EUR/USD Daily Outlook

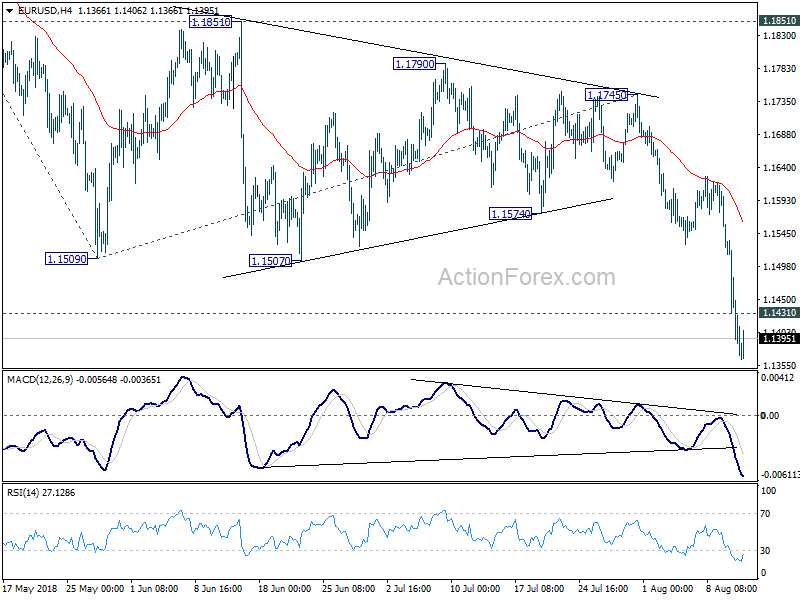

Daily Pivots: (S1) 1.1352; (P) 1.1445 (R1) 1.1502;

Intraday bias in EUR/USD remains on the downside for the moment. Down trend from 1.2555 is in progress and target 61.8% projection of 1.2413 to 1.1509 from 1.1745 at 1.1186. Note that it’s a cluster level with 61.8% retracement of 1.0339 to 1.2555 at 1.1186. Hence, we’ll tentatively look for short term bottoming around 1.1186. On the upside, above 1.1431 minor resistance will turn bias neutral and bring consolidations first, before staging another decline.

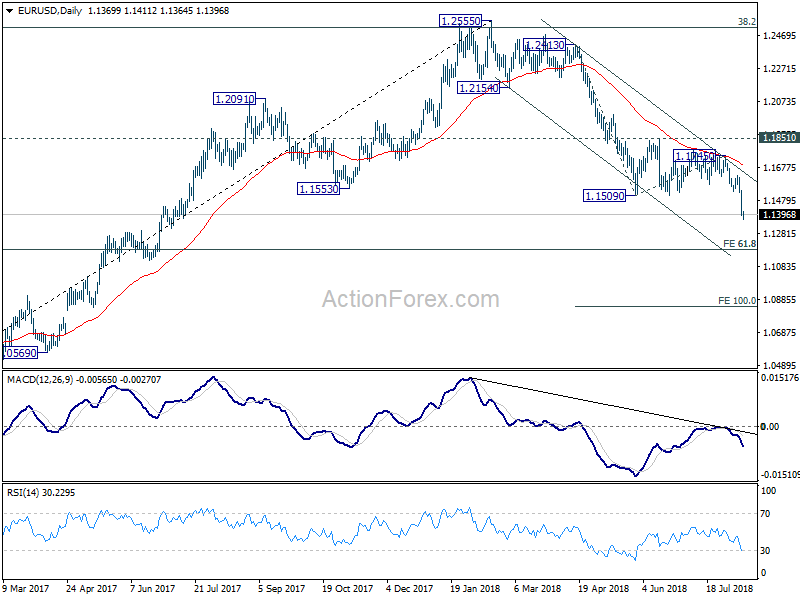

In the bigger picture, the down trend from 1.2555 medium term is in progress for 61.8% retracement of 1.0339 to 1.2555 at 1.1186. Note again that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. That carries some long term bearish implications. Sustained break of 1.1186 could pave the way back to retest 1.0339 low. For now, outlook will remain bearish as long as 1.1851 resistance holds, even in case of strong rebound.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3066; (P) 1.3110; (R1) 1.3190;

Intraday bias in USD/CAD remains on the upside for 1.3289 resistance. The correction from1.3385 has completed with three waves down to 1.2961. Break of 1.3289 will likely resume larger rise from 1.2061 through 1.3385 high. On the downside, though, break of 1.3035 minor support will dampen this bullish view and turn focus back to 1.2961 low.

In the bigger picture, as long as channel support (now at 1.2911) holds, we’re holding to the bullish view. That is, fall from 1.4689 (2015 high) has completed at 1.2061, ahead of 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Further rally should be seen for 61.8% retracement of 1.4689 to 1.2061 at 1.3685 and above. However, sustained break of the channel support will argue that rise from 1.2061 has completed and will bring deeper fall to 1.2526 support to confirm.