EUR/USD Daily Outlook

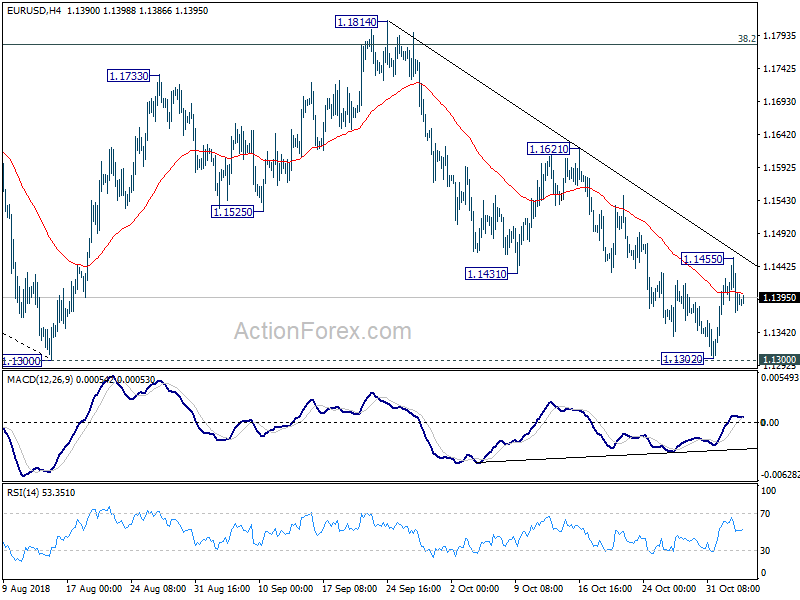

Daily Pivots: (S1) 1.1354; (P) 1.1406; (R1) 1.1439;

Intraday bias in EUR/USD remains neutral at this point. On the upside, above 1.1455 reaffirm that consolidation pattern from 1.1300 has started the third, rising leg. Further rise should be seen to 1.1621 resistance and above. But upside should be limited by 1.1814 to bring down trend resumption eventually. On the downside, break of 1.300 will resume whole down trend from 1.2555 and target 1.1186 fibonacci level next.

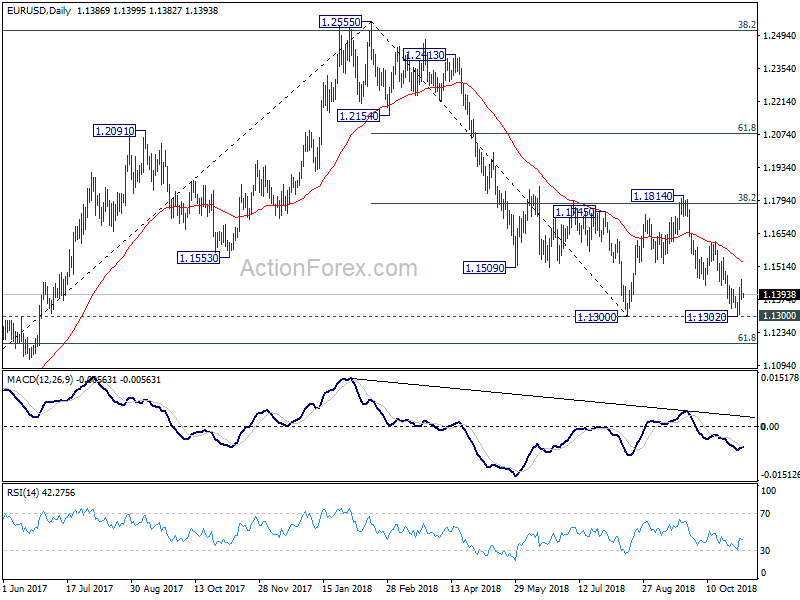

In the bigger picture, price actions from 1.1300 is seen as a corrective pattern. Decisive break of 1.1300 will resume the down trend from 1.2555 to 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. In case the consolidation from 1.1300 extends, upside should be limited by 1.1814 and 38.2% retracement of 1.2555 to 1.1300 at 1.1779. to bring down trend resumption eventually.

USD/CAD Daily Outlook

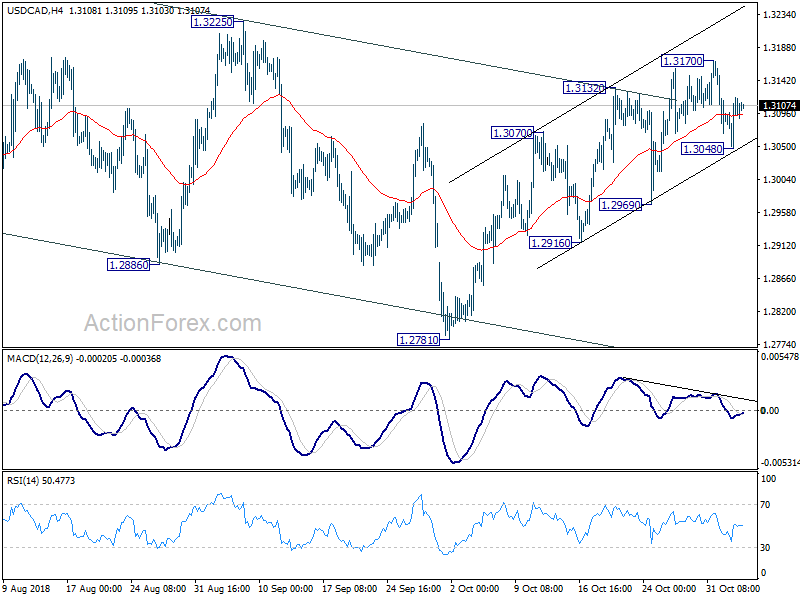

Daily Pivots: (S1) 1.3062; (P) 1.3090; (R1) 1.3132;

Intraday bias in USD/CAD remains neutral at this point. On the upside, break of 1.3170 target 1.3225 key near term resistance. Break will confirm completion of choppy fall from 1.3385 and target a retest on this high. Though, break of 1.3048 will turn focus to 1.2969 support. Firm break there will indicate completion of whole rebound from 1.2781. In that case, whole fall from 1.3385 might extend through 1.2781 support before completion.

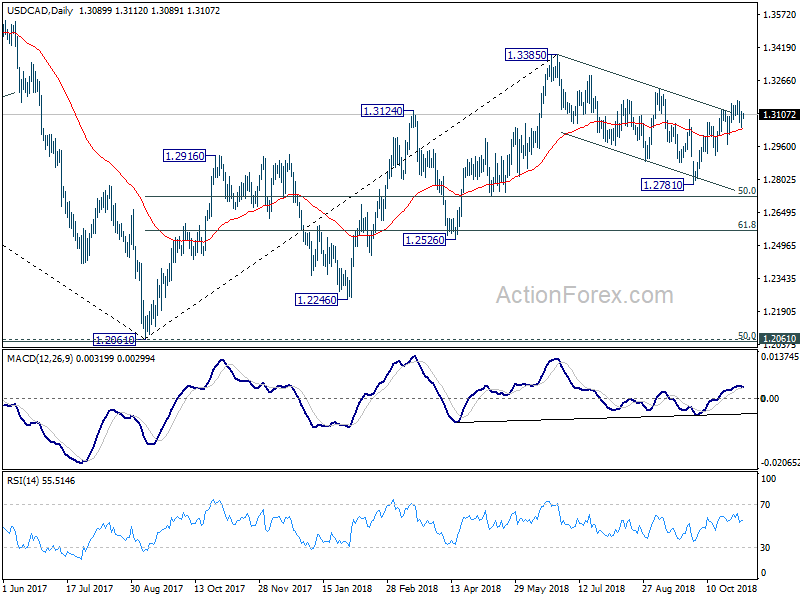

In the bigger picture, current development revives the case that corrective fall from 1.3385 has completed at 1.2781 already. And whole up trend from 1.2061 (2016 low) is ready to resume. Break of 1.3385 will target 61.8% retracement of 1.4689 (2016 high) to 1.2061 at 1.3685. This will now be the favored case as long as 1.2781 support holds.