GBP/USD Daily Outlook

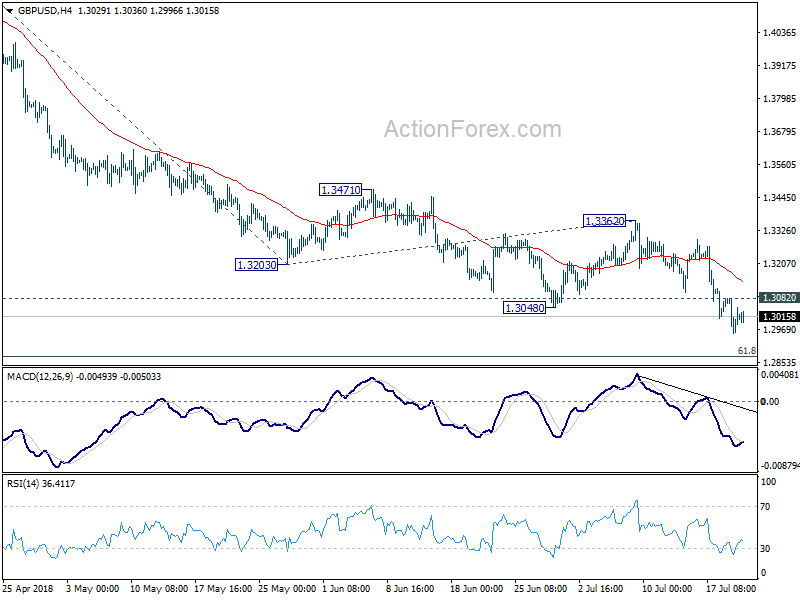

Daily Pivots: (S1) 1.2953; (P) 1.3019; (R1) 1.3079;

Intraday bias in GBP/USD remains on the downside with 1.3082 minor resistance intact. Current fall should target 61.8% projection of 1.4376 to 1.3203 from 1.3362 at 1.2637 next. On the upside, above 1.3082 minor resistance will turn intraday bias neutral and bring consolidations first. But recovery should be limited well below 1.3362 resistance to bring fall resumption.

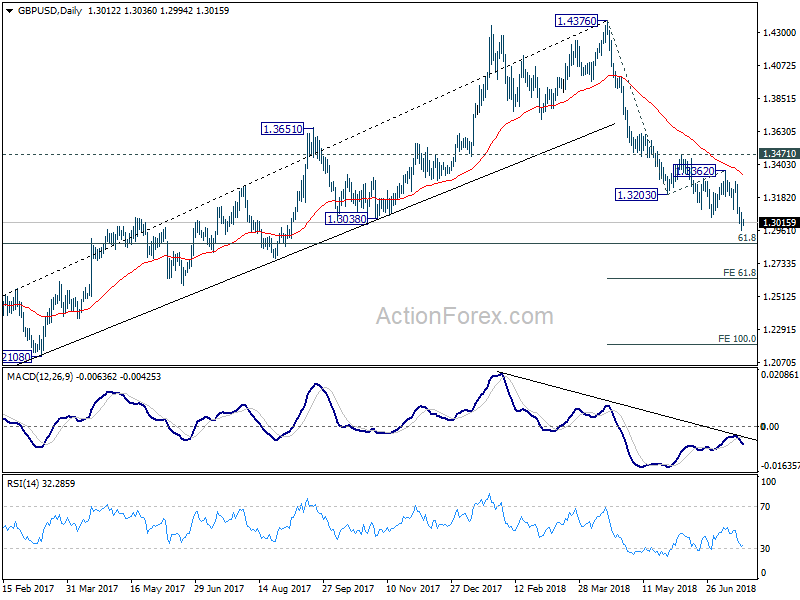

In the bigger picture, whole medium term rebound from 1.1946 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4179). Fall from 1.4376 should extend to 61.8% retracement of 1.1946 (2016 low) to 1.4376 at 1.2874 next. Decisive break of 1.2874 will raise the chance of long term down trend resumption through 1.1946 low. On the upside, break of 1.3471 resistance is needed to be the first indication of medium term bottoming. Otherwise, outlook will remain bearish even in case of strong rebound.

EUR/USD Daily Outlook

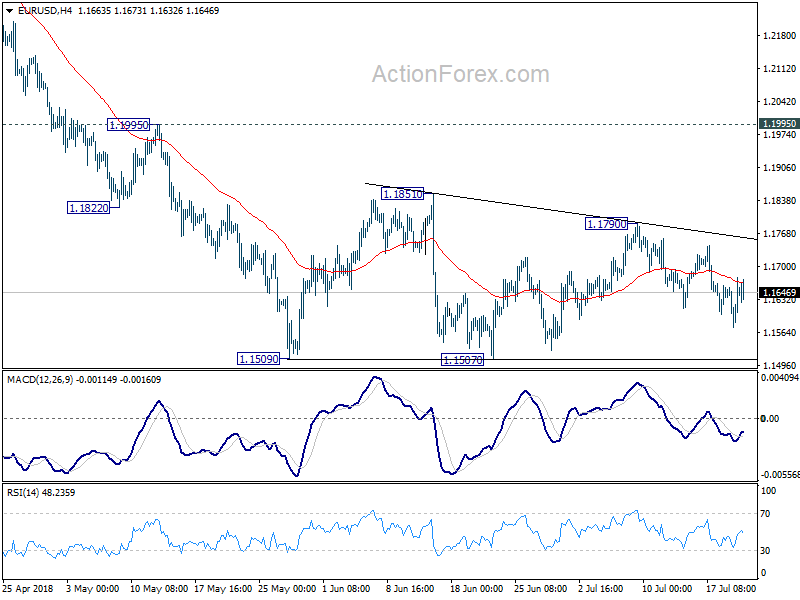

Daily Pivots: (S1) 1.1586; (P) 1.1631 (R1) 1.1688;

EUR/USD lost downside momentum again as seen in 4 hour MACD. Intraday bias is turned neutral gain. Overall outlook remain bearish and downside breakout is expected, sooner or later. Firm break of 1.1507 will resume whole decline from 1.2555, through 50% retracement of 1.0339 to 1.2555 at 1.1447 to 61.8% retracement at 1.1186. On the upside, in case of another rise as consolidation extends, upside should be limited by 1.1851 resistance to bring fall resumption eventually.

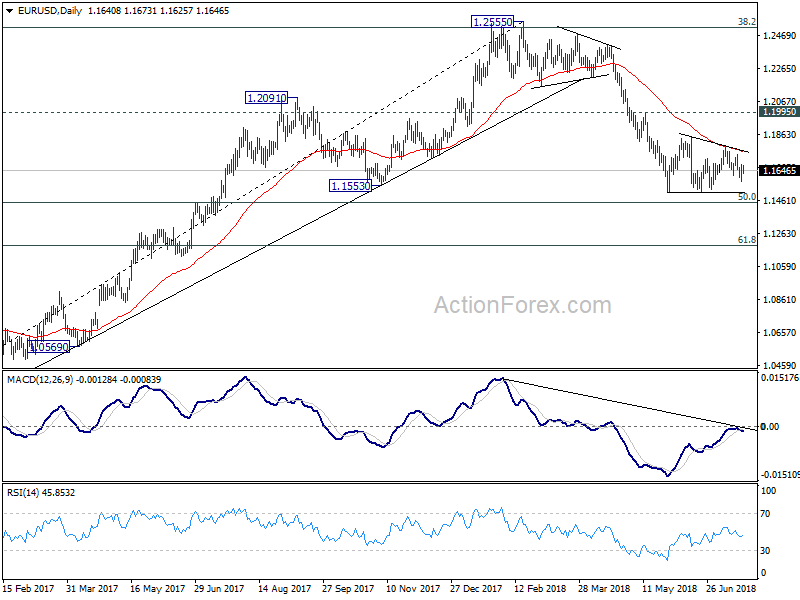

In the bigger picture, EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.