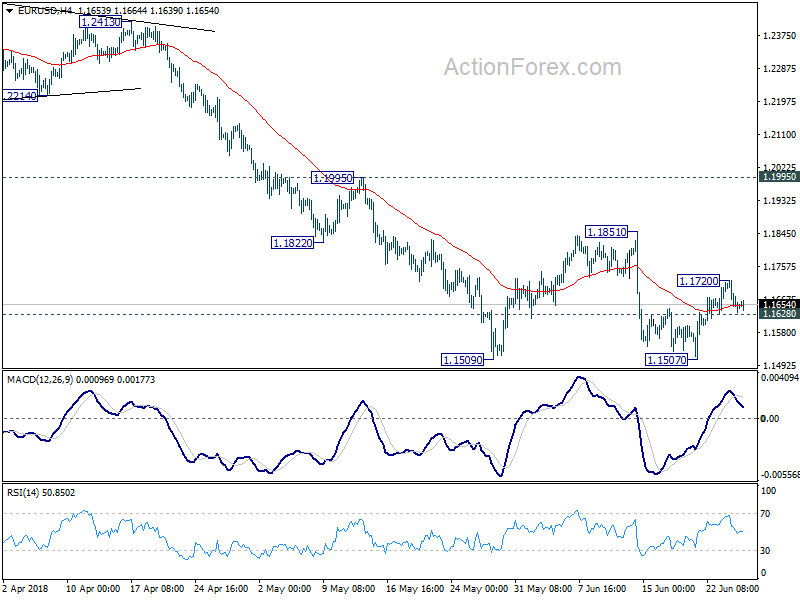

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1616; (P) 1.1668 (R1) 1.1702;

Intraday bias in EUR/USD remains neutral for the moment. In case the rebound from 1.1507 extends, upside should be limited by 1.1851 resistance to bring fall resumption eventually. On the downside, below 1.1628 will bring retest of 1.1507 first. Break will resume the whole fall from 1.2555 through 50% retracement of 1.0339 to 1.2555 at 1.1447 to 61.8% retracement at 1.1186.

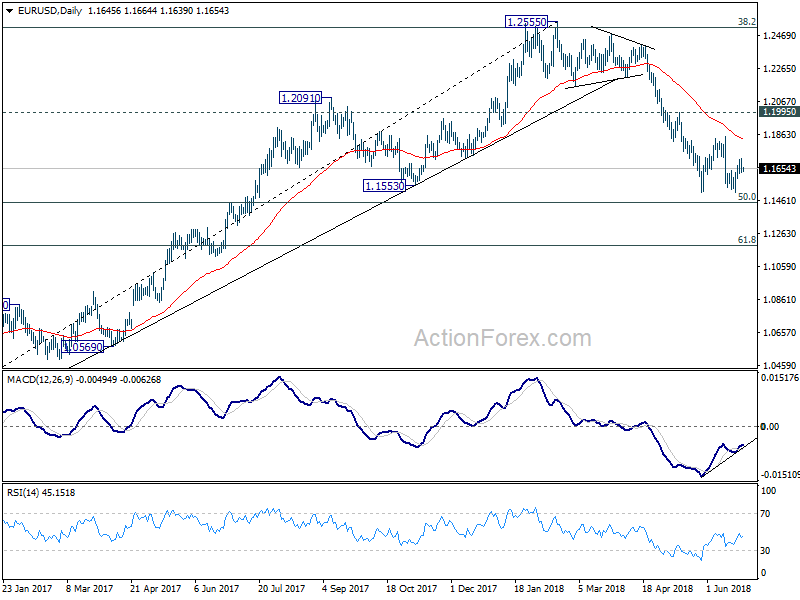

In the bigger picture, current development suggests that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.