EUR/USD Daily Outlook

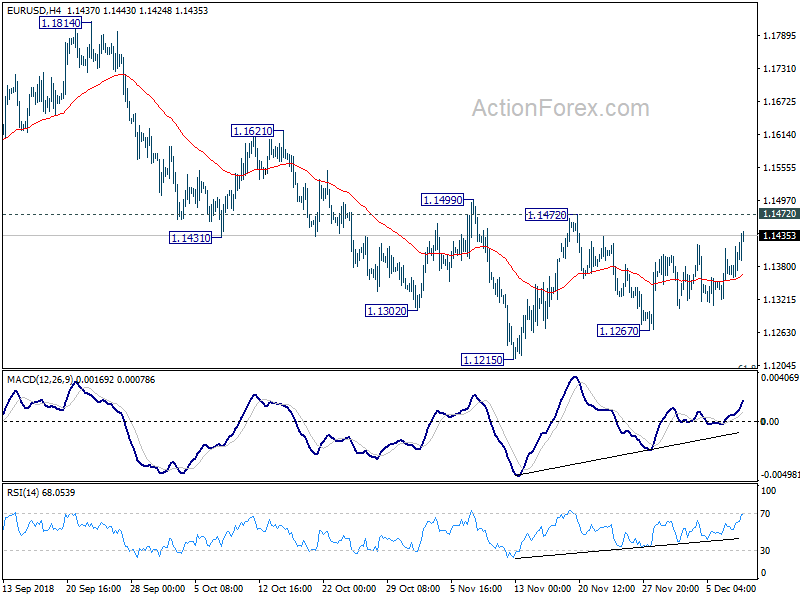

Daily Pivots: (S1) 1.1361; (P) 1.1394; (R1) 1.1429;

EUR/USD strengthens further today but it’s still limited below 1.1472 resistance. Intraday bias remains neutral and another fall is in favor. On the downside, break of 1.1267 will target 1.1215 low first. Firm break there will resume larger down trend from 1.2555 for 1.1186 fibonacci level next. However, considering bullish convergence condition in daily MACD, firm break of 1.1472 will be suggest medium term bottoming and turn outlook bullish for 1.1814 resistance instead.

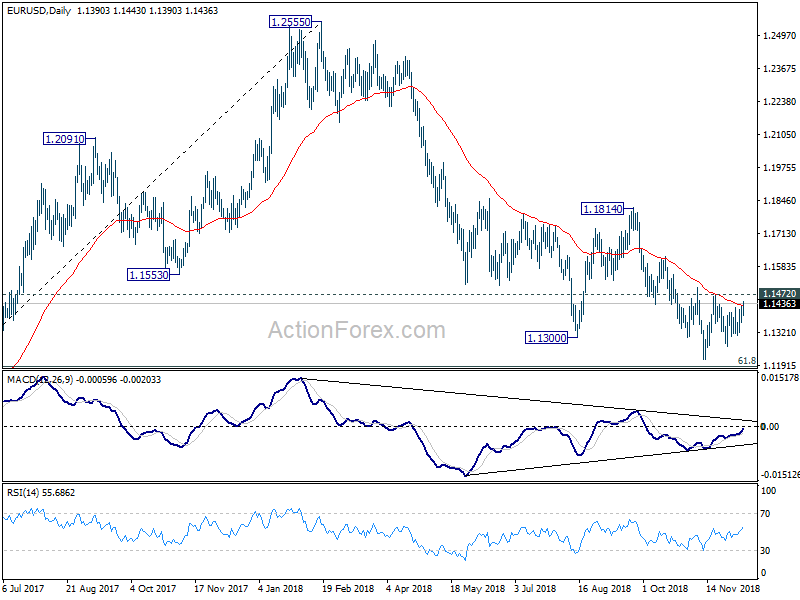

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

USD/CHF Daily Outlook

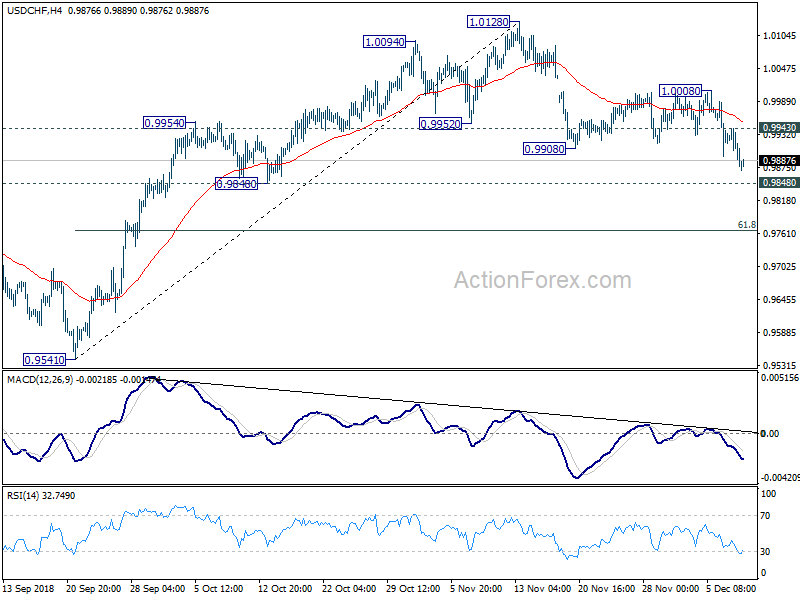

Daily Pivots: (S1) 0.9877; (P) 0.9911; (R1) 0.9932;

Intraday bias in USD/CHF remains on the downside for 0.9848 support. Decisive break there will confirm near term reversal and target 61.8% retracement of 0.9541 to 1.0128 at 0.9765 and below. Above upside, above 0.9943 minor resistance will turn intraday bias neutral first. But break of 1.0008 resistance is needed to indicate short term bottoming. Otherwise, near term outlook will now remain bearish in case of recovery.

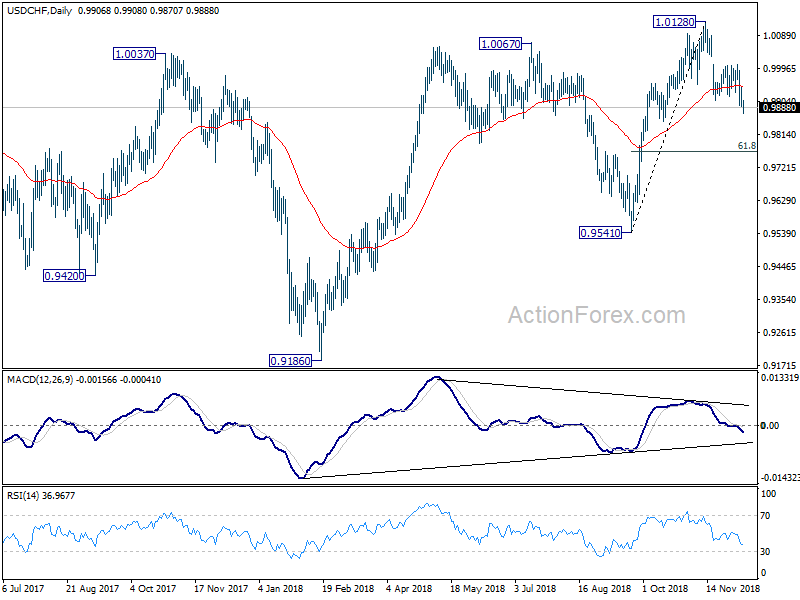

In the bigger picture, rise from 0.9541 could have topped at 1.0128. But as long as 0.9541 support holds, we’d still expect rise from 0.9186 to resume at a later stage. Break of 1.0128 will target 1.0342 key resistance. However, break of 0.9514 will pave the way back to 0.9186 low.