EUR/USD Daily Outlook

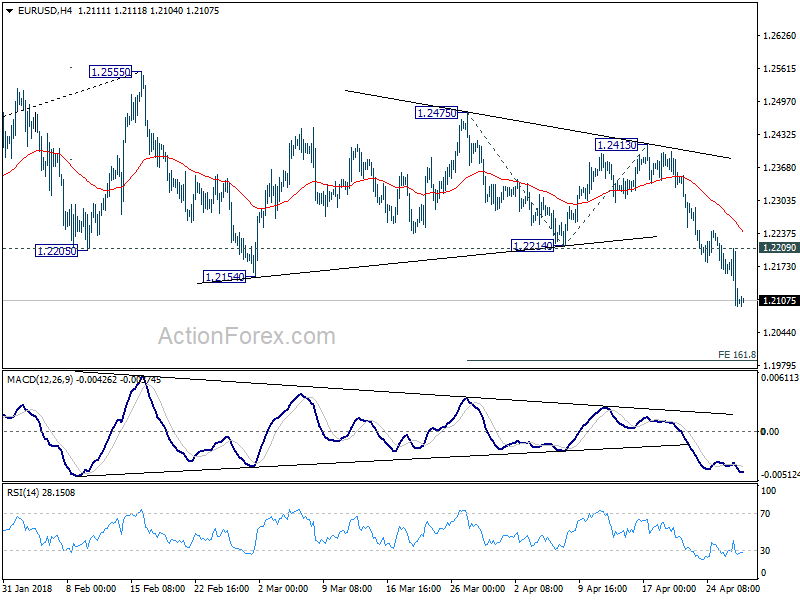

Daily Pivots: (S1) 1.2063; (P) 1.2136 (R1) 1.2176;

EUR/USD reaches as low as 1.2095 as decline accelerated after breaking 1.2154 key support. Intraday bias stays on the downside for 161.8% projection of 1.2475 to 1.2214 from 1.2413 at 1.1991 first. Break will target 200% projection at 11891. On the upside, break of 1.2209 minor resistance is needed to be the first sign of short term bottoming. Otherwise, outlook will stay bearish in case of recovery.

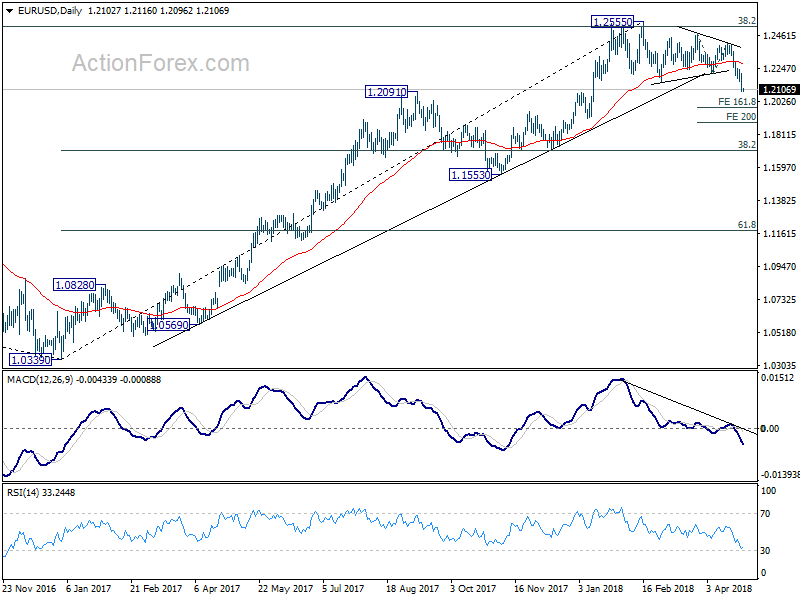

In the bigger picture, current decline and firm break of 1.2154 support confirms rejection by 38.2% retracement of 1.6039 (2008 high) to 1.0339 (2017 low) at 1.2516. A medium term top should be in place at 1.2555 and deeper decline would be seen back to 38.2% retracement of 1.0339 to 1.2555 at 1.1708 first. We’ll look at the structure and momentum of such decline before decision if it’s an impulsive or corrective move.

AUD/USD Daily Outlook

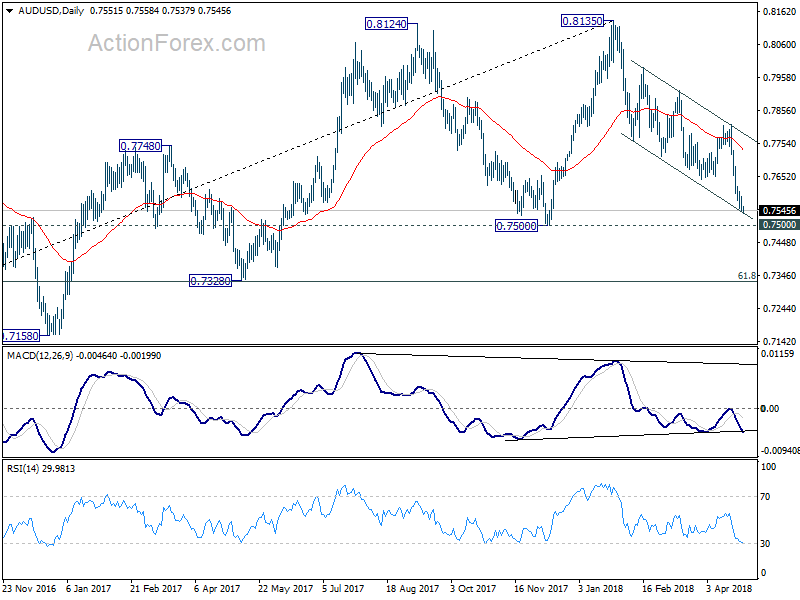

Daily Pivots: (S1) 0.7536; (P) 0.7562; (R1) 0.7578;

AUD/USD’s decline continues despite losing downside momentum as seen in 4 hour MACD. Deeper fall should be seen to 0.7500 key support level. Decisive break there will indicate medium term reversal and target 0.7328 support next. On the upside, above 0.7620 minor resistance will turn intraday bias neutral and bring consolidations. But recovery should be limited below 0.7812 resistance to bring fall resumption.

In the bigger picture, medium term rebound from 0.6826 is seen as a corrective move. It might still extend higher but we’d expect strong resistance from 38.2% retracement of 1.1079 to 0.6826 at 0.8451 to limit upside to bring long term down trend resumption. On the downside, break of 0.7500 support will now be an important signal that such corrective rebound is completed. In that case, AUD/USD would be heading back to 0.6826 low in medium term.