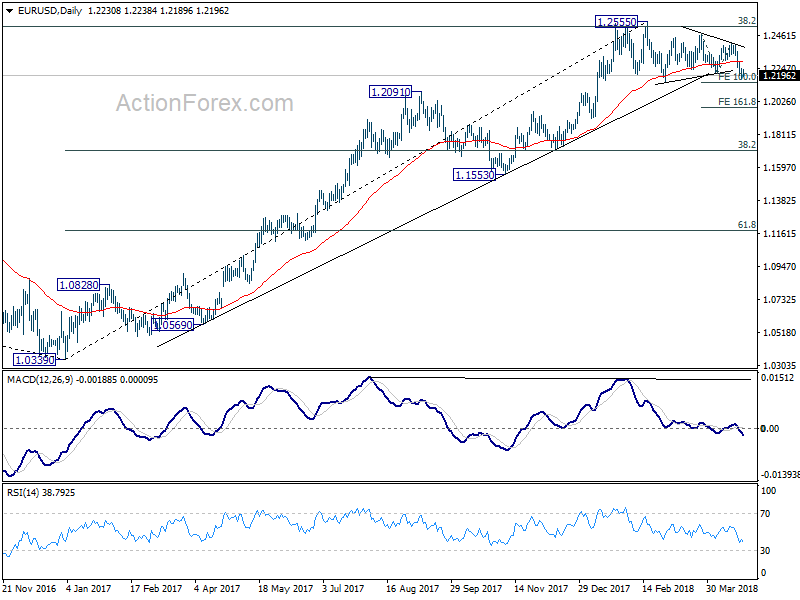

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.2194; (P) 1.2220 (R1) 1.2258;

A temporary low is in place at 1.2181 and intraday bias is turned neutral first. Some consolidations could be seen. But upside should be limited by 4 hour 55 EMA (now at 1.2295) to bring another decline. below 1.2181 will target 1.2154 key support level. Decisive break there should confirm the bearish case of medium term reversal. And EUR/USD should then target 161.8% projection of 1.2475 to 1.2214 from 1.2413 at 1.1991.

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Firm break of 1.2154 support will confirm rejection by this fibonacci level. And in that case, a medium term top is at least formed at 1.2555. EUR/USD should then head back to 38.2% retracement of 1.0339 to 1.2555 at 1.1708 first. We’ll look at the structure and momentum of such decline before decision if it’s an impulsive or corrective move.

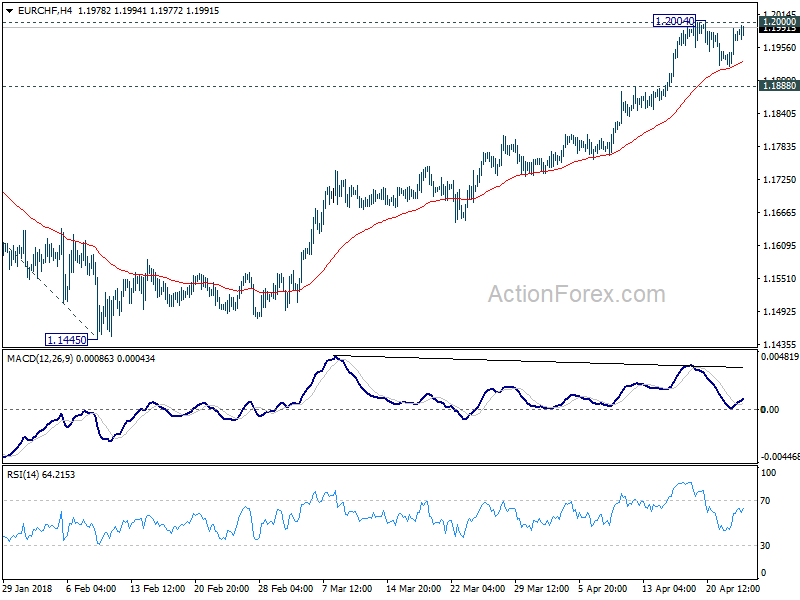

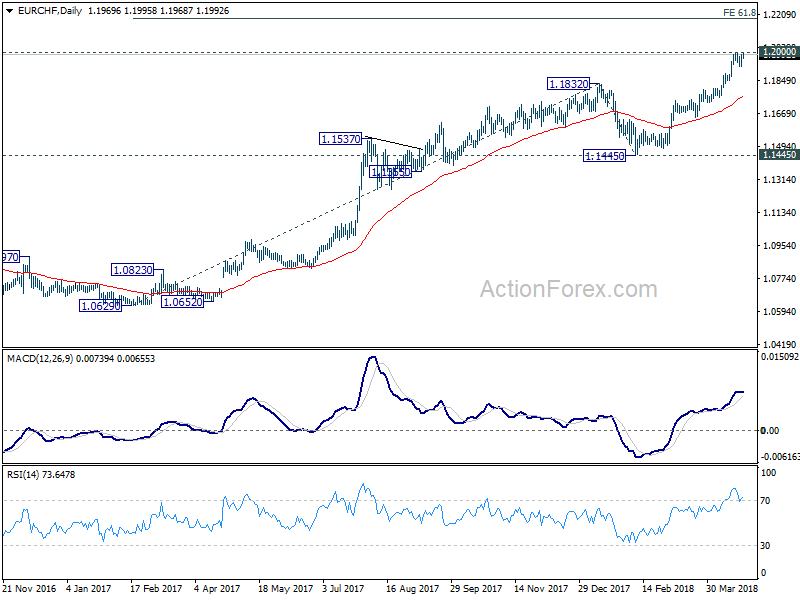

EUR/CHF Daily Outlook

Daily Pivots: (S1) 1.1935; (P) 1.1963; (R1) 1.2001;

EUR/CHF recovered strongly, but it’s still staying below 1.2004 temporary top. Intraday bias remains neutral first. Consolidation could extend but should be relatively brief as long as 1.1888 minor support holds. Decisive break of 1.2 will pave the way to 61.8% projection of 1.0629 to 1.1832 from 1.1445 at 1.2188. However, considering bearish divergence condition in 4 hour MACD, break of 1.1888 will indicate short term topping. In that case, deeper pull back would be seen back to 1.1445/1832 support zone.

In the bigger picture, long term up trend in EUR/CHF is still in progress. Prior SNB imposed floor at 1.2003 was already met but there is no sign of reversal yet. As long as 1.1445 support holds, we’d expect the up trend to extend to 2013 high at 1.2649 next.