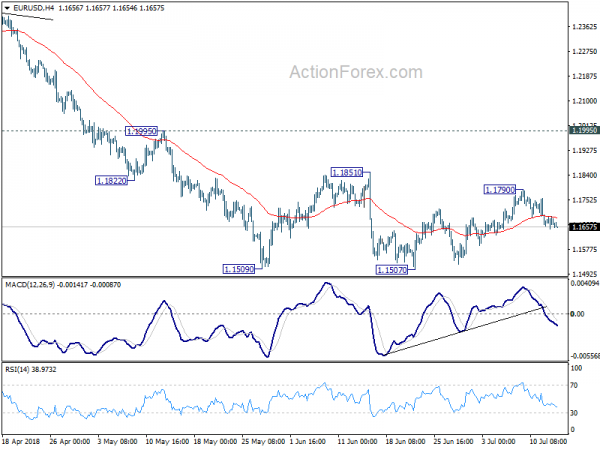

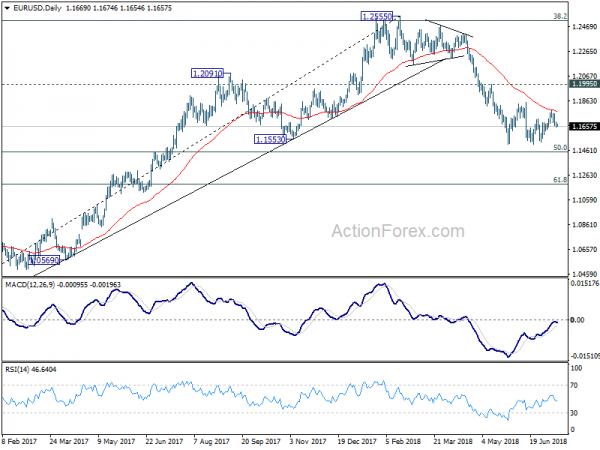

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1648; (P) 1.1672 (R1) 1.1696;

Intraday bias in EUR/USD remains on the downside for retesting 1.1507 low. Decisive break there will resume larger fall from 1.2555. In that case, EUR/USD should drop through 50% retracement of 1.0339 to 1.2555 at 1.1447 to 61.8% retracement at 1.1186. On the upside, in case of another recovery, upside should be limited by 1.1851 resistance to bring reversal.

In the bigger picture, EUR/USD was rejected by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. And, a medium term top was formed at 1.2555 already. Decline from there should extend further to 61.8% retracement of 1.0339 to 1.2555 at 1.1186 and below. For now, even in case of rebound, we won’t consider the fall from 1.2555 as finished as long as 1.1995 resistance holds.

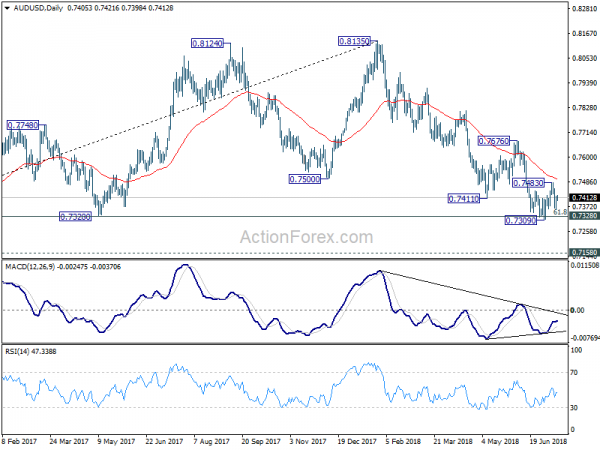

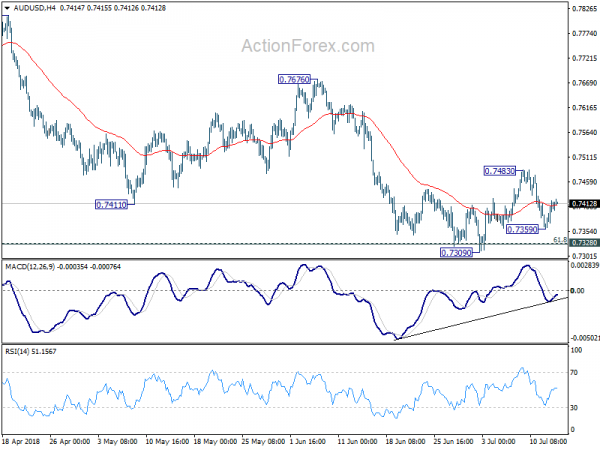

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7372; (P) 0.7396; (R1) 0.7432;

AUD/USD recovers after hitting 0.7359 and intraday bias is turned neutral first. Corrective pattern from 0.7309 could extend with another rise through 0.7483 resistance. But even in that case, upside should be limited below 0.7676 resistance to bring fall resumption eventually. On the downside, decisive break of 0.7328 cluster support (61.8% retracement of 0.6826 to 0.8135 at 0.7326) will extend the larger fall from 0.8135 to 0.7158 support next.

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move that should be completed at 0.8135. Deeper decline would be seen back to retest 0.6826 low. This will now remain the favored case as long as 0.7676 resistance holds.