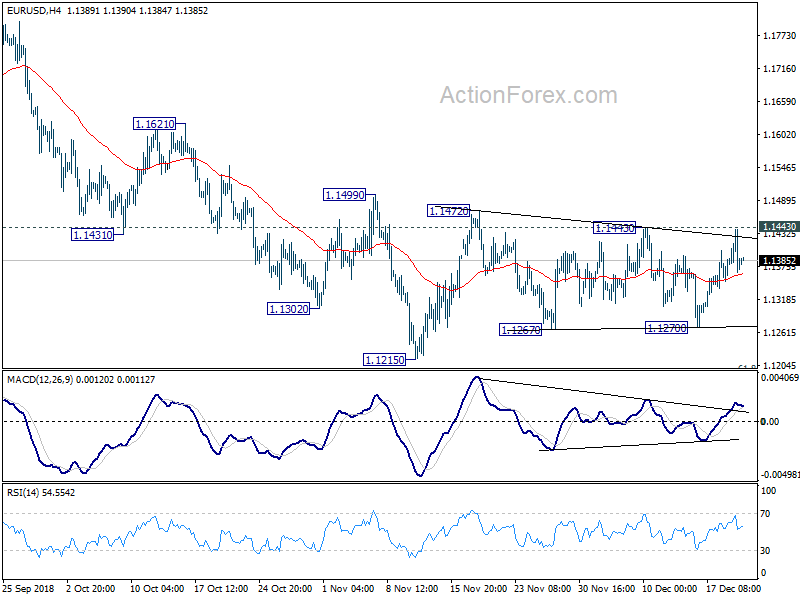

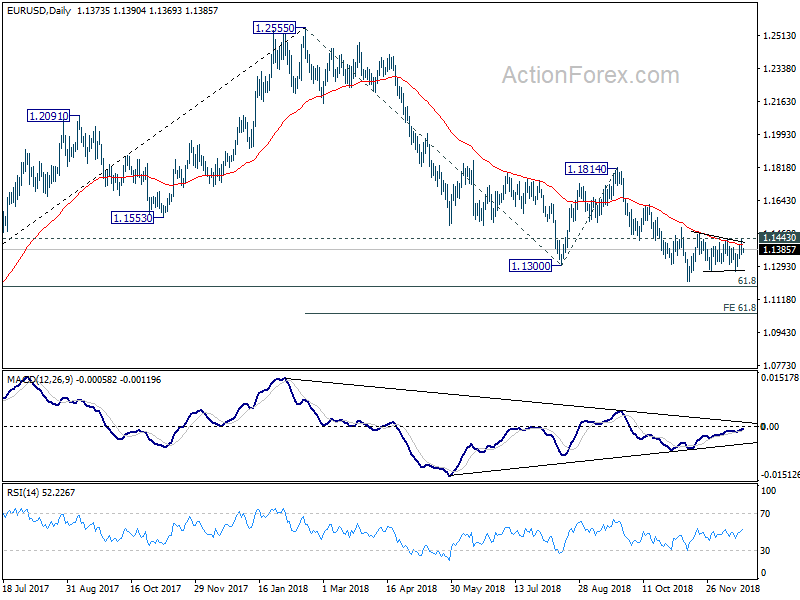

EUR/USD Daily Outlook

Daily Pivots: (S1) 1.1344; (P) 1.1393; (R1) 1.1424;

Intraday bias in EUR/USD remains neutral at this point. While the rebound from 1.1270 was strong, it’s still limited below 1.1443 resistance. And near term outlook will remain mildly bearish with downside breakout slightly favored. On the downside, break of 1.1270 will argue that larger fall is resumption should target 1.1251 low next. Decisive break there will confirm this bearish case. EUR/USD should drop through 1.1186 fibonacci level to 61.8% projection of 1.2555 to 1.1300 from 1.1814 at 1.1038 next. However, firm break of 1.1443 resistance will indicate near term reversal and bring stronger rise back to 1.1814 resistance.

In the bigger picture, as long as 1.1814 resistance holds, down trend down trend from 1.2555 medium term top is still in progress and should target 61.8% retracement of 1.0339 (2017 low) to 1.2555 at 1.1186 next. Sustained break there will pave the way to retest 1.0339. However, break of 1.1814 will confirm completion of such down trend and turn medium term outlook bullish.

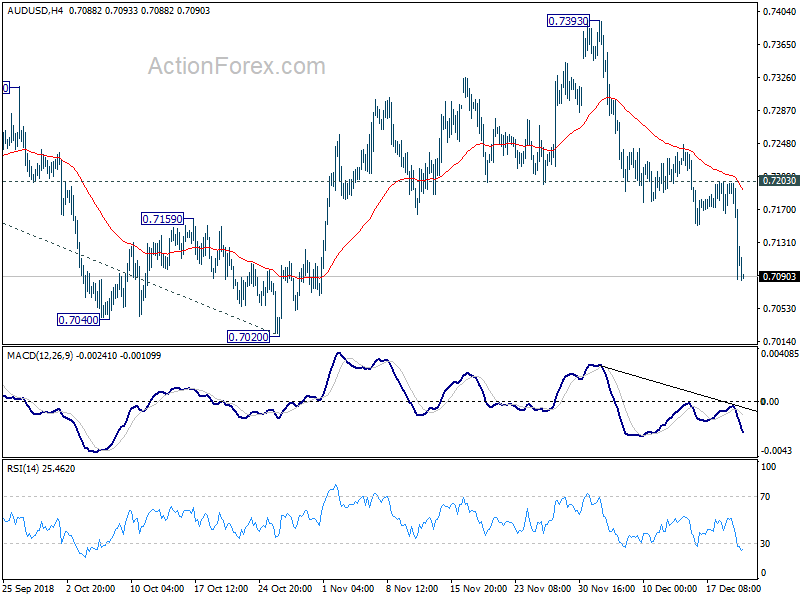

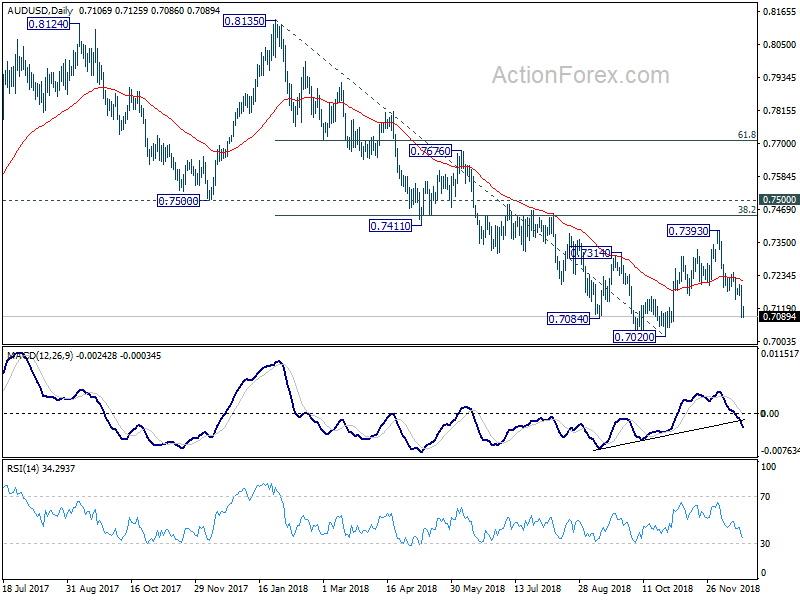

AUD/USD Daily Outlook

Daily Pivots: (S1) 0.7064; (P) 0.7132; (R1) 0.7177;

AUD/USD’s fall from 0.7393 resumed after brief consolidations and reaches as low as 0.7086 so far. Intraday bias is back on the downside for 0.7020 low. Decisive break there will resume larger decline from 0.8135 for 0.6826 key support. On the upside, break of 0.7203 resistance is needed to indicate short term bottoming. Otherwise, outlook will remain bearish in case of recovery.

In the bigger picture, a medium term bottom is in place at 0.7020 ahead of 0.6826 key support (2016 low). Stronger rebound could still be seen to correct the whole fall from 0.8135 high. But we’d expect strong resistance from 0.7500 support turned resistance to limit upside. Medium term fall from 0.8135 should resume later and extend to take on 0.6826 low at a later stage, after the correction from 0.7020 completes.