GBP/JPY Daily Outlook

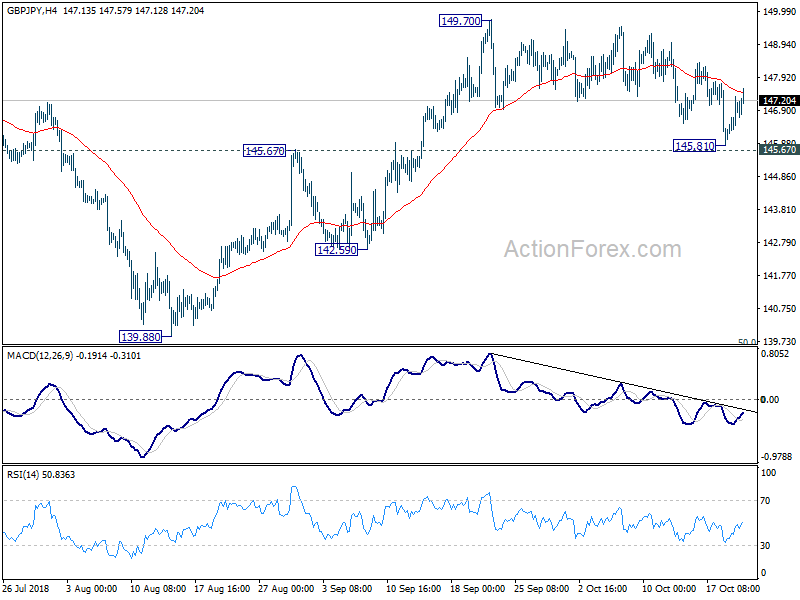

Daily Pivots: (S1) 146.28; (P) 146.77; (R1) 147.53;

Intraday bias in GBP/JPY remains mildly on the upside at this point. Corrective pull back from 149.70 could have completed at 145.81, ahead of 145.67 key support. Break of 149.70 will confirm resumption of whole rise from 139.88. However, firm break of 145.67 will suggest that the rebound from 139.88 has completed and turn near term outlook bearish again.

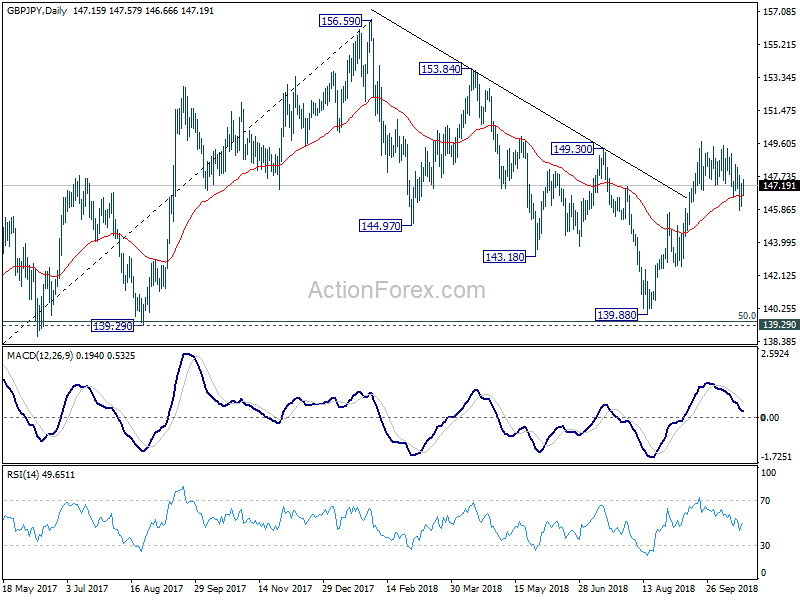

In the bigger picture, current development suggests that GBP/JPY has successfully defended 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47). And, the rally from 122.36 (2016 low) is still intact. Such medium to long term rise would extend through 156.96 high. This will now be the preferred case as long as 145.67 near term support holds. However, break of 145.67 will turn focus back to 139.29/47 key support zone.

EUR/USD Daily Outlook

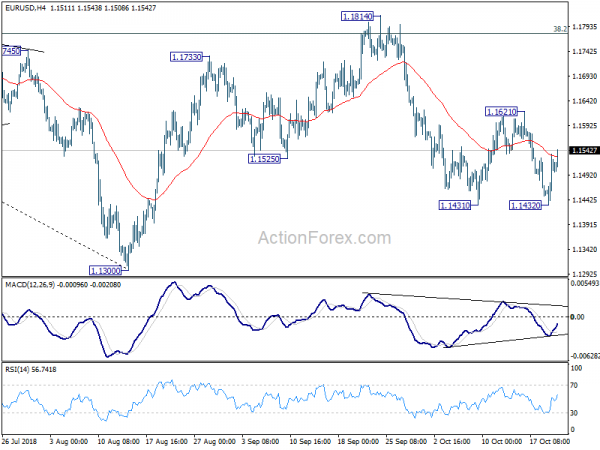

Daily Pivots: (S1) 1.1454; (P) 1.1494; (R1) 1.1556;

EUR/USD’s rebound from 1.1432 extends higher today. While further rise could be seen, near term outlook will still remain mildly bearish as long as 1.1621 resistance holds. On the downside, break of 1.1431 will resume the fall form 1.1814 to retest 1.1300 low. Nonetheless, break of 1.1621 will turn focus back to 1.1814 instead.

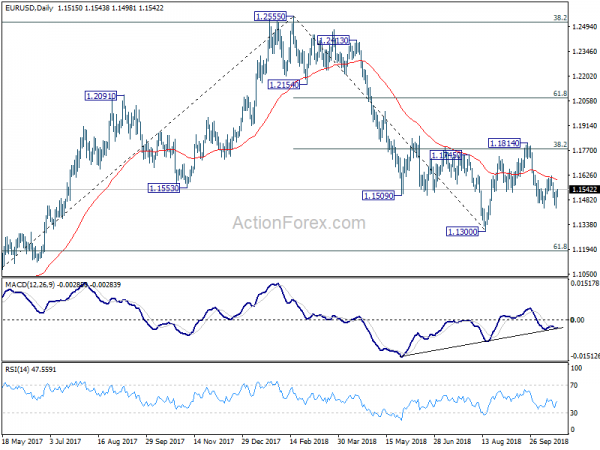

In the bigger picture, corrective pattern from 1.1300 could have completed at 1.1814 after hitting 38.2% retracement of 1.2555 to 1.1300 at 1.1779. Decisive break of 1.1300 will resume the down trend from 1.2555 to 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1814 will delay the bearish case and extend the correction from 1.1300 with another rise before completion.