EUR/USD Daily Outlook

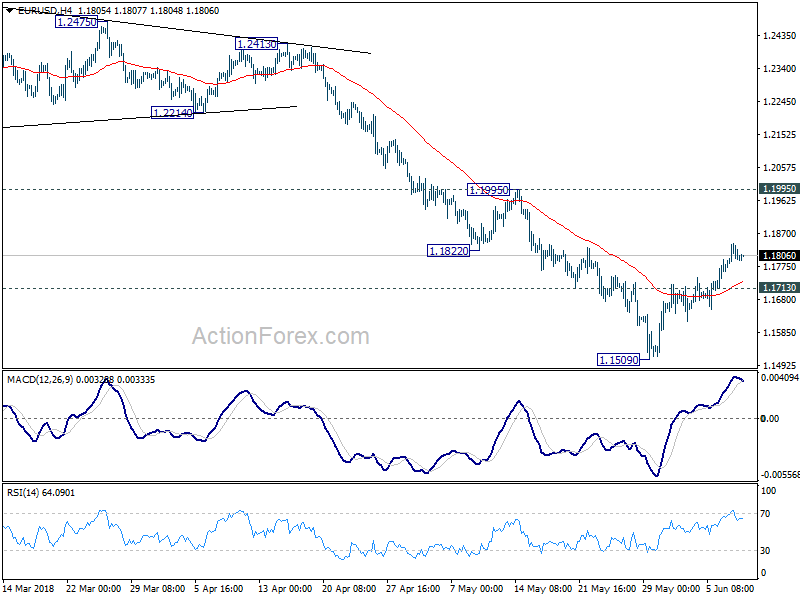

Daily Pivots: (S1) 1.1768; (P) 1.1804 (R1) 1.1837;

EUR/USD is losing upside momentum as seen in 4 hour MACD. But near term outlook is unchanged. Corrective rise from 1.1509 could extend higher. But upside should be limited by 1.1995 resistance to bring fall resumption eventually. On the downside, break of 1.1713 minor support will likely resume larger fall from 1.2555 through 1.1509 to 50% retracement of 1.0339 to 1.2555 at 1.1447.

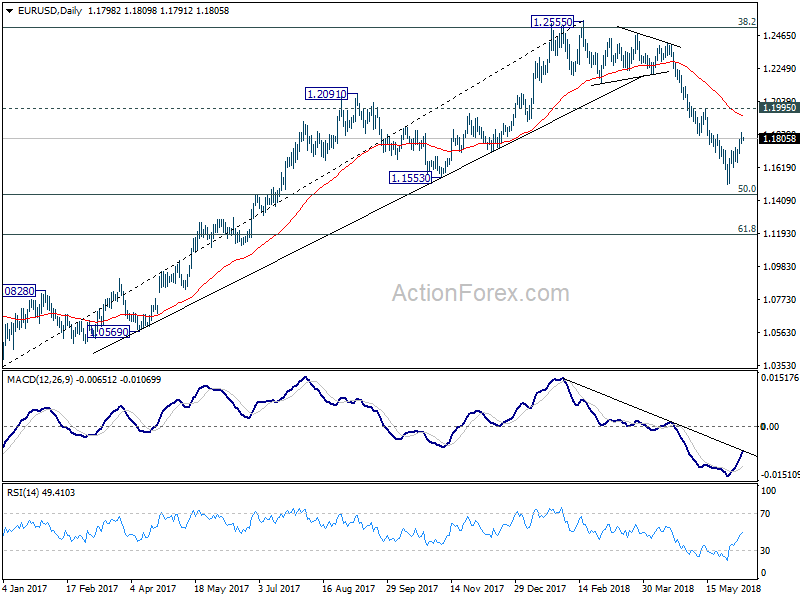

In the bigger picture, current development suggests that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.

USD/CAD Daily Outlook

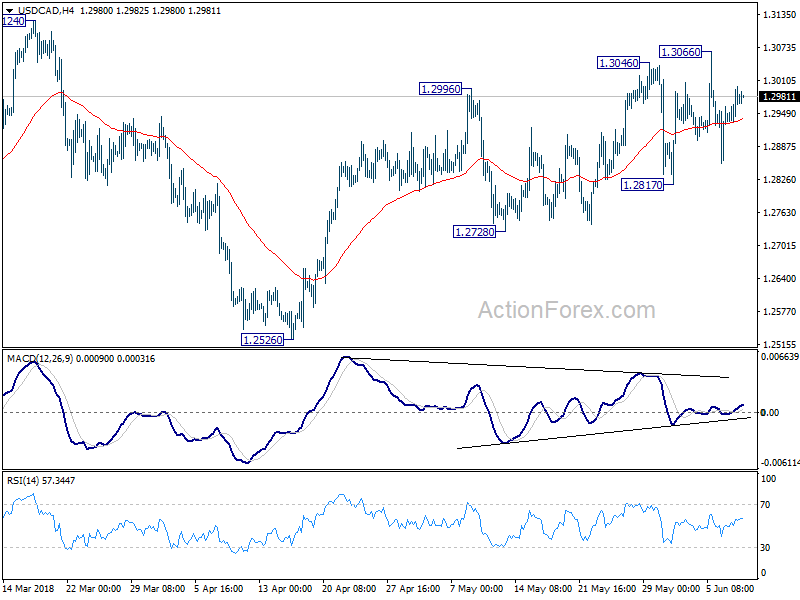

Daily Pivots: (S1) 1.2933; (P) 1.2967; (R1) 1.3007;

USD/CAD is still bounded in tight range below 1.3066 and intraday bias remains neutral. Near term outlook will stay cautiously bullish as long as 1.2817 support holds. Above 1.3066 will extend the rise from 1.2526 to 1.3124 key resistance. Decisive break there will carry larger bullish implication. However, break of 1.2817 will indicate near term reversal and turn bias to the downside for 1.2728 support and below.

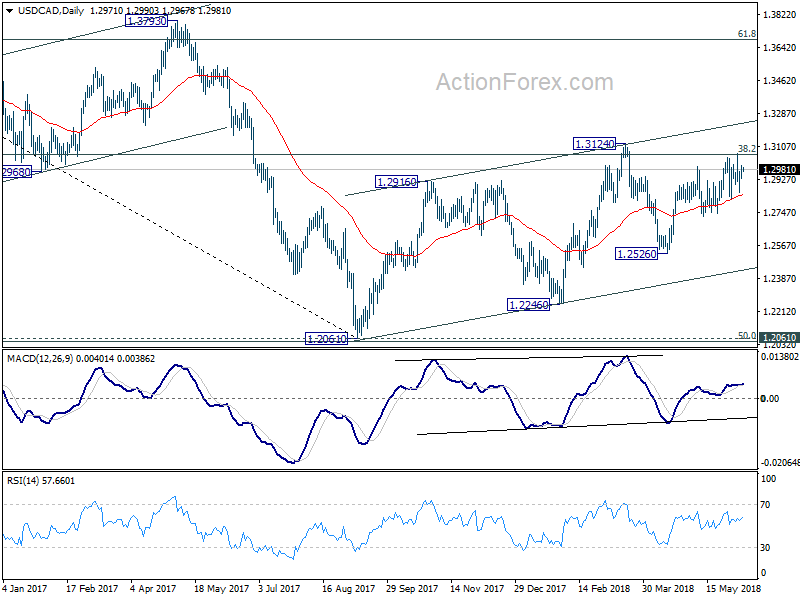

In the bigger picture, we’re favoring the case that that rebound from 1.2061 has not completed yet. But there is no follow through upside momentum so far. Focus remains on 38.2% retracement of 1.4689 to 1.2061 at 1.3065. Sustained trading above there will confirm medium term bullish reversal. That is, down trend from 1.4689 has completed at 1.2061 already. In that case, next target will be 61.8% retracement at 1.3685. However, break of 1.2526 support will dampen this bullish view again. And, focus will be back on 1.2061 key support level, which is close to 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048.