EUR/USD Daily Outlook

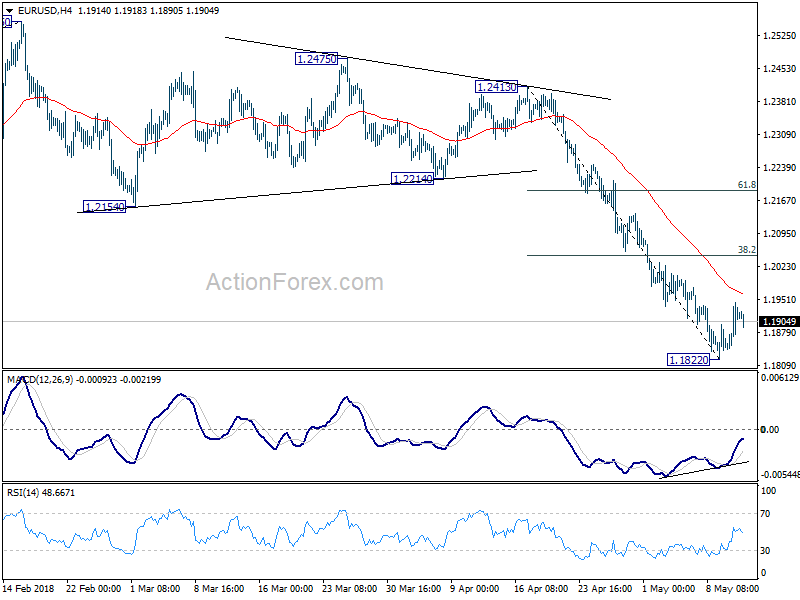

Daily Pivots: (S1) 1.1856; (P) 1.1901 (R1) 1.1960;

With a short term bottom formed at 1.1822, further rebound is in favor in EUR/USD for 4 hour 55 EMA (now at 1.1962) and above. However, upside should be limited by 38.2% retracement of 1.2413 to 1.1822 at 1.2048 to bring fall resumption. Below 1.1822 will resume the whole decline from 1.2555 and target 1.1708 medium term fibonacci level next.

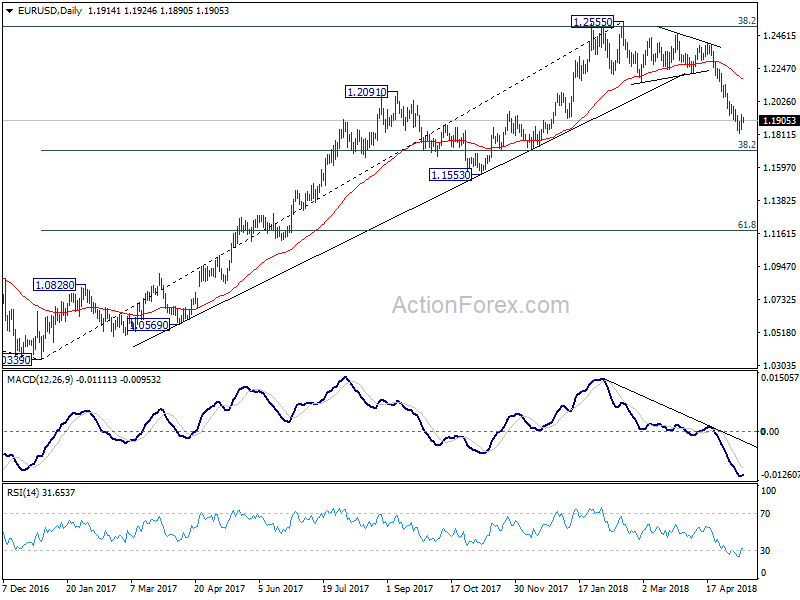

In the bigger picture, current decline and firm break of 1.2154 support confirms rejection by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. A medium term top should be in place at 1.2555 and deeper decline would be seen back to 38.2% retracement of 1.0339 to 1.2555 at 1.1708 first. With current downside acceleration, there is prospect of hitting 61.8% retracement at 1.1186 before completing the decline. But still, we’ll need to look at the structure before deciding if it’s a corrective or impulsive move.

USD/CHF Daily Outlook

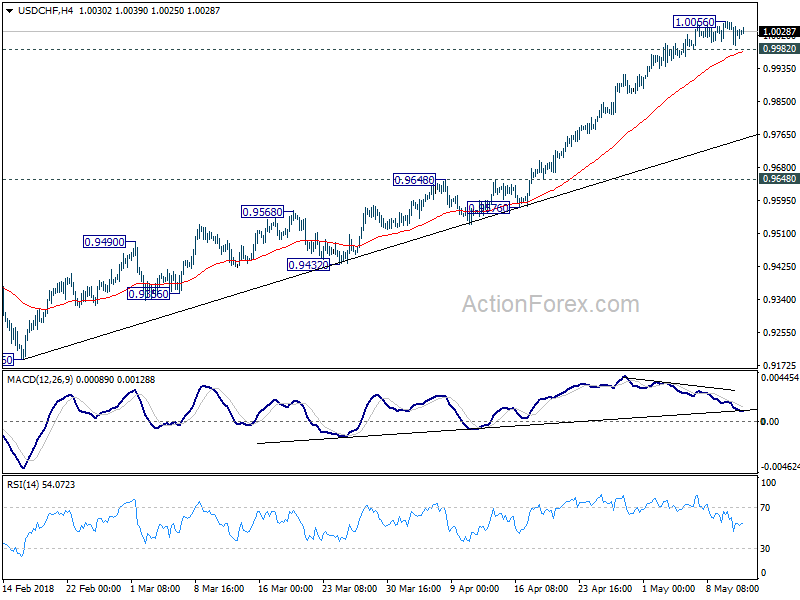

Daily Pivots: (S1) 0.9996; (P) 1.0026; (R1) 1.0058;

Intraday bias in USD/CHF remains neutral for the moment. Consolidation should be brief as long as 0.9982 minor support holds. Break of 1.0056 will resume recent rise for 1.0342 key resistance. However, break of 0.9982 will turn bias to the downside for deeper pull back, possibly to trend line support (now at 0.9757) before staging another rally.

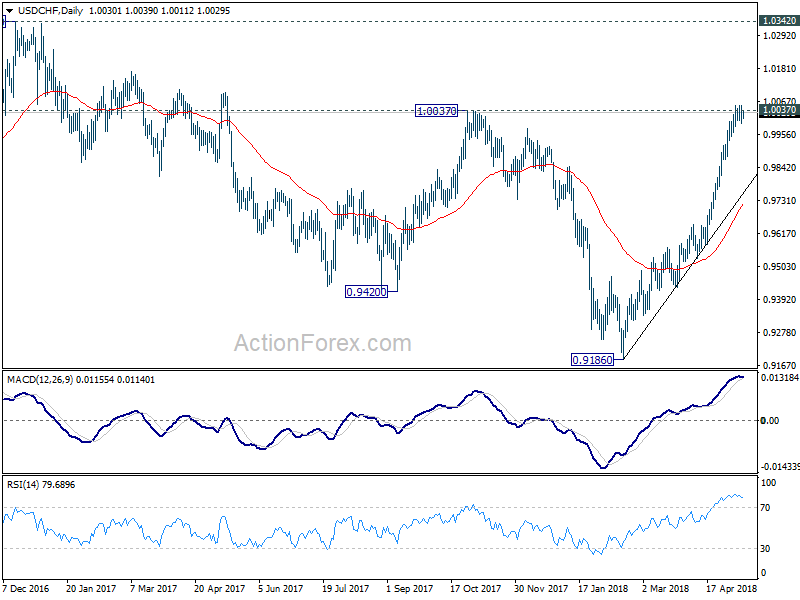

In the bigger picture, medium term decline from 1.0342 has completed with three waves down to 0.9186. Rise from there is currently viewed as a leg inside the long term range pattern. Hence, while further rally would be seen, we’d be cautious on strong resistance from 1.0342 to limit upside. For now, further rise is expected as long as 0.9648 resistance turned support holds, even in case of pull back.