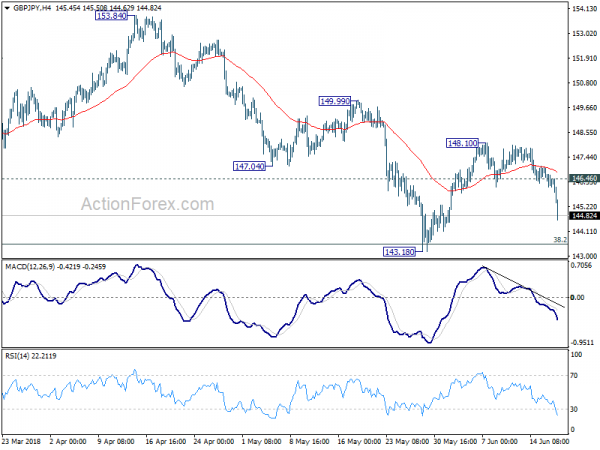

GBP/JPY Daily Outlook

Daily Pivots: (S1) 146.01; (P) 146.55; (R1) 146.99;

GBP/JPY’s decline accelerates to as low as 144.62 so far today. The solid break of 145.82 minor support indicates completion of the rebound from 143.18. Intraday bias is turned back to the downside for 143.18 low. Firm break there will resume larger decline from 156.59 and target 139.25/47 cluster support level. On the upside, break of 146.46 minor resistance is needed to indicate completion of the fall. Otherwise, deeper decline will now be in favor in case of recovery.

In the bigger picture, no change in the view that decline from 156.59 is a corrective move. In case of another fall, strong support should be seen above 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) to contain downside and bring rebound. Meanwhile, break of 153.84 should confirm that the correction is completed and target 156.59 and above to resume the medium term up trend.

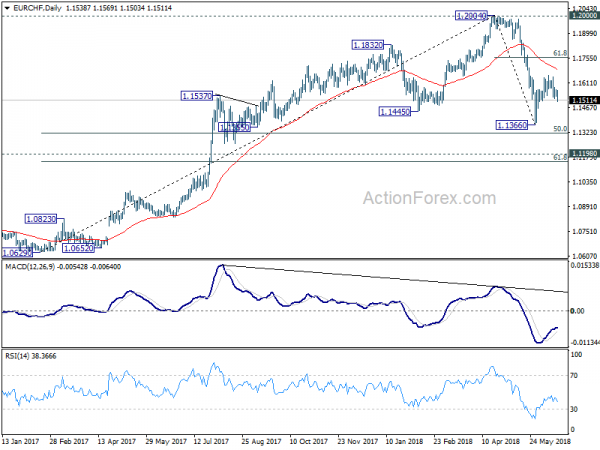

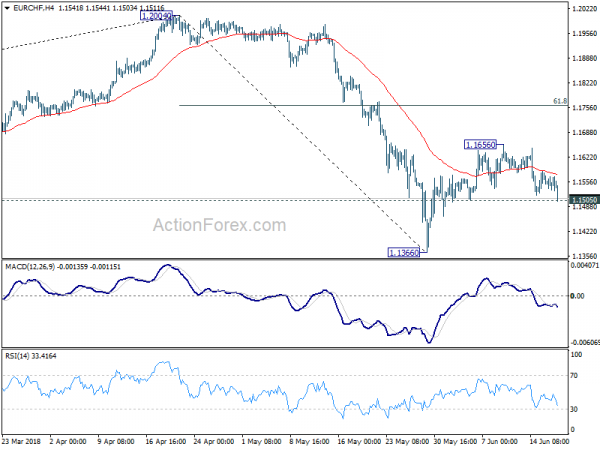

EUR/CHF Daily Outlook

Daily Pivots: (S1) 1.1533; (P) 1.1566; (R1) 1.1598;

Focus in EUR/CHF is now on 1.1505 minor support with the current fall. Break will confirm completion of the rebound from 1.1366. And, corrective pattern from 1.2004 would then extend with the third leg, through 1.1366 low. On the upside, above 1.1656 will extend the rebound from 1.1366. But upside should be limited by 61.8% retracement of 1.2004 to 1.1366 at 1.1760.

In the bigger picture, current development suggests solid rejection by prior SNB imposed floor at 1.2000. Considering bearish divergence condition in daily and weekly MACD, 1.2004 should be a medium term top. And price action from 1.2004 is correcting the up trend from 1.0629. Such correction is expected to extend for a while and therefore, we’re not anticipating a break of 1.2004 in near term. Another decline cannot be ruled out yet. But in that case, strong support should be seen at 1.1198 (2016 high), 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to contain downside.