EUR/JPY Daily Outlook

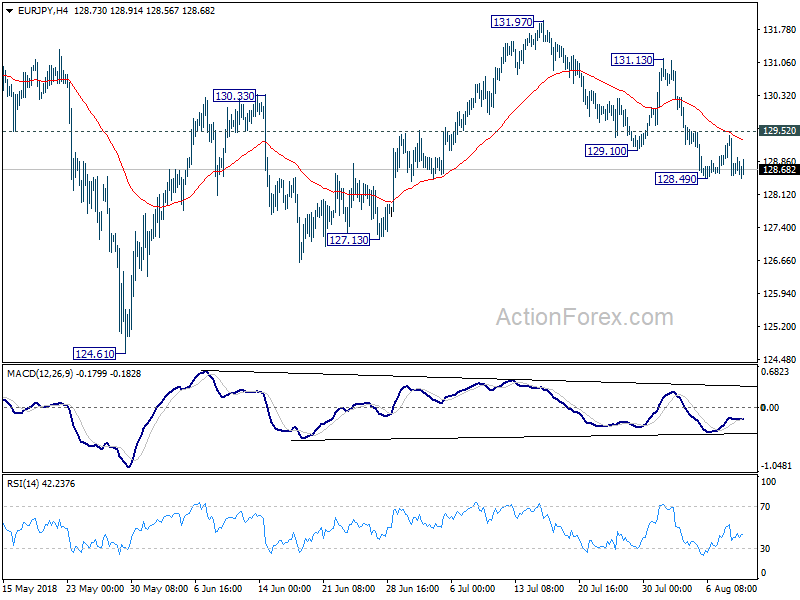

Daily Pivots: (S1) 128.43; (P) 128.94; (R1) 129.33;

Intraday bias in EUR/JPY remains neutral at this point. Overall, we’re holding on to the view that corrective rebound from 124.61 could have completed with three waves up to 131.97 already. Break of 128.49 will extend the fall from 131.97 to 127.13 support for confirming this. Meanwhile, near term risk will stay on the downside as long as 131.13 resistance holds, even in case of stronger than expected rebound.

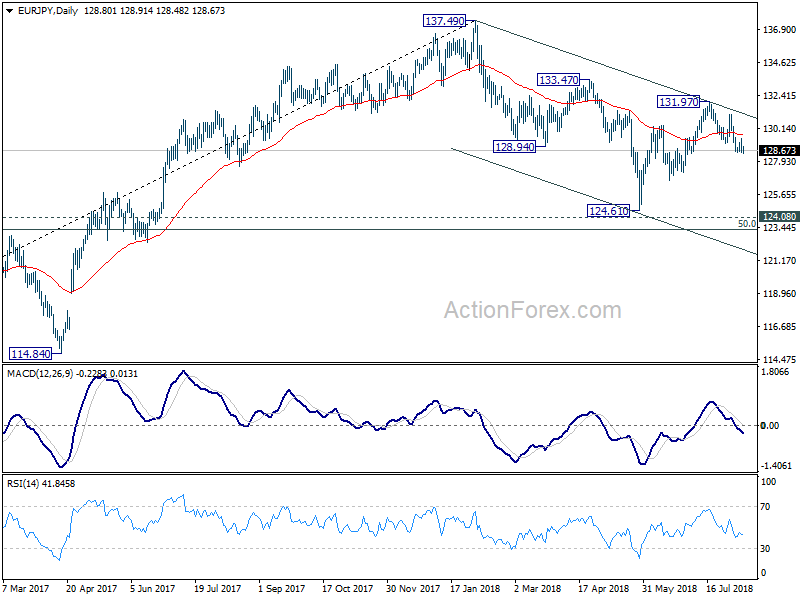

In the bigger picture, for now, EUR/JPY is still holding above 124.08 key support turned resistance. And the larger rise from 109.03 (2016 low) mildly in favor to resume. Break of 133.47 should send the cross through 137.49 high. However, decisive break of 124.08 will confirm medium term reversal and could then pave the way back to 109.03 low and below.

GBP/JPY Daily Outlook

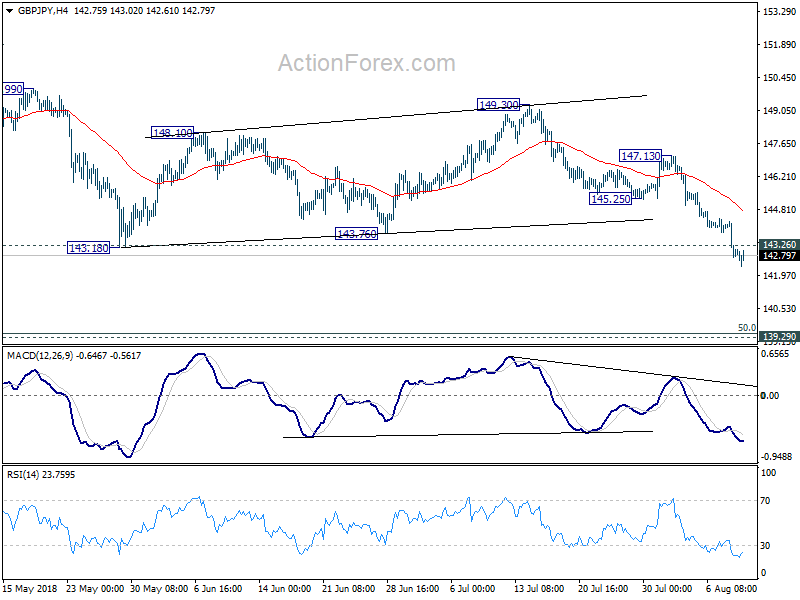

Daily Pivots: (S1) 142.35; (P) 143.32; (R1) 143.89;

GBP/JPY drops to as low as 142.33 so far today. Intraday bias remains on the downside. Current decline from 156.59 should target 139.29/47 key support level. On the upside, above 143.26 minor resistance will turn bias neutral and bring consolidation. But recovery should be limited by 145.25 support turned resistance to bring fall resumption.

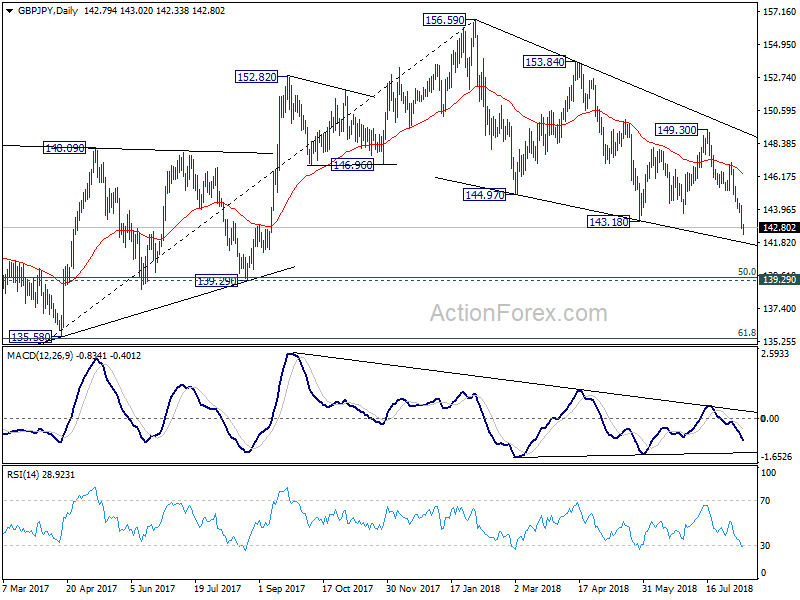

In the bigger picture, decline from 156.59 is seen as a corrective move. In case of deeper fall, strong support should be seen above 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) to contain downside and bring rebound. However, sustained break of 139.29/47 will confirm medium term reversal and turn outlook bearish for 122.36 (2016 low) again.