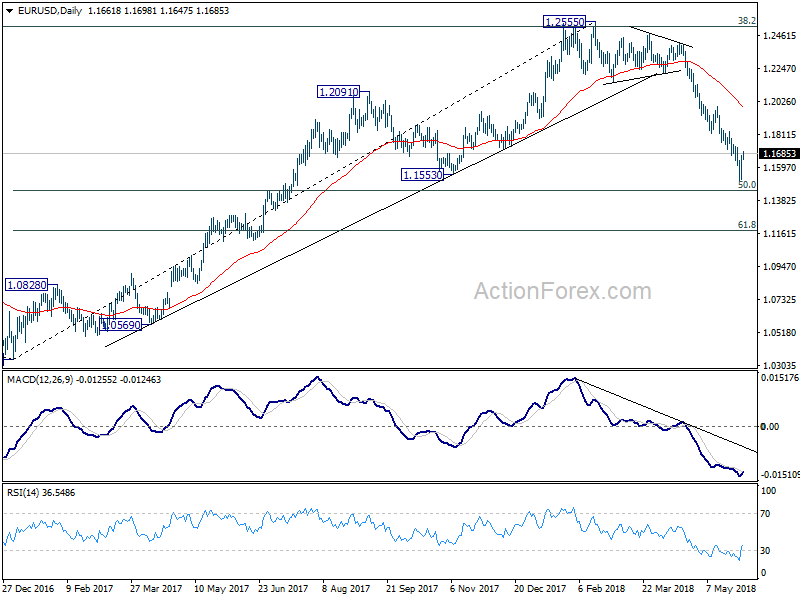

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1563; (P) 1.1620 (R1) 1.1720;

EUR/USD’s recovery from 1.1509 is still in progress and touches 4 hour 55 EMA. Further rise could be seen. But upside should be limited by 1.1822/1995 resistance zone to bring fall resumption. Below 1.1509 will target 50% retracement of 1.0339 to 1.2555 at 1.1447 first. Break will target 61.8% retracement at 1.1186 next.

In the bigger picture, current development suggests that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.

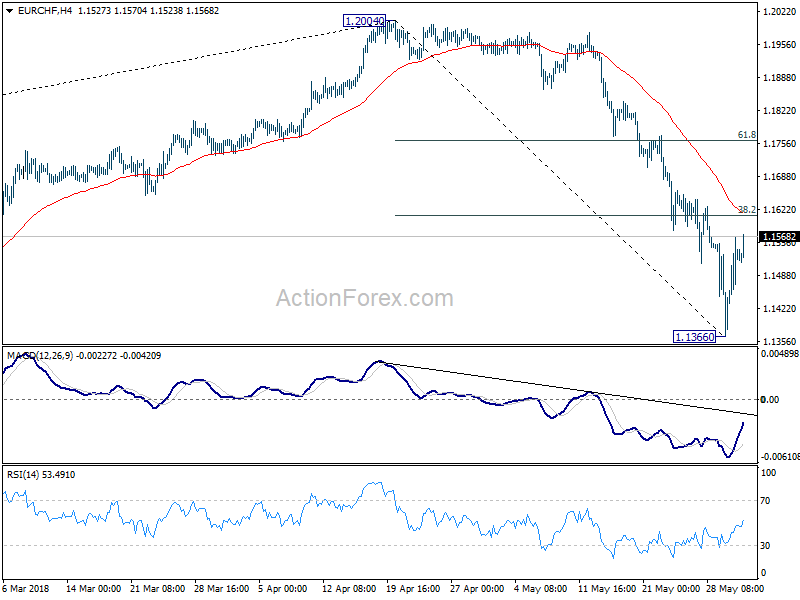

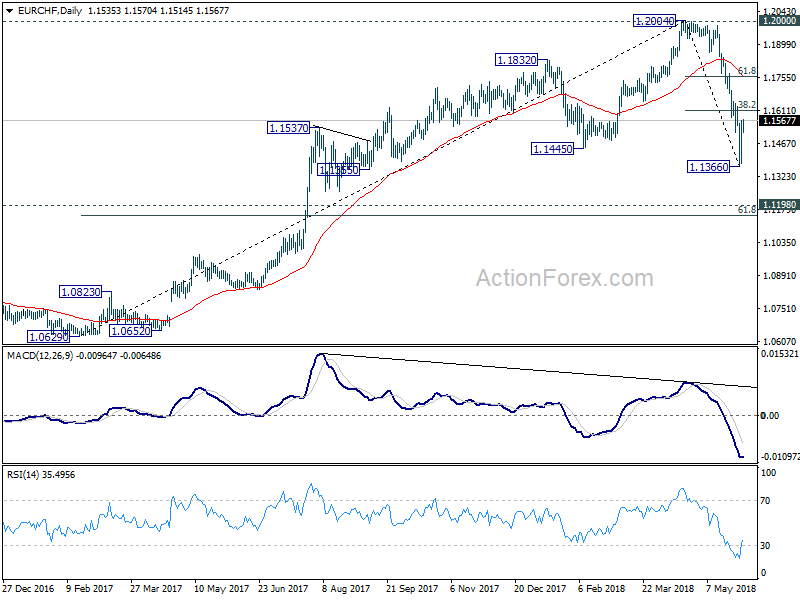

EUR/CHF Daily Outlook

Daily Pivots: (S1) 1.1450; (P) 1.1508; (R1) 1.1597;

EUR/CHF’s rebound from 1.1366 extends higher today and further rise could be seen. But for now, we’d expect strong resistance from 38.2% retracement of 1.2004 to 1.1366 at 1.1610 to bring another decline. Below 1.1366 will resume the fall from 1.2004 and target next key support zone between 1.1154 and 1.1198.

In the bigger picture, current development suggests solid rejection by prior SNB imposed floor at 1.2000. Considering bearish divergence condition in daily MACD, 1.2004 should be a medium term top. And price action from 1.2004 is correcting the up trend from 1.0629. The cross has met 1.1445 already, which is close to 38.2% retracement of 1.0629 to 1.2004 at 1.1479. We’d expect strong support from there to bring rebound to extend the medium term corrective pattern. However, sustained break of 1.1445 will target next key cluster level at 1.1198 (2016 high), 61.8% retracement of 1.0629 to 1.2004 at 1.1154.