EUR/USD Daily Outlook

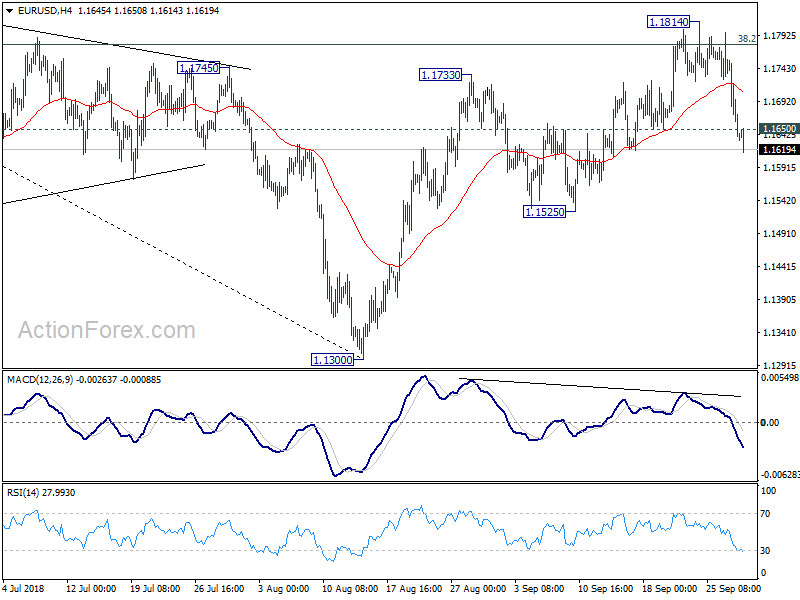

Daily Pivots: (S1) 1.1601; (P) 1.1680; (R1) 1.1721;

EUR/USD’s fall from 1.1814 is still in progress and intraday bias remains on the downside for 1.1525 support first. As noted before, corrective rise from 1.1300 should have completed at 1.1814, after meeting strong resistance from 38.2% retracement of 1.2555 to 1.1300 at 1.1779. Break of 1.1525 support will confirm this bearish view and target a test on 1.1300 low. On the upside, above 1.1650 minor resistance will turn intraday bias neutral and bring recovery. But upside should be limited well below 1.1814 to bring fall resumption.

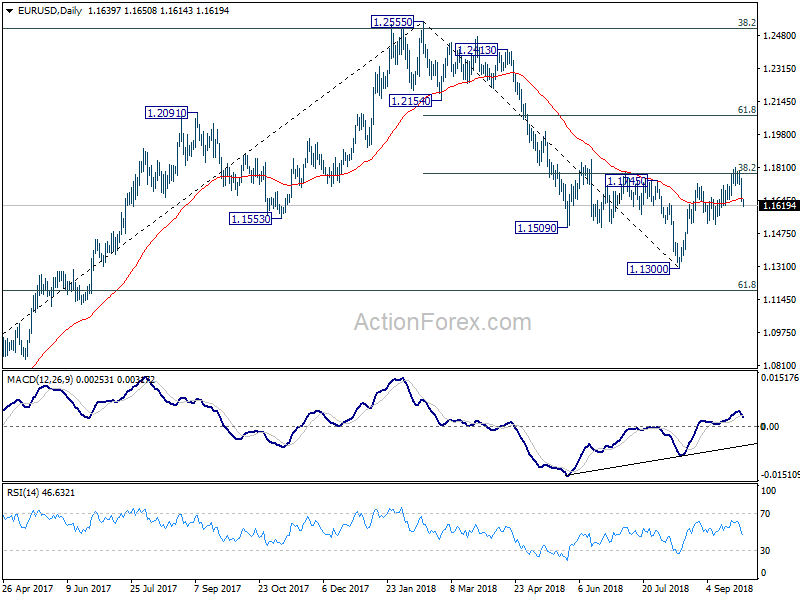

In the bigger picture, a medium term bottom should be in place at 1.1300, on bullish convergence condition in daily MACD and some consolidations would be seen. But still, note that EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. That carries some long term bearish implications. Thus, we’d expect fall from 1.2555 high to resume after consolidation completes. Below 1.1300 should send EUR/USD through 61.8% retracement of 1.0339 to 1.2555 at 1.1186. And, in that case, EUR/USD would head to retest 1.0339 (2017 low).

AUD/USD Daily Outlook

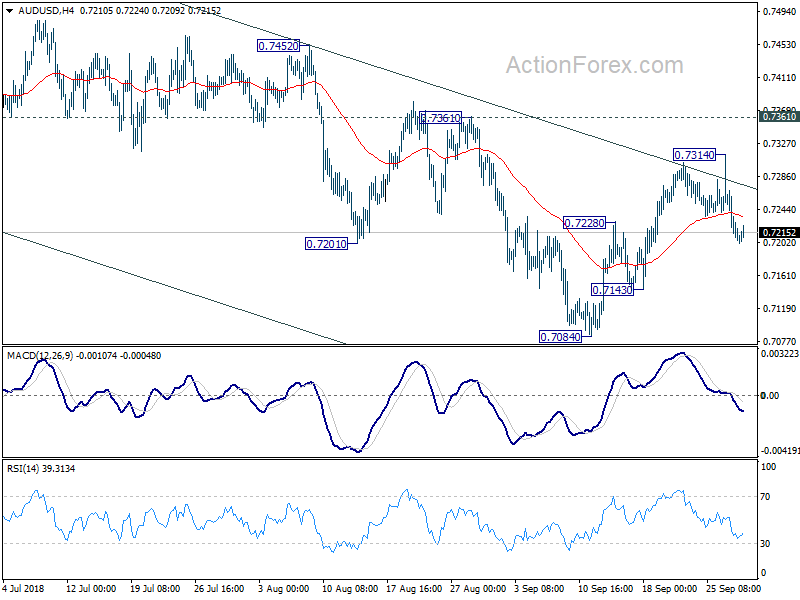

Daily Pivots: (S1) 0.7183; (P) 0.7226; (R1) 0.7248;

Intraday bias in AUD/USD remains on the downside for 0.7143 support. As noted before, whole corrective rebound from 0.7084 has completed at 0.7314. Break of 0.7143 will likely resume larger down trend from 0.8135 through 0.7084 low. On the upside, in case of another rise, upside should be limited below 0.7361 resistance to complete the correction and bring down trend resumption.

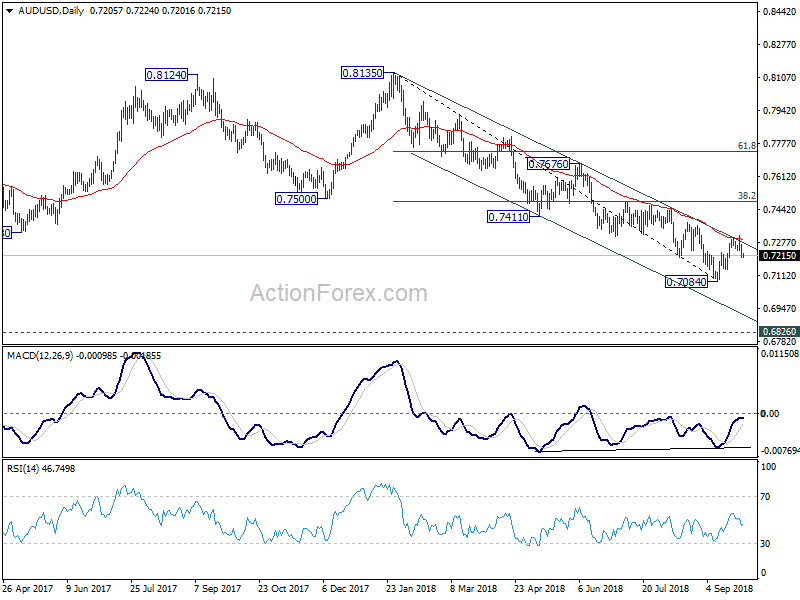

In the bigger picture, rebound from 0.6826 (2016 low) is seen as a corrective move that should be completed at 0.8135. Fall from there would extend to have a test on 0.6826. There is prospect of resuming long term down trend from 1.1079 (2011 high). Current downside momentum as seen in weekly MACD support this bearish case. Firm break of 0.6826 will target 0.6008 key support next (2008 low). On the upside, break of 0.7361 resistance, however, argues that a medium term bottom is possibly in place, and stronger rebound could follow. We’ll assess the medium term outlook later if this happens.