EUR/AUD Daily Outlook

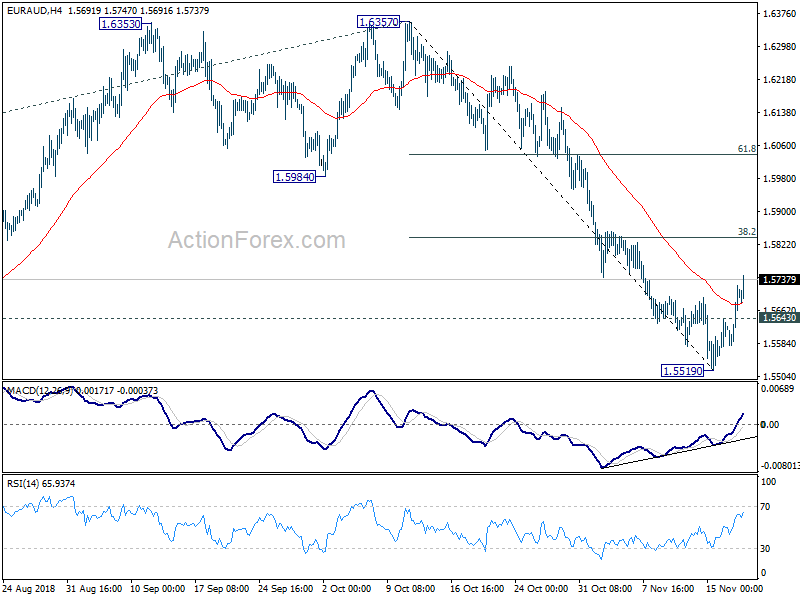

Daily Pivots: (S1) 1.5613; (P) 1.5668; (R1) 1.5759;

The break of 1.5693 minor resistance suggests that a short term bottom is formed at 1.5519 in AUD/USD, in bullish convergence condition in 4 hour MACD. Intraday bias is turned back to the upside for rebound to 38.2% retracement of 1.6357 to 1.5519 at 1.5839 and possibly above. But upside should be limited well below 1.5984 support turned resistance to bring fall resumption. On the downside, below 1.5643 minor support will bring retest of 1.5519 low.

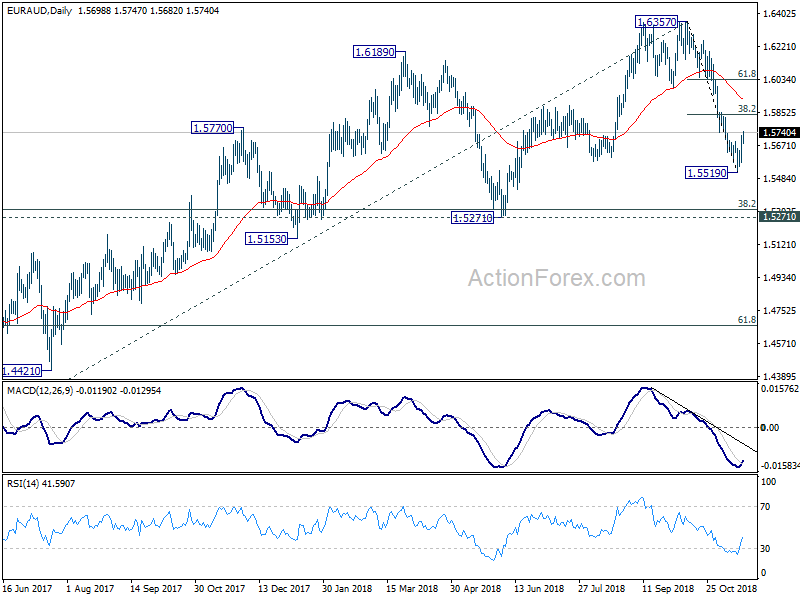

In the bigger picture, current development argues that up trend from 1.3624 (2017 low) is possibly completed at 1.6357, ahead of 1.6587 (2015 high). This is supported by bearish divergence condition in weekly MACD. Deeper decline is now in favor to 1.5271 cluster support (38.2% retracement of 1.3624 to 1.6357 at 1.5313). Break will target 61.8% retracement at 1.4668. On the upside, break of 1.5984 support turned resistance is now needed to revive the prior medium term up trend. Otherwise, further decline will be in favor even in case of strong interim rebound.

EUR/GBP Daily Outlook

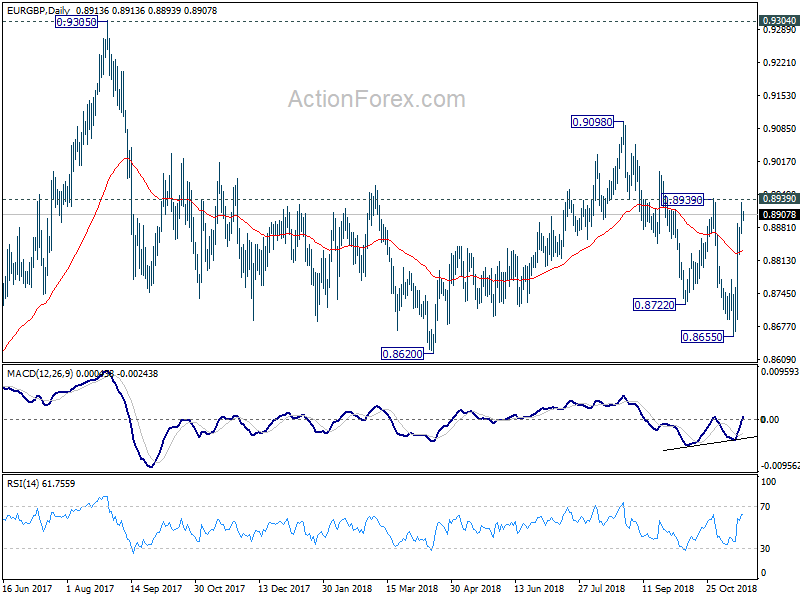

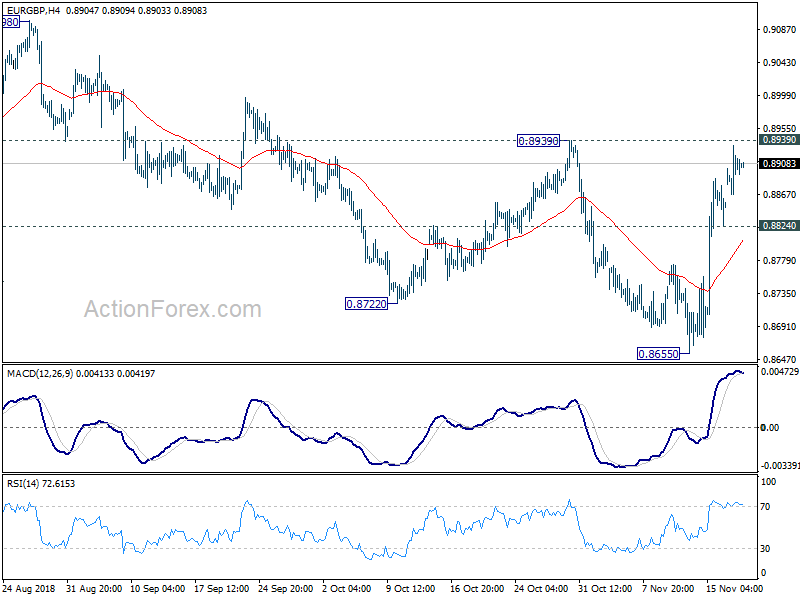

Daily Pivots: (S1) 0.8877; (P) 0.8903; (R1) 0.8938;

EUR/GBP is losing some upside momentum as seen in 4 hour MACD. But further rise is expected as long as 0.8824 support holds. Decisive break of 0.8939 resistance will pave the way to 0.9098 high. However, break of 0.8824 will now suggest completion of the rebound from 0.8655. Intraday bias will be turned back to the downside instead.

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). Medium term fall from 0.9305 is possibly in progress and could extend through 0.8620. On the upside, break of 0.8939 resistance is needed to indicate medium term reversal. Otherwise, outlook will remain cautiously bearish even in case of rebound.