EUR/USD Daily Outlook

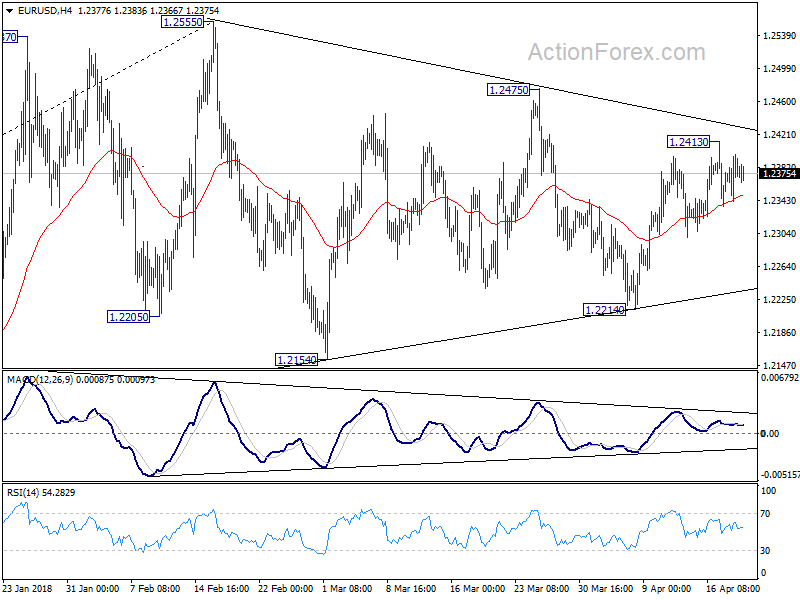

Daily Pivots: (S1) 1.2345; (P) 1.2371 (R1) 1.2401;

Intraday bias in EUR?USD remains neutral. On the upside, above 1.2413 will extend the rebound from 1.2214 to 1.2475 resistance. Break will target 1.2516/2555 key resistance zone. On the downside, however, break of 1.2214 will revive the case of trend reversal and turn outlook bearish.

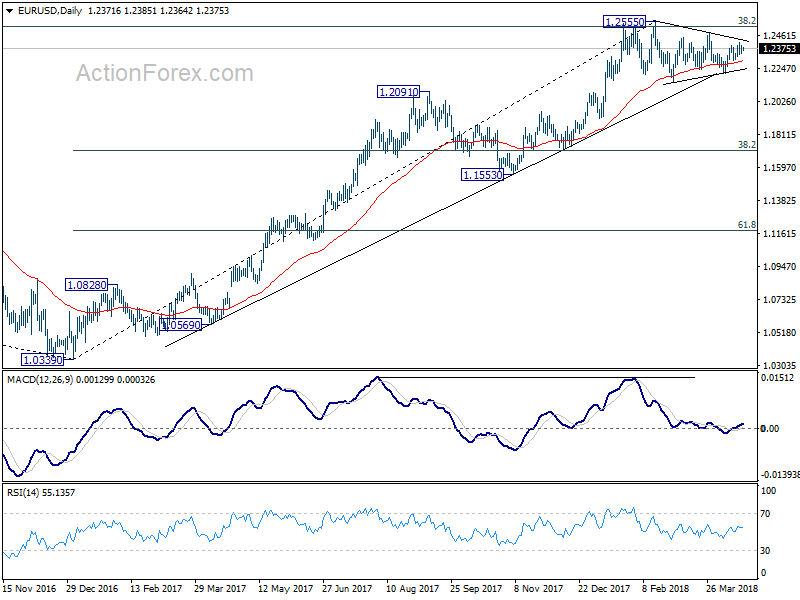

In the bigger picture, key fibonacci level at 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516 remains intact despite attempts to break. Hence, rise from 1.0339 medium term bottom is still seen as a corrective move for the moment. Rejection from 1.2516 will maintain long term bearish outlook and keep the case for retesting 1.0039 alive. Firm break of 1.1553 support will add more medium term bearishness. However, sustained break of 1.2516 will carry larger bullish implication and target 61.8% retracement of 1.6039 to 1.0339 at 1.3862 in medium term.

EUR/CHF Daily Outlook

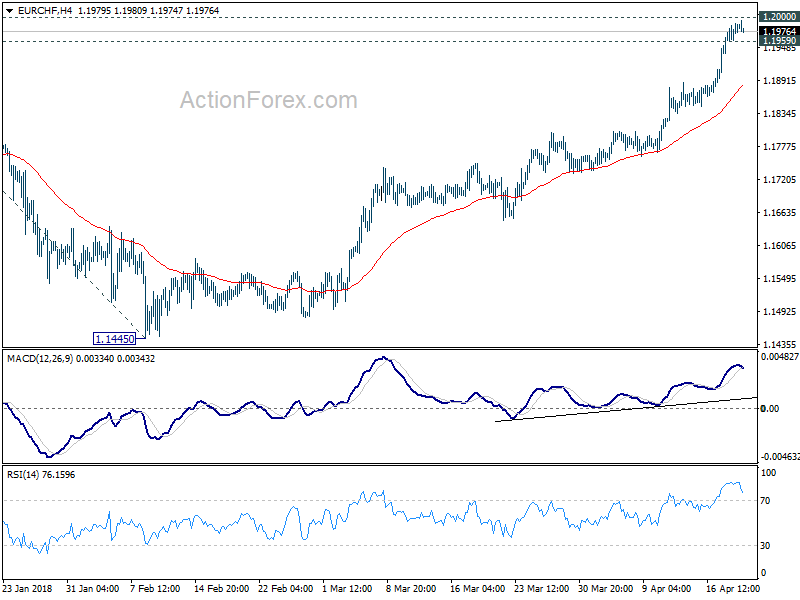

Daily Pivots: (S1) 1.1955; (P) 1.1974; (R1) 1.2004;

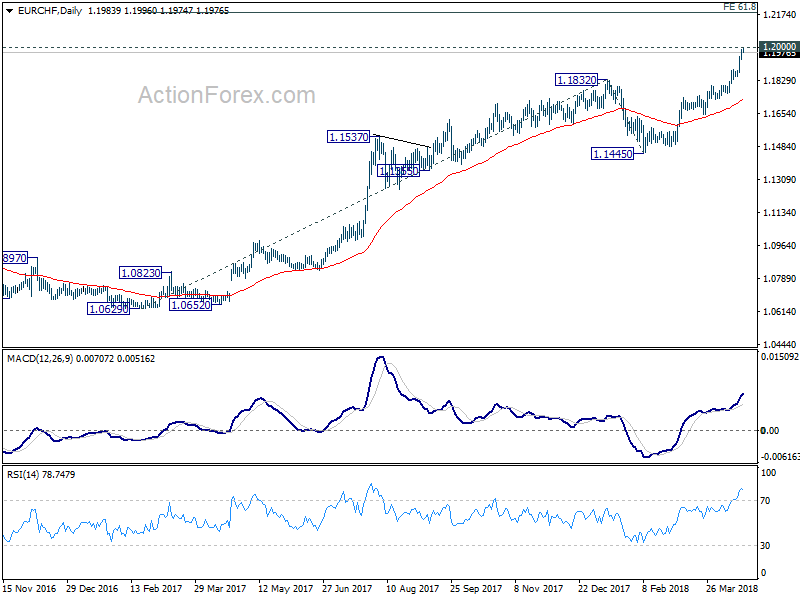

EUR/CHF’s rally extends today and reaches as high as 1.1996 so far, just inch below 1.2 handle. While it’s staying to lose upside momentum as seen in 4 hour MACD, intraday bias stays on the upside as long as 1.1959 minor support holds. Sustained break of 1.2 will extend the current up trend to 61.8% projection of 1.0629 to 1.1832 from 1.1445 at 1.2188. On the downside, below 1.1959 will turn bias neutral and bring consolidation first, before staging another rally.

In the bigger picture, decisive break of 1.1832 should now extend the medium term up trend through prior SNB imposed floor at 1.2000. 2013 high at 1.2649 should be the next target. Outlook will remain bullish as long as 1.1445 support holds, even in case of deep pull back.