EUR/USD Daily Outlook

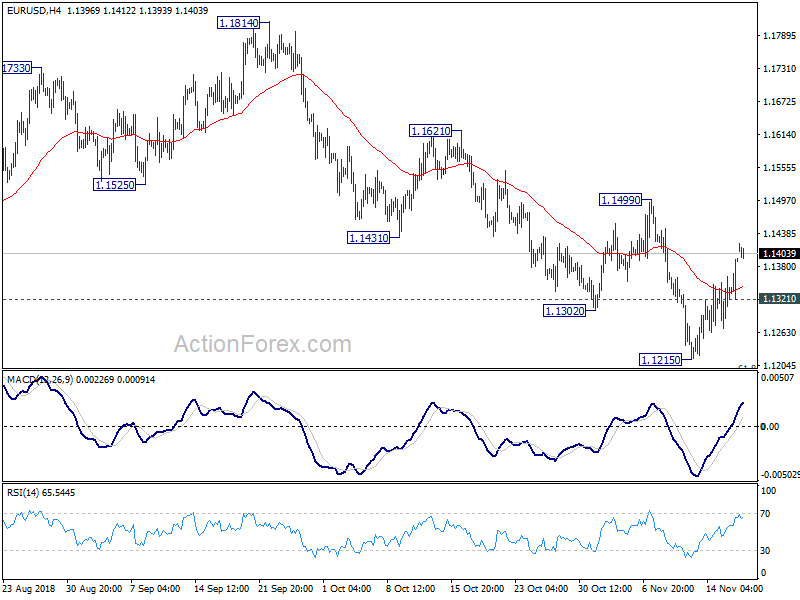

Daily Pivots: (S1) 1.1351; (P) 1.1387; (R1) 1.1452;

No change in EUR/USD’s outlook. While recovery from 1.1215 might extend, it’s seen as a corrective move. Hence, upside should be limited by 1.1499 resistance. On the downside, below 1.1321 minor support will turn bias to the downside for 1.1215 and then 1.1186. However, firm break of 1.1499 will indicate near term reversal and turn outlook bullish for 1.1814 resistance again.

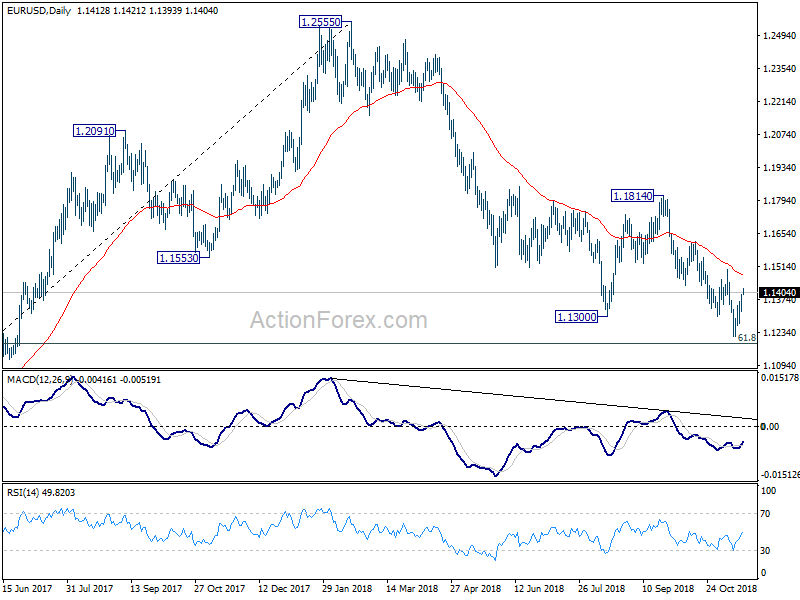

In the bigger picture, down trend from 1.2555 medium term top has just resumed and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. On the upside, break of 1.1814 resistance is now needed to confirm medium term bottoming. Otherwise, outlook will stay bearish in case of strong rebound.

USD/CAD Daily Outlook

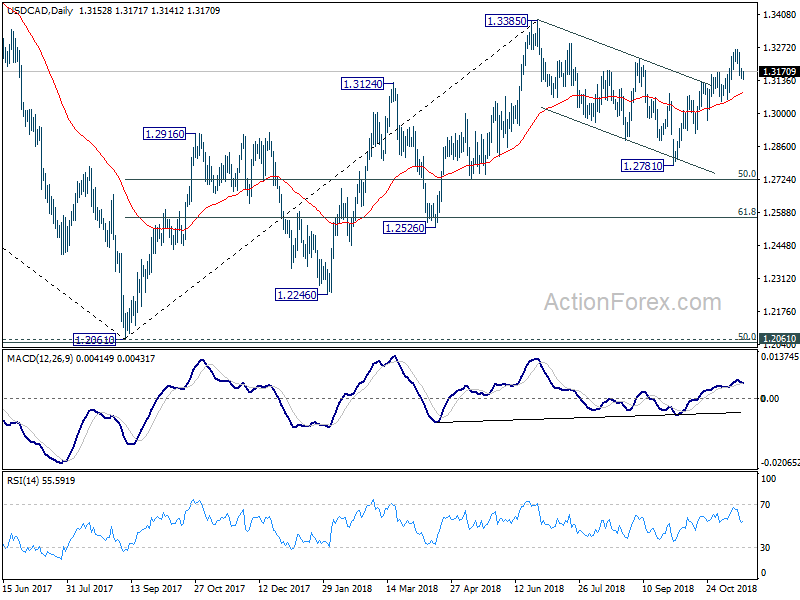

Daily Pivots: (S1) 1.3121; (P) 1.3155; (R1) 1.3182;

Intraday bias in USD/CAD remains neutral at this point. And further rise is expected as long as 1.3056 support holds. On the upside, break of 1.3264 will resume the rise from 1.2781 and target 1.3385 key resistance next. On the downside, however, break of break of 1.3056 will indicate near term reversal and turn outlook bearish.

In the bigger picture, current development revives the case that corrective fall from 1.3385 has completed at 1.2781 already. And whole up trend from 1.2061 (2016 low) is ready to resume. Break of 1.3385 will target 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685. This will now be the favored case as long as 1.2781 support holds.