EUR/USD Daily Outlook

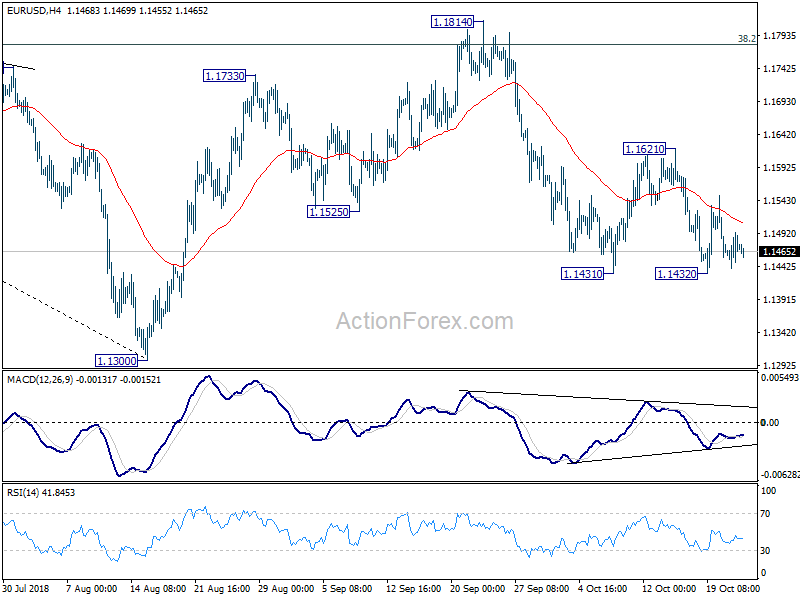

Daily Pivots: (S1) 1.1442; (P) 1.1468; (R1) 1.1496;

Intraday bias in EUR/USD remains neutral at this point as range trading continues. On the downside, break of 1.1431 will resume the fall from 1.1814. Intraday bias would then be turned back to the downside for retesting 1.1300 low next. In case of another recovery, upside should be limited by 1.1621 resistance to bring fall resumption eventually. However, break of 1.1621 will turn focus back to 1.1814 resistance instead.

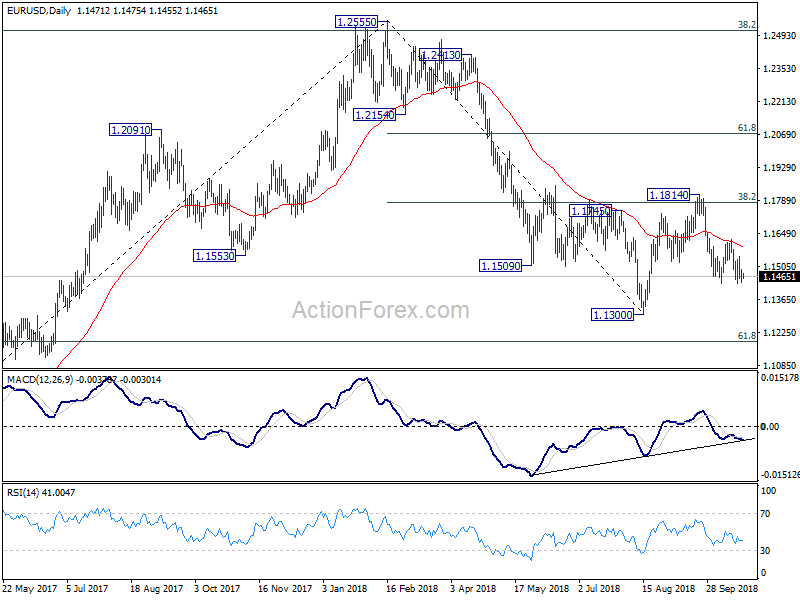

In the bigger picture, corrective pattern from 1.1300 could have completed at 1.1814 after hitting 38.2% retracement of 1.2555 to 1.1300 at 1.1779. Decisive break of 1.1300 will resume the down trend from 1.2555 to 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1814 will delay the bearish case and extend the correction from 1.1300 with another rise before completion.

USD/CAD Daily Outlook

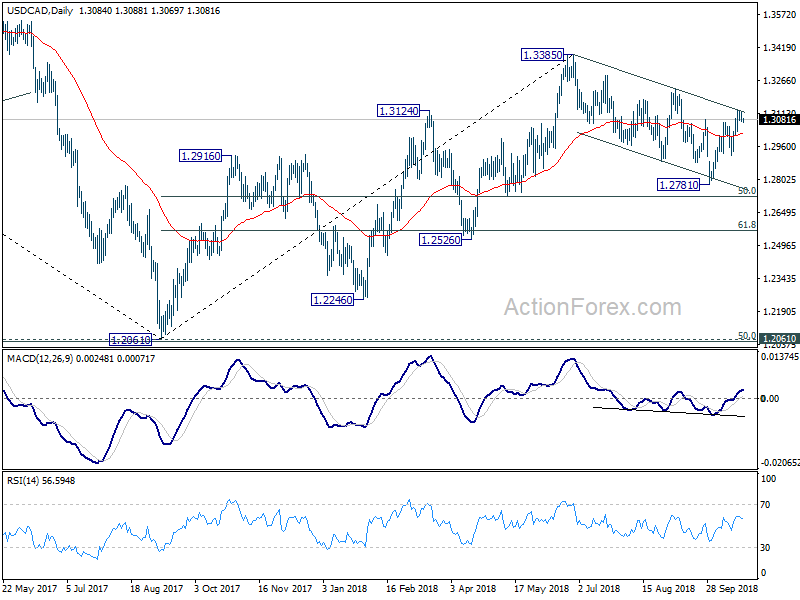

Daily Pivots: (S1) 1.3066; (P) 1.3094; (R1) 1.3112;

Intraday bias in USD/CAD is neutral as consolidation from 1.3132 temporary top extends. As long as 1.3027 minor support holds, further rally is expected. On the upside, above 1.3132 will target 1.3225 resistance first. Decisive break there will confirm that corrective decline from 1.3385 has completed at 1.2781. In that case, retest of 1.3385 high should be seen next. On the downside, however, break of 1.3027 minor support will suggest rejection by channel resistance. Intraday bias will be turned back to the downside for 1.2916 and below.

In the bigger picture, current development argues that choppy corrective fall from 1.3385 has completed at 1.2781 already. And that in turns suggests that the up trend from 1.2061 is still in progress. Decisive break of 1.3385 will pave the way to 61.8% retracement of 1.4689 to 1.2061 at 1.3685. On the downside, though, break of 1.2916 support will likely extend the fall from 1.3385 to 61.8% retracement of 1.2061 to 1.3385 at 1.2567 before completion.