GBP/JPY Daily Outlook

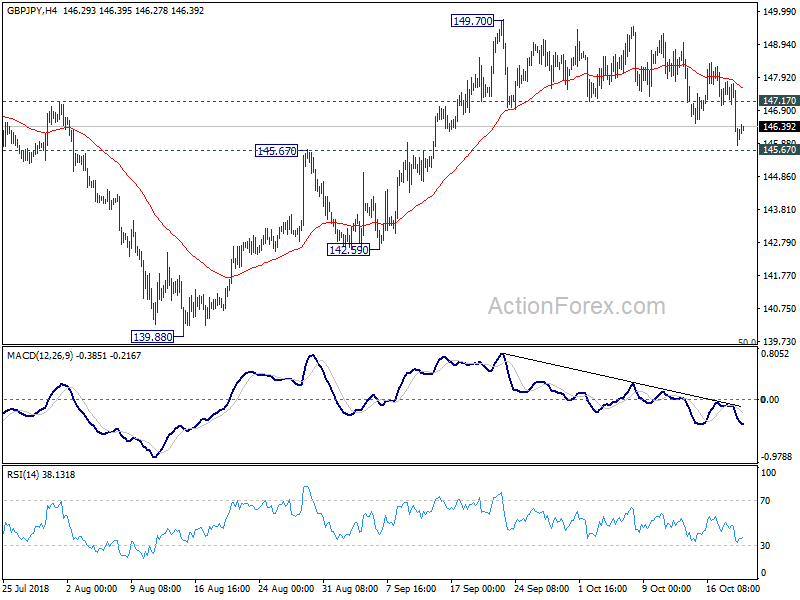

Daily Pivots: (S1) 145.27; (P) 146.58; (R1) 147.34;

GBP/JPY drops to as low as 145.81 so far and focus is now on 145.67 resistance turned support. Decisive break there will suggests that whole rebound form 139.88 has completed. In that case, near term outlook will be turned bearish for 139.88 low again. On the upside, though, above 147.17 minor resistance will reaffirm the case that price actions from 149.70 are merely corrective. And intraday bias will be turned back to the upside for retesting 149.70.

In the bigger picture, current development suggests that GBP/JPY has successfully defended 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47). And, the rally from 122.36 (2016 low) is still intact. Such medium to long term rise would extend through 156.96 high. This will now be the preferred case as long as 145.67 near term support holds. However, break of 145.67 will turn focus back to 139.29/47 key support zone.

AUD/USD Daily Outlook

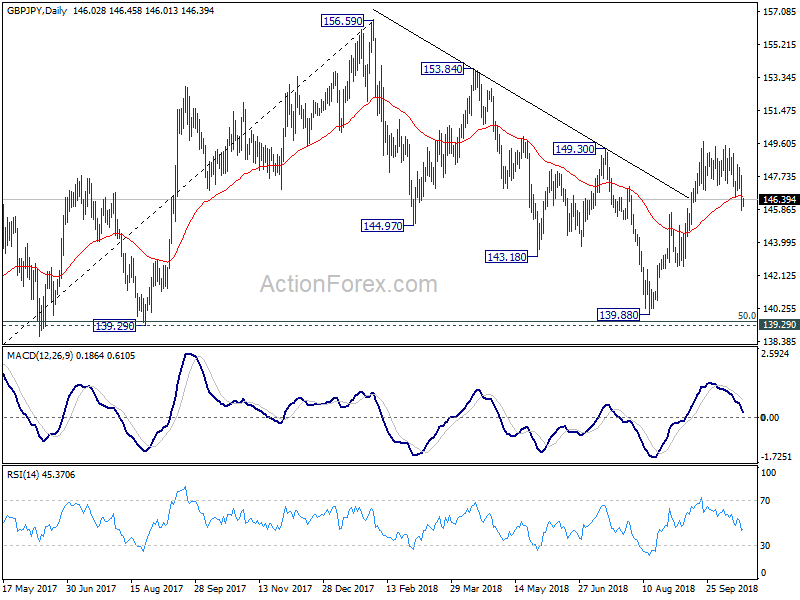

Daily Pivots: (S1) 0.7081; (P) 0.7116; (R1) 0.7136;

AUD/USD’s breach of 0.7098 minor support suggests that corrective rebound from 0.7040 has completed at 0.7159 already. Intraday bias is back on the downside for retesting 0.7040 low first. Break there will resume recent down trend to 61.8% projection of 0.7676 to 0.7084 from 0.7314 at 0.6948 next. On the upside, above 0.7159 will delay the bearish case and bring more consolidation first.

In the bigger picture, fall from 0.8135 is tentatively treated as resuming long term down trend from 1.1079 (2011 high). Decisive break of 0.6826 will target 0.6008 key support next (2008 low). However, break of 0.7500 support turned resistance will argue that the corrective pattern from 0.6826 is going to extend with another rising leg before completion.