EUR/JPY Daily Outlook

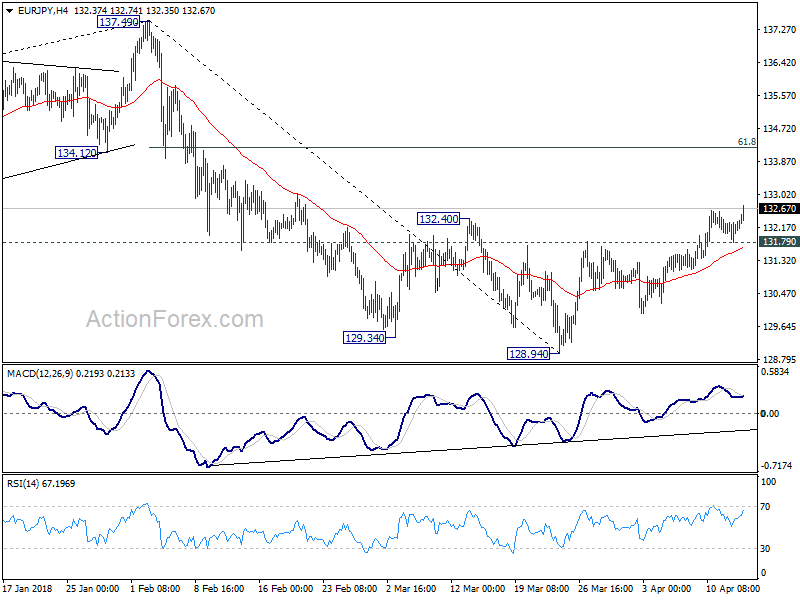

Daily Pivots: (S1) 131.96; (P) 132.14; (R1) 132.49;

EUR/JPY’s rally resumed after brief consolidation and reaches as high as 132.74 so far. Intraday bias is back on the upside and rebound from 128.94 should target 61.8% retracement of 137.49 to 128.94 at 134.22 and above. On the downside, below 131.79 minor support will turn intraday bias neutral first.

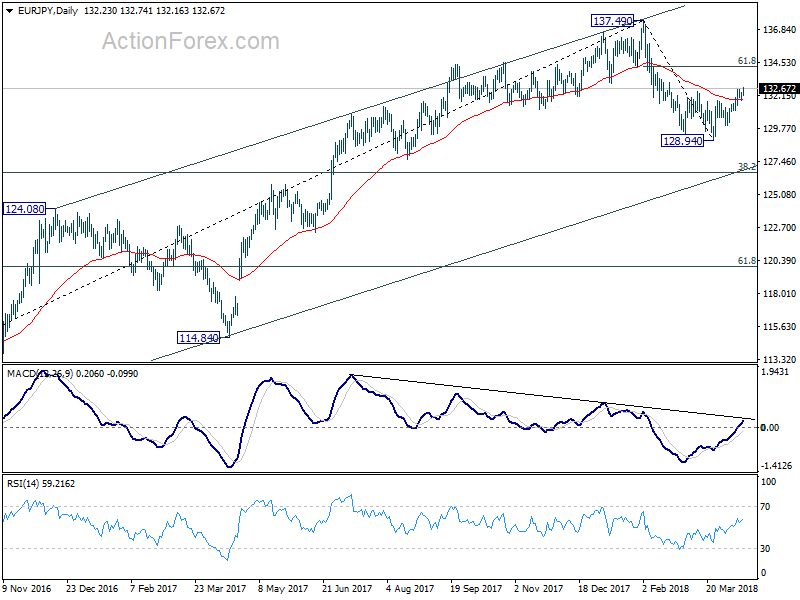

In the bigger picture, price action from 137.49 medium term top are developing into a corrective pattern. Strong support from 55 EMA (now at 129.91) suggests that the first leg has completed at 128.94 already. Nonetheless, break of 137.49 is needed to confirm resumption of the rise from 109.03 (2016 low). Otherwise, we’d expect more corrective range trading another, with risk of another fall to 38.2% retracement of 109.03 to 137.49 at 126.61 before completion.

GBP/JPY Daily Outlook

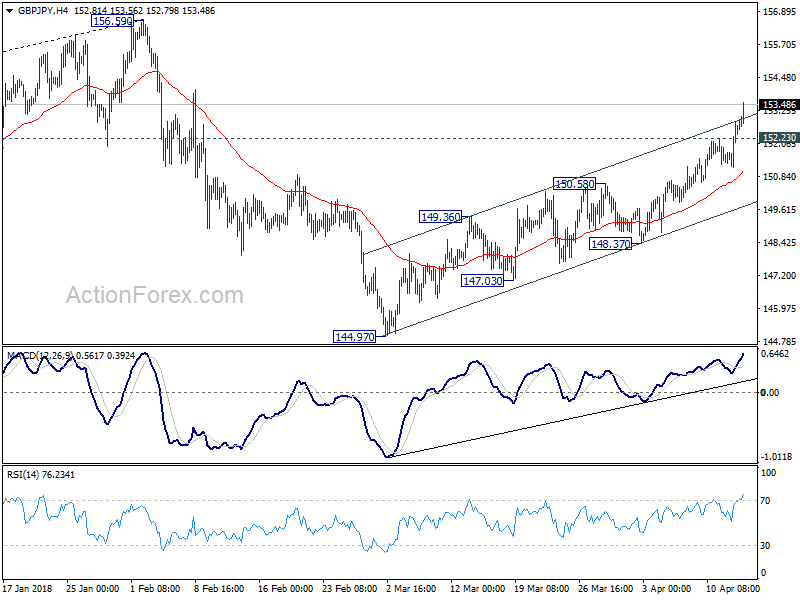

Daily Pivots: (S1) 151.62; (P) 152.25; (R1) 153.33;

GBP/JPY’s rally from 144.97 continues today and reaches as high as 153.56 so far. Break of near term channel resistance shows upside acceleration. Intraday bias stays on the upside for a test on 156.59 high next. On the downside, below 152.23 minor support will turn intraday bias neutral first. But another rise would be expected as long as 150.58 resistance turned support holds.

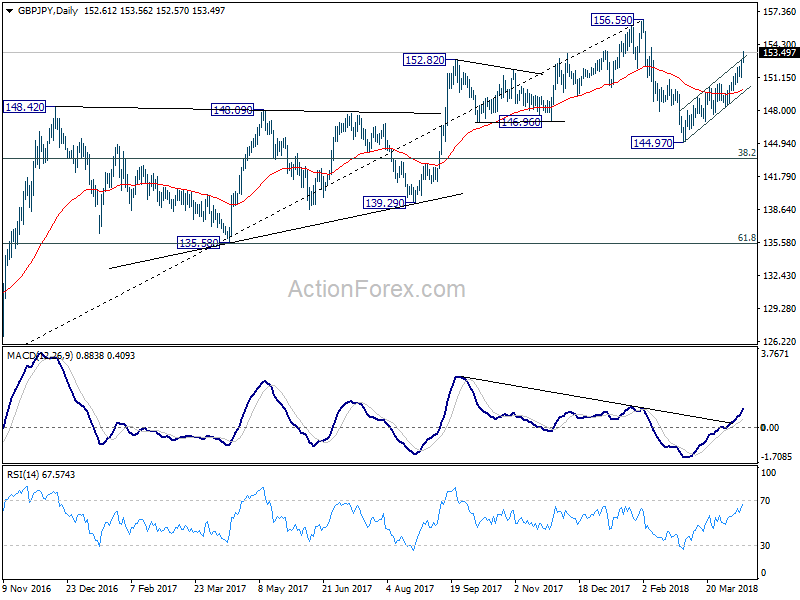

In the bigger picture, the outlook is turning mixed again. On the one hand, the cross was rejected by 55 month EMA (now at 154.20) after breaching it briefing. On the other hand, there was no sustainable selling pushing it through 38.2% retracement of 122.36 to 156.59 at 143.51. The most likely scenario is that GBP/JPY is turning into a sideway pattern between 143.51 and 156.59. And more range trading would now be seen before a breakout, possibly on the upside.