EUR/USD Daily Outlook

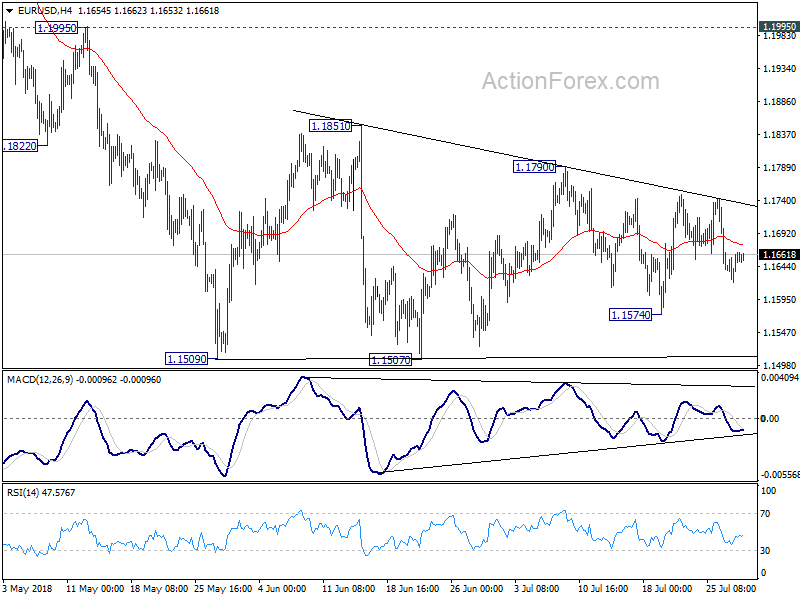

Daily Pivots: (S1) 1.1631; (P) 1.1648 (R1) 1.1675;

Intraday bias in EUR/USD remains neutral as sideway consolidation from 1.1509 is still in progress. In case of another recovery, upside should be limited by 1.1851 resistance to bring fall resumption eventually. On the downside, decisive break of 1.1507 low will resume larger down trend from 1.2555 through 50% retracement of 1.0339 to 1.2555 at 1.1447.

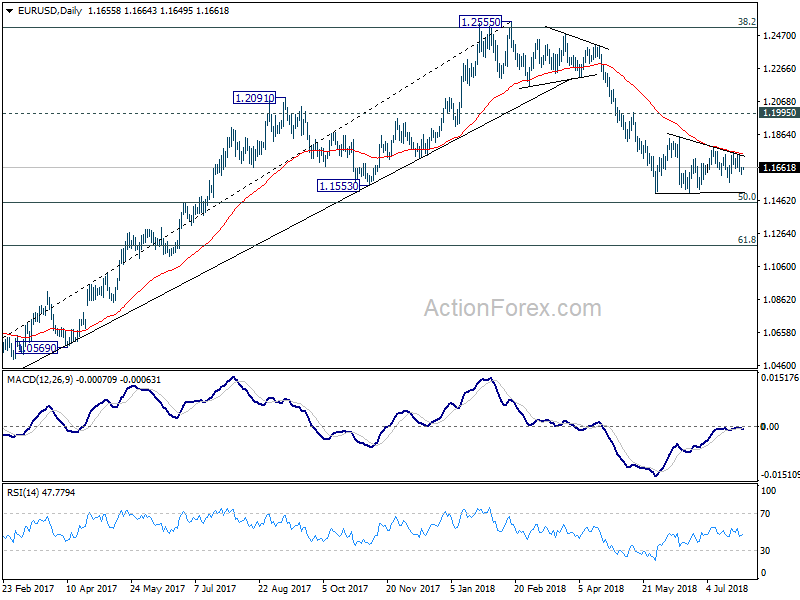

In the bigger picture, EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.

USD/CHF Daily Outlook

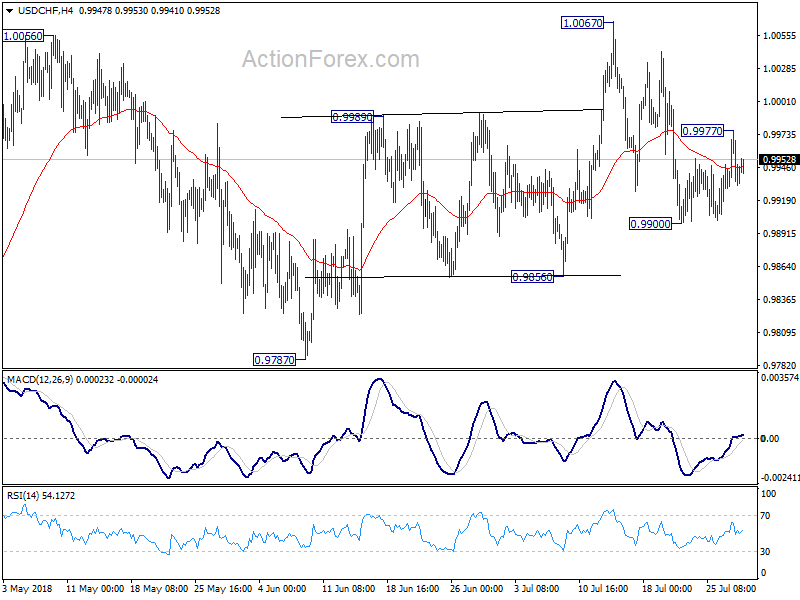

Daily Pivots: (S1) 0.9923; (P) 0.9951; (R1) 0.9974;

Intraday bias in USD/CHF remains neutral for the moment. We’re slightly favoring the case that pull back from 1.0067 has completed already. On the upside, above 0.9977 minor resistance will extend the rebound from 0.9900 to retest 1.0067 high. Break will resume whole rally from 0.9186. However, on the downside, break of 0.9900 will target 0.9856 support instead.

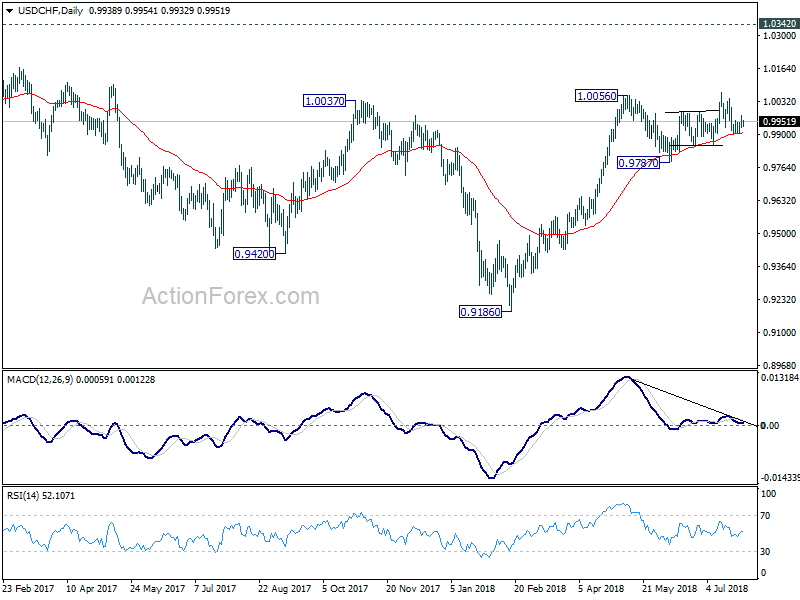

In the bigger picture, as long as 0.9787 support holds, we’re favoring the bullish case. That is, rise from 0.9787 is resuming the whole up trend from 0.9186 and should target 1.0342 key resistance on resumption. However, break of 0.9787 will indicate medium term reversal and turn outlook bearish.