EUR/USD Daily Outlook

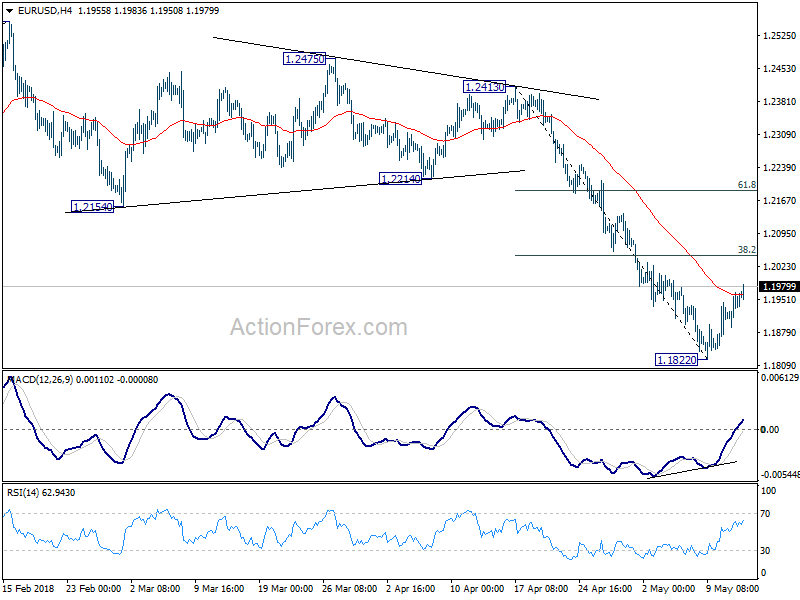

Daily Pivots: (S1) 1.1897; (P) 1.1932 (R1) 1.1974;

EUR/USD’s rebound from 1.1822 short term bottom extends higher today. Intraday bias remains on the upside for 38.2% retracement of 1.2413 to 1.1822 at 1.2048. We’d expect strong resistance from there to limit upside to bring fall resumption. On the downside, below 1.1822 will resume the whole decline from 1.2555 and target 1.1708 medium term fibonacci level next.

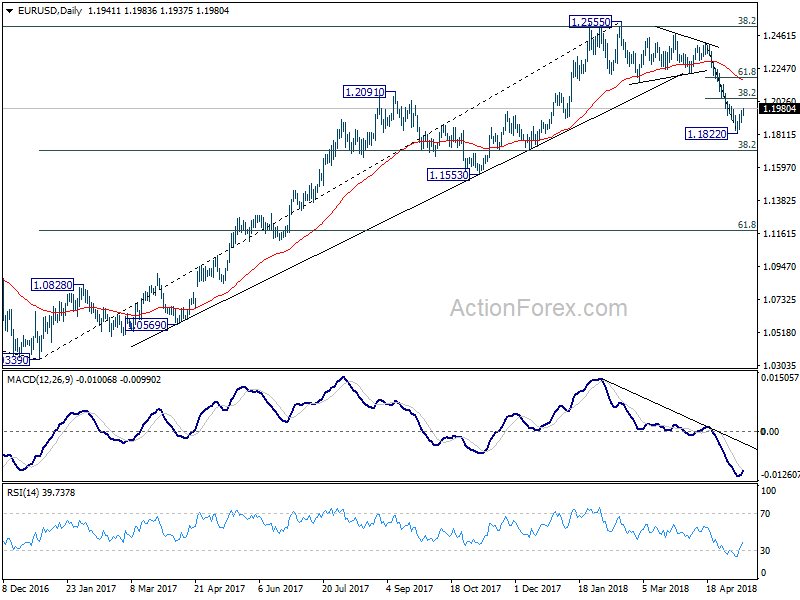

In the bigger picture, current development suggests that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term was formed at 1.2555 already. Decline from there should extend further. Break of 38.2% retracement of 1.0339 to 1.2555 at 1.1708 will target 61.8% retracement at 1.1186. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 55 day EMA (now at 1.2179) holds.

USD/CAD Daily Outlook

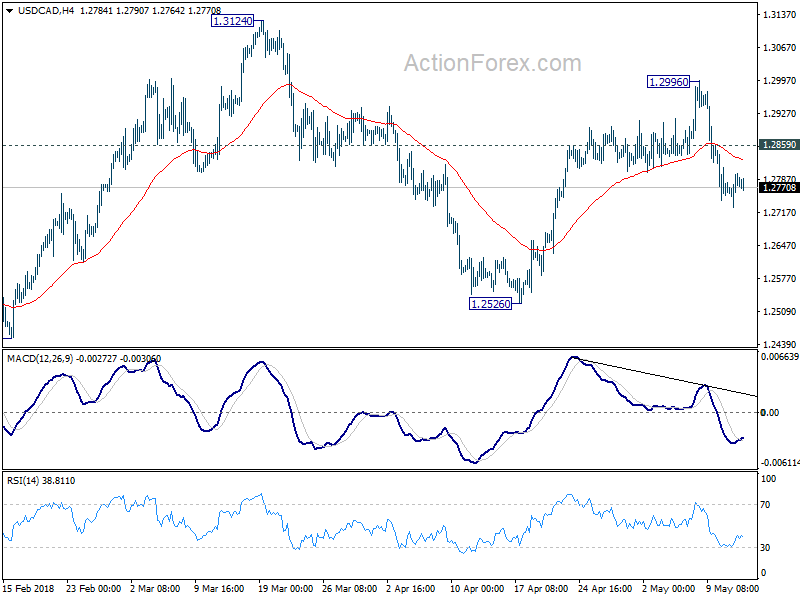

Daily Pivots: (S1) 1.2744; (P) 1.2772; (R1) 1.2818;

Intraday bias in USD/CAD remains mildly on the downside as pull back from 1.2996 could extend lower. Nonetheless, we continue to favor the bullish case that rebound from 1.2061 hasn’t completed. Therefore, downside should be contained well above 1.2526 support and bring rebound. On the upside, above 1.2859 will bring retest of 1.2996 first. However, firm break of 1.2526 will resume the fall from 1.3124 to 1.2246 support and likely below.

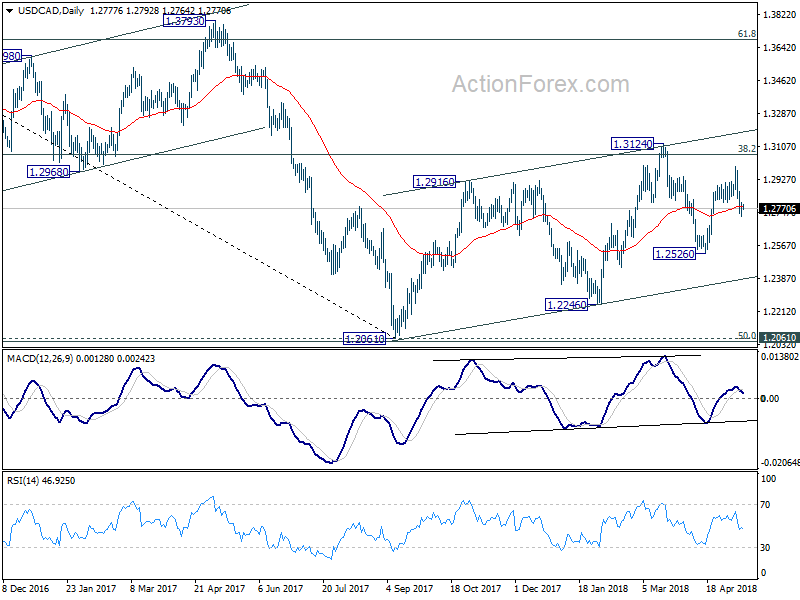

In the bigger picture, current development suggests that rebound from 1.2061 has not completed yet. Focus is back on 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Sustained trading above there will confirm medium term bullish reversal. That is, down trend from 1.4689 has completed at 1.2061 already. In that case, next target will be 61.8% retracement at 1.3685. However, break of 1.2526 support will dampen this bullish view again. And, focus will be back on 1.2061 key support level, which is close to 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048