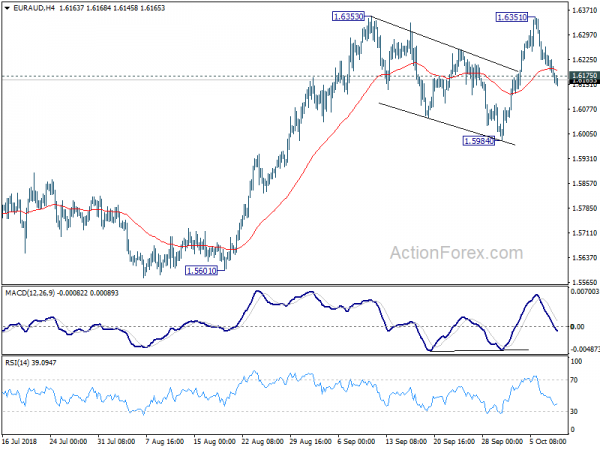

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.6151; (P) 1.6207; (R1) 1.6237;

EUR/AUD’s decline from 1.6351 extends lower today. the break of 1.6175 minor support suggests rejection from 1.6353 and dampens our bullish view. Intraday bias is mildly on the downside for deeper fall. But overall, price actions from 1.6353 are seen as a corrective pattern. Hence, downside should be contained by 1.5984 support to bring up trend resumption eventually.

In the bigger picture, up trend from 1.3624 (2017 low) is still in progress. Further rise should be seen to retest 1.6587 (2015 high). Decisive break there will resume the long term rally and target 1.7488 fibonacci level. On the downside, break of 1.5984 support is need to be the first sign of medium term reversal. Otherwise, outlook will remain bullish in case of deep pull back.

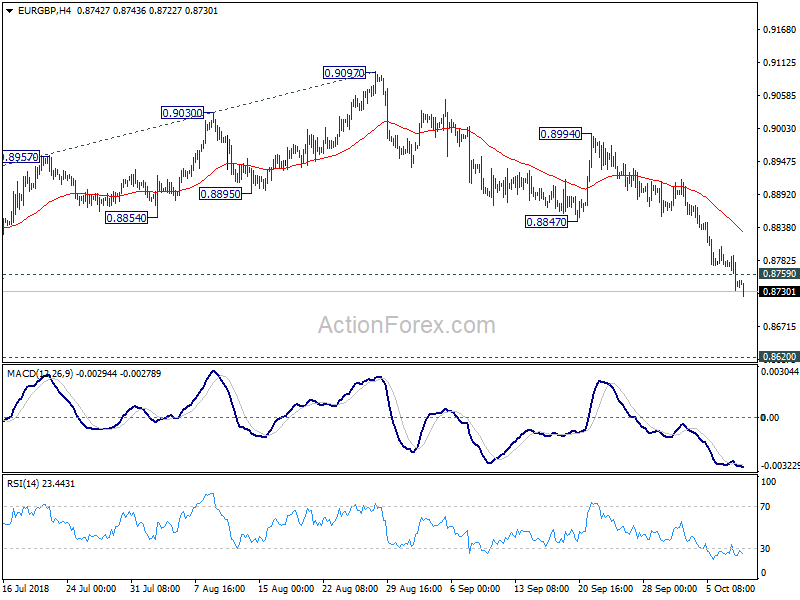

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8720; (P) 0.8756; (R1) 0.8780;

EUR/GBP’s decline continues today and reaches as low as 0.8722 so far. Intraday bias remains on the downside for 0.8620 low next. Decisive break there will resume whole down trend from 0.9304. In that case, next target will be 100% projection of 0.9305 to 0.8620 from 0.9097 at 0.8412. On the upside, above 0.8759 minor resistance will turn intraday bias neutral first. But outlook will stay bearish as long as 0.8847 support turned resistance holds, even in case of strong recovery.

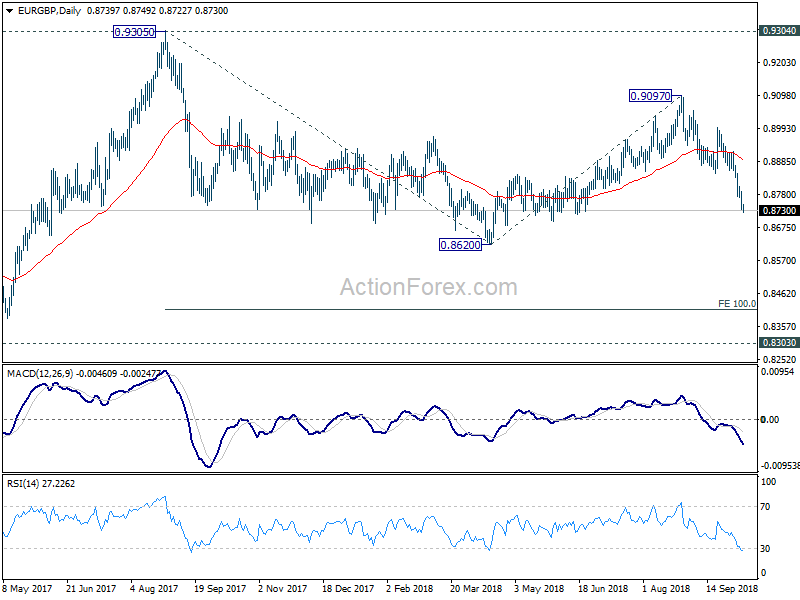

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). Current development suggests that fall from 0.9303, as a down leg in the pattern, is still in progress. But in case of deeper fall, downside should be contained by 0.8116 cluster support, 50% retracement of 0.6935 (2015 low) to 0.9304 at 0.8120, to bring rebound.