EUR/USD Daily Outlook

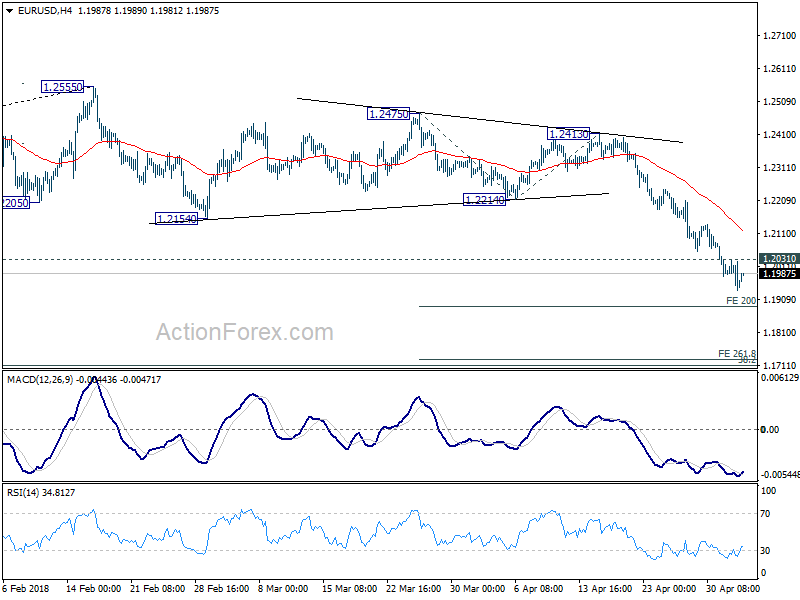

Daily Pivots: (S1) 1.1914; (P) 1.1973 (R1) 1.2008;

EUR/USD dipped further to as low as 1.1937 but started to lose downside momentum on oversold condition in 4 hour RSI. For the moment, intraday bias stays on the downside with 1.2031 minor resistance intact. Next target is 200% projection of 1.2475 to 1.2214 from 1.2413 at 1.1891. Break will target 261.8% projection at 1.1730. On the upside, though, break of 1.2031 will indicate short term bottoming and bring lengthier consolidation before staging another fall.

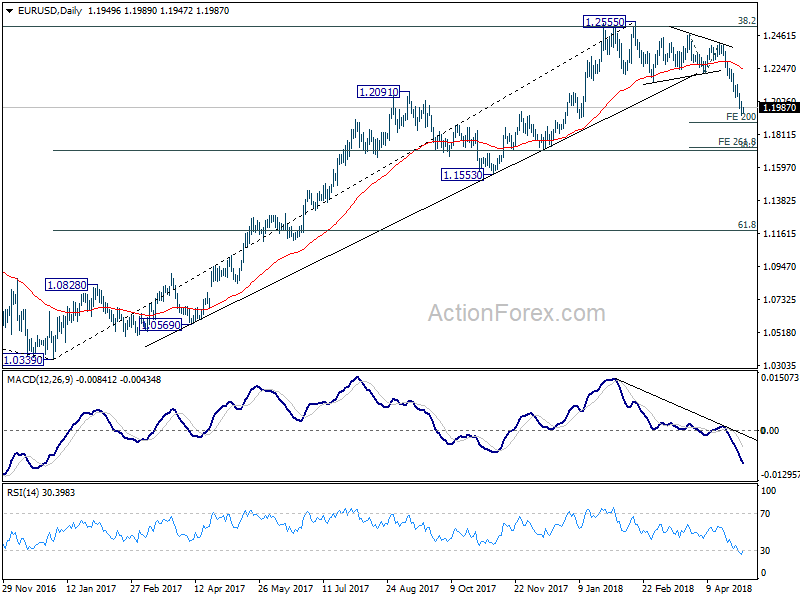

In the bigger picture, current decline and firm break of 1.2154 support confirms rejection by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. A medium term top should be in place at 1.2555 and deeper decline would be seen back to 38.2% retracement of 1.0339 to 1.2555 at 1.1708 first. With current downside acceleration, there is prospect of hitting 61.8% retracement at 1.1186 before completing the decline. But still, we’ll need to look at the structure to before deciding if it’s a corrective or impulsive move.

GBP/USD Daily Outlook

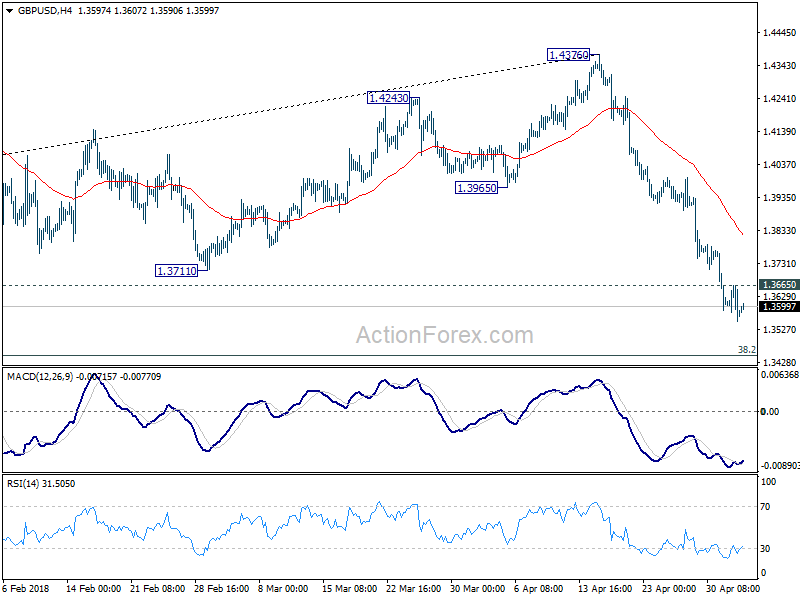

Daily Pivots: (S1) 1.3528; (P) 1.3597; (R1) 1.3639;

GBP/USD’s decline resumed after brief consolidation and intraday bias is back on the downside. Current fall from 1.4376 is in progress for 1.3448 fibonacci level next. On the upside, above 1.3665 will argue that a short term bottom is formed. In that case, lengthier consolidation could be seen before another decline.

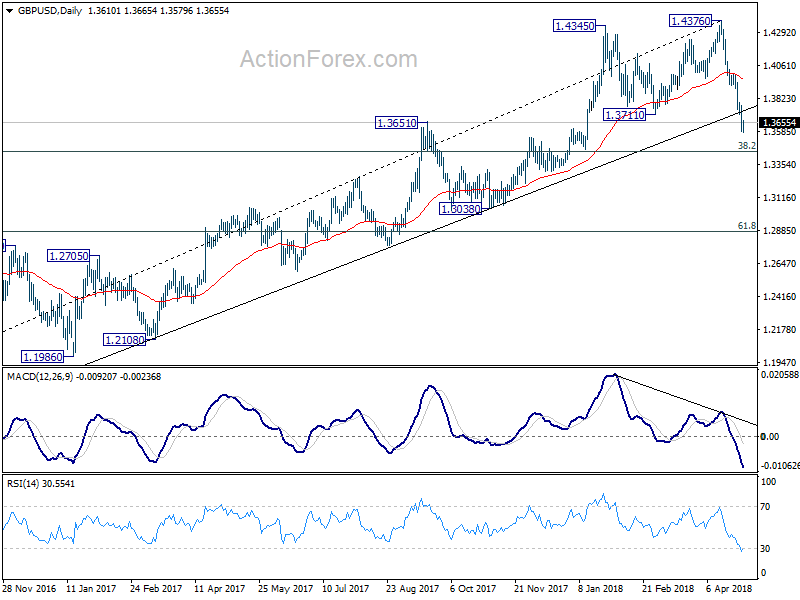

In the bigger picture, current development suggests that whole medium term rebound from 1.1936 (2016 low) has completed at 1.4376 already, with trend line broken, on bearish divergence condition in daily MACD, after rejection from 55 month EMA (now at 1.4248). Deeper decline should be seen to 38.2% retracement of 1.1936 (2016 low) to 1.4376 at 1.3448 first. Break will target 61.8% retracement at 1.2874 and below. Outlook will stay bearish as long as 55 day EMA (now at 1.3955) holds, even in case of strong rebound.