EUR/USD Daily Outlook

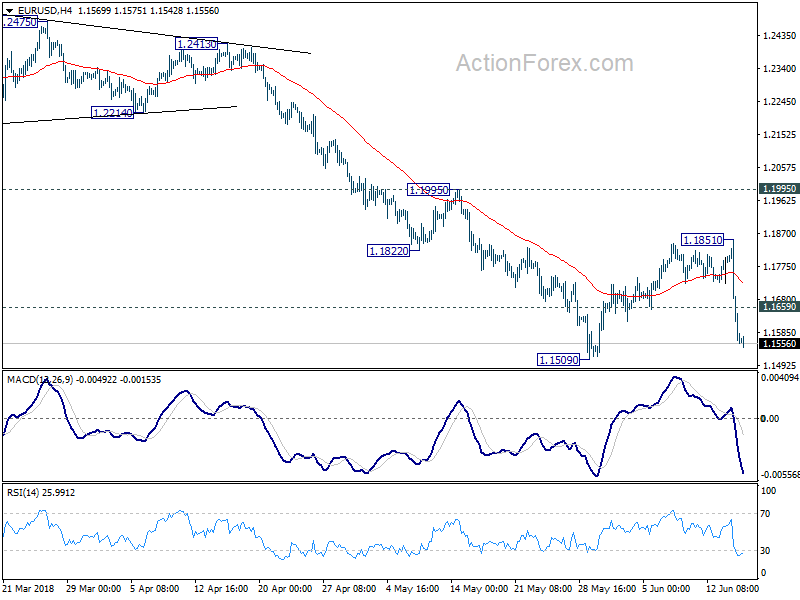

Daily Pivots: (S1) 1.1468; (P) 1.1659 (R1) 1.1756;

Intraday bias in EUR/USD remains on the downside for 1.1509 low first. Break there will confirm resumption of larger decline from 1.2555. EUR/USD should take out 50% retracement of 1.0339 to 1.2555 at 1.1447 with ease to 61.8% retracement at 1.1186. On the upside, above 1.1659 minor resistance will delay the bearish case and bring more consolidation first.

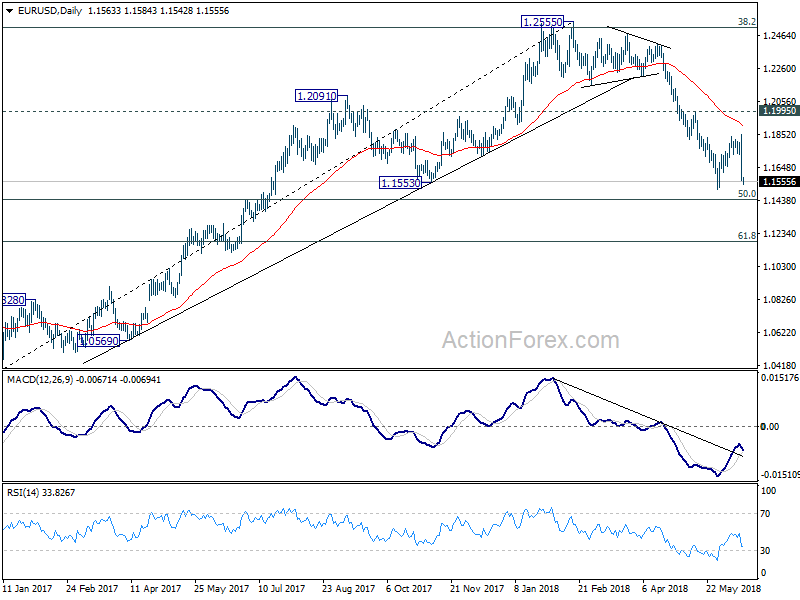

In the bigger picture, current development suggests that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.

EUR/AUD Daily Outlook

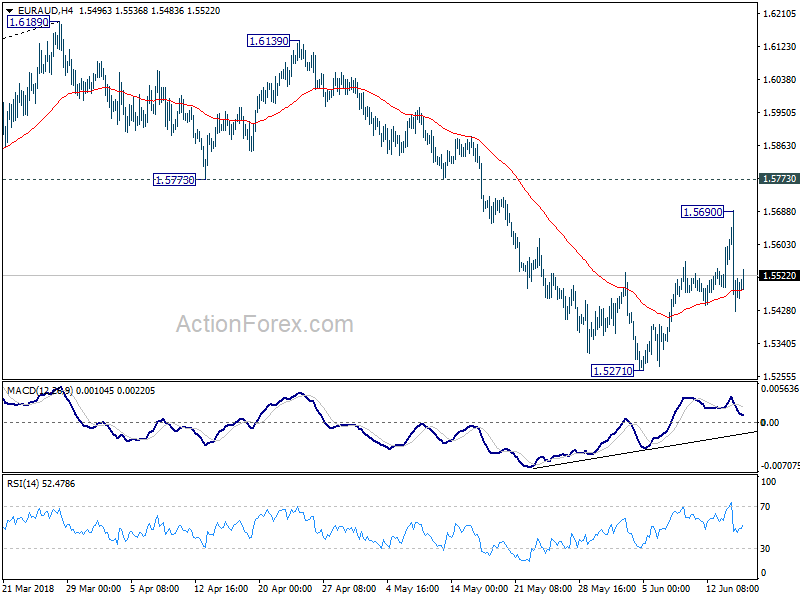

Daily Pivots: (S1) 1.5367; (P) 1.5532; (R1) 1.5635;

As noted before, the corrective rebound from 1.5271 should have completed at 1.5690 already. Deeper fall is expected in EUR/AUD to retest 1.5271 first. Break will resume whole decline from 1.6189 to 1.5153 key support. In case of another rise, we’d continue to expect strong resistance from 1.5773 support turned resistance to limit upside.

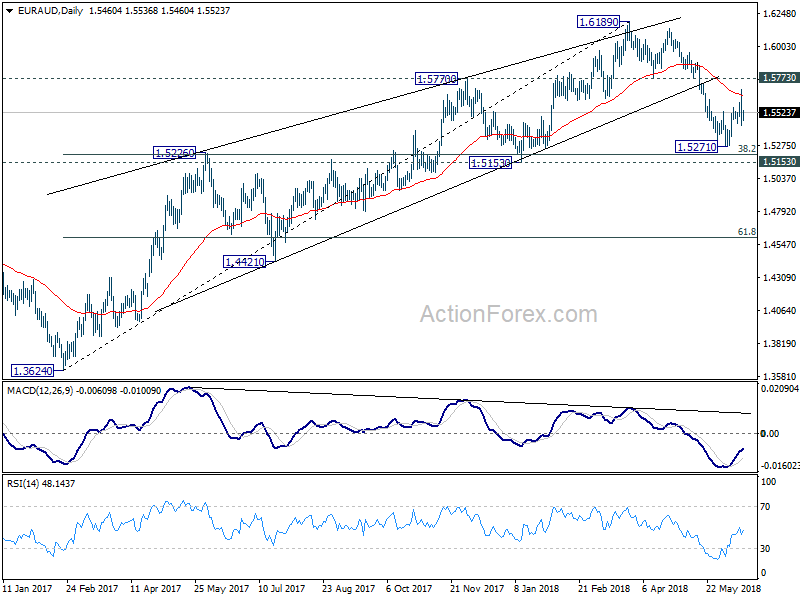

In the bigger picture, rally from 1.3624 (2017 low) should have completed at 1.6189 already, ahead of 1.6587 key resistance (2015 high). 1.6189 is seen as a medium term top. Deeper fall would be seen to 38.2% retracement of 1.3624 to 1.6189 at 1.5209 first. Decisive break there will pave the way to 61.8% retracement at 1.4604. In that case, we’ll look for bottoming again below 1.4604. On the upside, firm break of 1.5773 support turned resistance is needed to indicate completion of the fall from 1.6189. Otherwise, further decline is expected in medium term, even in case of strong rebound.