GBP/USD Daily Outlook

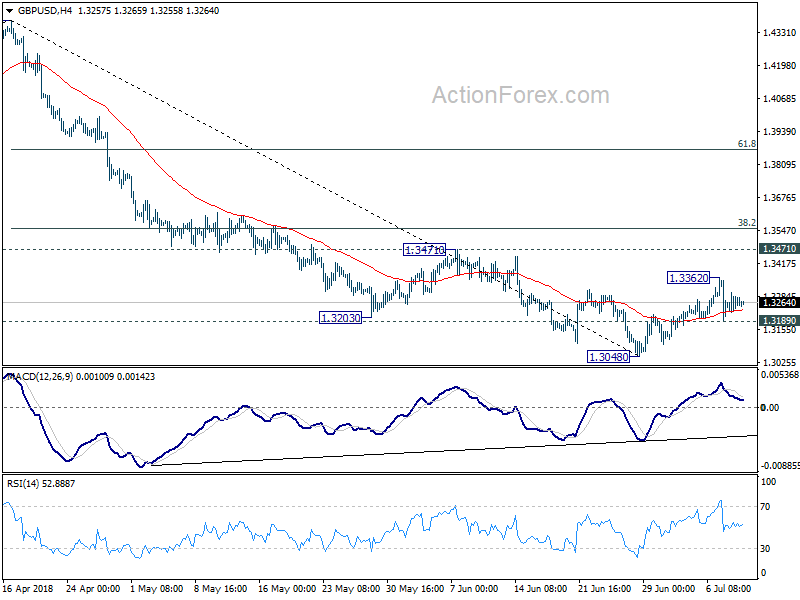

Daily Pivots: (S1) 1.3221; (P) 1.3275; (R1) 1.3325;

GBP/USD is staying in tight range of 1.3189/3362 and intraday bias stays neutral for the moment. On the downside, break of 1.3189 minor support should confirm that corrective rise from 1.3048 has completed at 1.3362. And intraday bias will be turned to the downside for 1.3048 first. Break will resume larger fall from 1.4376 for 1.2874 fibonacci level next. In case of another rise through 1.3362, we’d expect strong resistance from 1.3471 to limit upside to finish the corrective rebound.

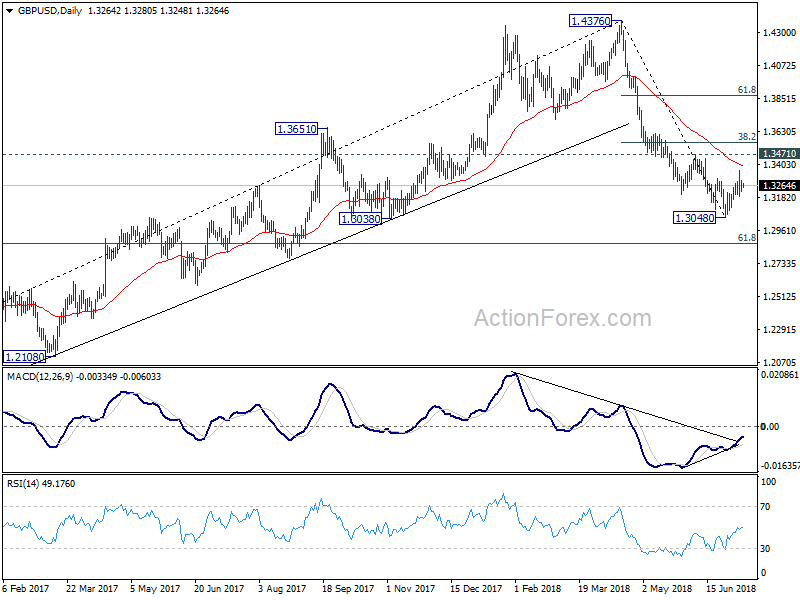

In the bigger picture, whole medium term rebound from 1.1936 (2016 low) should have completed at 1.4376 already, after rejection from 55 month EMA (now at 1.4179). Fall from 1.4376 should extend to 61.8% retracement of 1.1936 (2016 low) to 1.4376 at 1.2874 next. We’ll pay attention to the reaction from there to asses the chance of long term down trend resumption. On the upside, sustained break of 38.2% retracement of 1.4376 to 1.3048 at 1.3555 is needed to indicate medium term bottoming. Otherwise, outlook will remain bearish in case of strong rebound.

EUR/CHF Daily Outlook

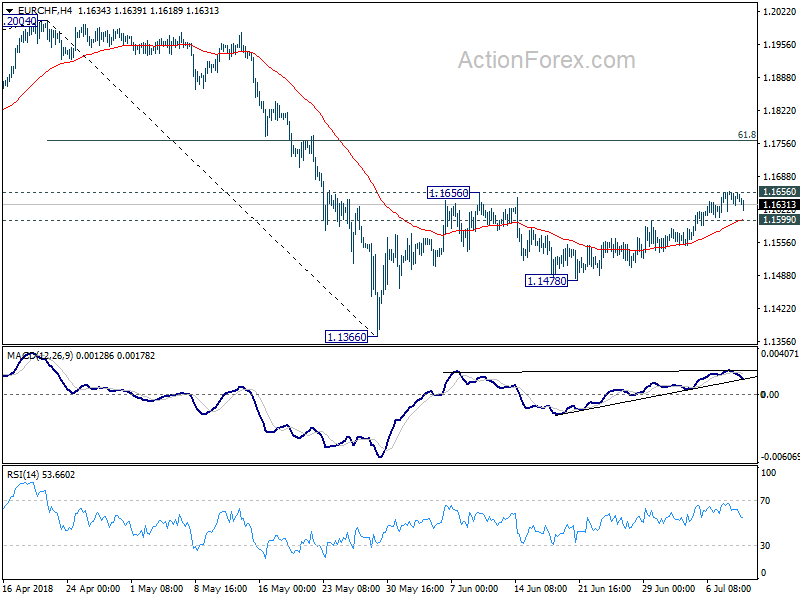

Daily Pivots: (S1) 1.1634; (P) 1.1648; (R1) 1.1664;

Intraday bias in EUR?CHF remains neutral at this point. On the downside, break of 1.1599 minor support will suggest that rebound from 1.1478 is completed. And bias will be turned back to the downside for 1.1478 and then a test on 1.1366 short term bottom. On the upside, firm break of 1.1656 will resume the corrective rise from 1.1366 to 61.8% retracement of 1.2004 to 1.1366 at 1.1760. But we would expect strong resistance from there to limit upside.

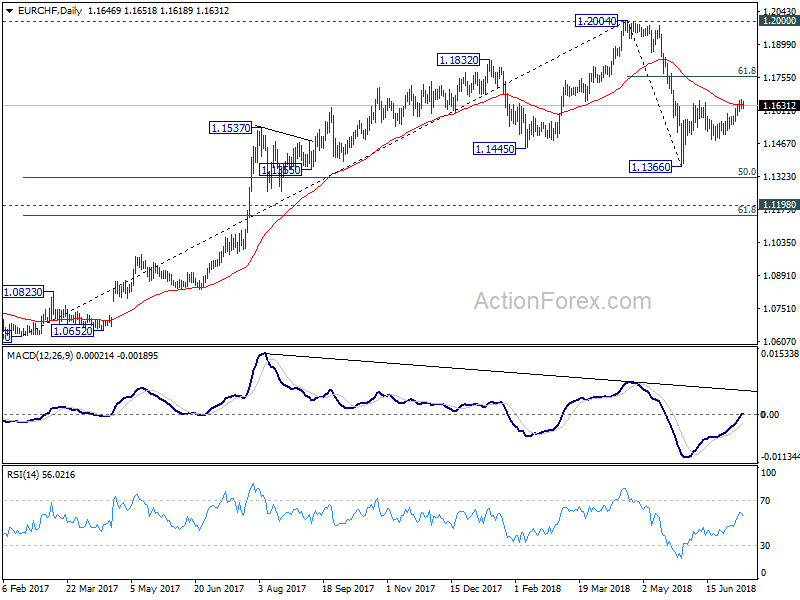

In the bigger picture, EUR/CHF was solidly rejected by prior SNB imposed floor at 1.2000. Considering bearish divergence condition in daily and weekly MACD, 1.2004 should be a medium term top. And price action from 1.2004 is correcting the up trend from 1.0629. Such correction is expected to extend for a while and therefore, we’re not anticipating a break of 1.2004 in near term. Another decline cannot be ruled out yet. But in that case, strong support should be seen at 1.1198 (2016 high), 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to contain downside.