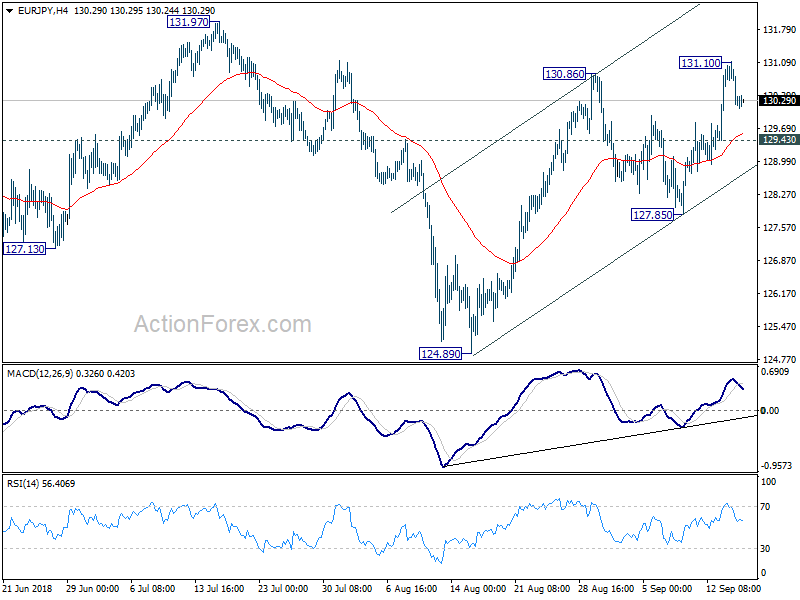

EUR/JPY Daily Outlook

Daily Pivots: (S1) 129.92; (P) 130.53; (R1) 130.87;

Intraday bias in EUR/JPY remains neutral for consolidation below 131.30 temporary top. Further rise is expected as long as 129.43 minors support holds. On the upside, break of 131.10 will resume the rebound from 124.89 to 131.97 resistance and then key fibonacci resistance at 132.56.

In the bigger picture, as long as 124.08 key resistance turned support, larger up trend from 109.03 (2016 low) remains in favor to continue. Decisive break of 61.8% retracement of 137.49 to 124.61 at 132.56 will pave the way to retest 137.49 high. However, firm break of 124.08 will argue that whole rise from 109.03 (2016 low) has completed at 137.49. Deeper decline would be seen to 61.8% retracement of 109.03 to 137.49 at 119.90 next.

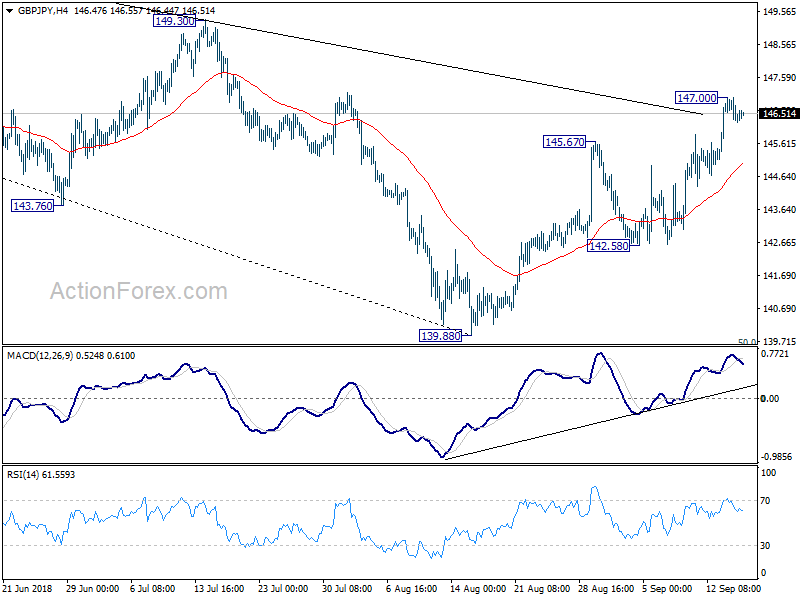

GBP/JPY Daily Outlook

Daily Pivots: (S1) 146.13; (P) 146.58; (R1) 146.90;

Intraday bias in GBP/JPY remains neutral for consolidation below 147.00 temporary top first. Current development argues that whole decline from 156.59 has completed at 139.88, just ahead of 139.29/47 key support zone. Break of 147.00 will target 149.30 key resistance for confirming our bullish view. On the downside, break of 142.58 support is needed to confirm completion of the rebound from 139.88. Otherwise, further rise remains in favor even in case of deep retreat.

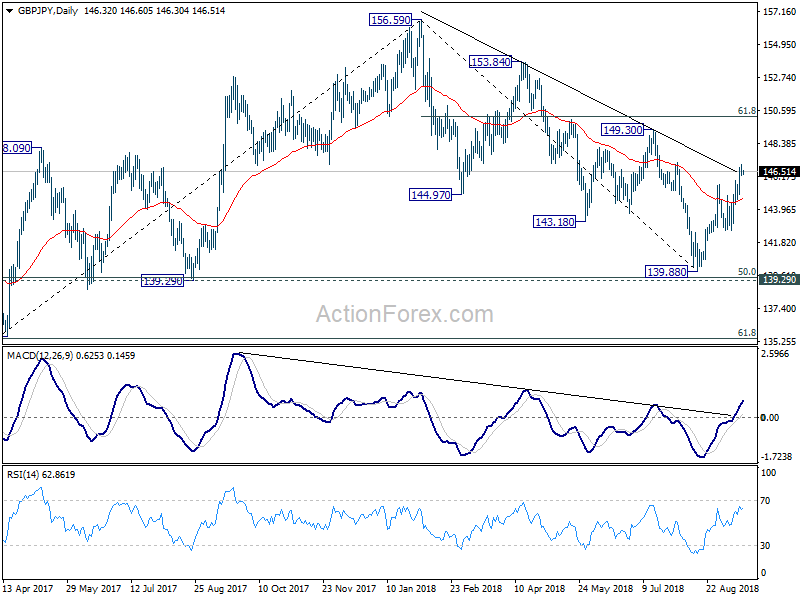

In the bigger picture, as long as 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) holds, the decline from 156.69 is seen as corrective move. That is, rise from 122.36 (2016 low), is still expected to extend higher through 156.69. However, sustained break of 139.29/47 should confirm medium term reversal and turn outlook bearish.