EUR/JPY Daily Outlook

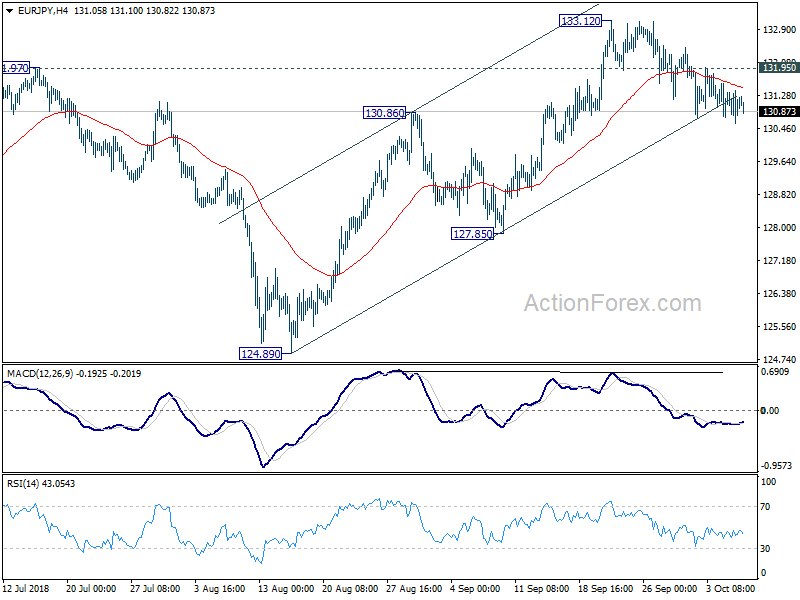

Daily Pivots: (S1) 130.61; (P) 131.01; (R1) 131.43;

Intraday bias in EUR/JPY remains mildly on the downside for the moment. The rise from 124.89 might have completed at 133.12 already. Deeper decline would now be seen to 55 day EMA (now at 130.17). Break will target 127.85 support and below. On the upside, break of 131.95 minor resistance will turn bias back to the upside for 133.12 resistance instead.

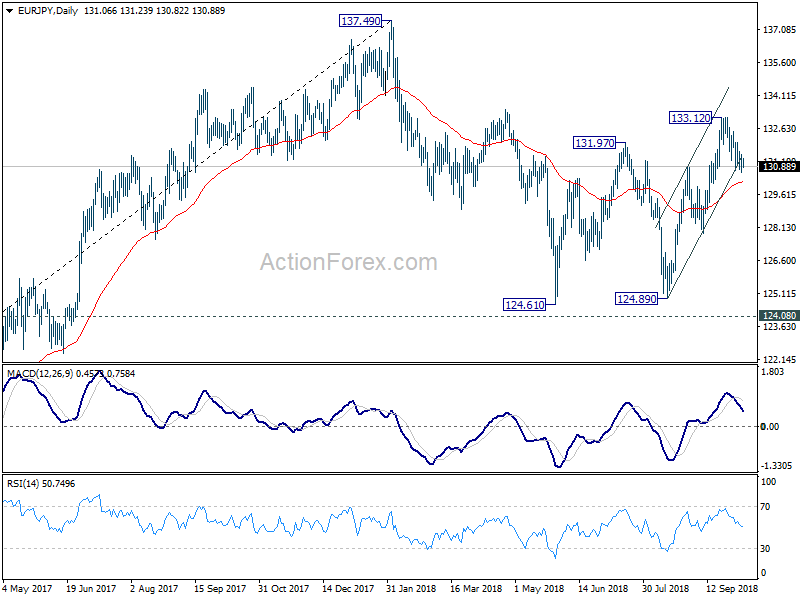

In the bigger picture, current development suggests that EUR/JPY could have defended key support level of 124.08 key resistance turned support. And, the larger up trend from 109.03 (2016 low) is still in progress. Firm break of 137.49 structural resistance will target 141.04/149.76 resistance zone next. This will now be the preferred case as long as 127.85 near term support holds.

GBP/JPY Daily Outlook

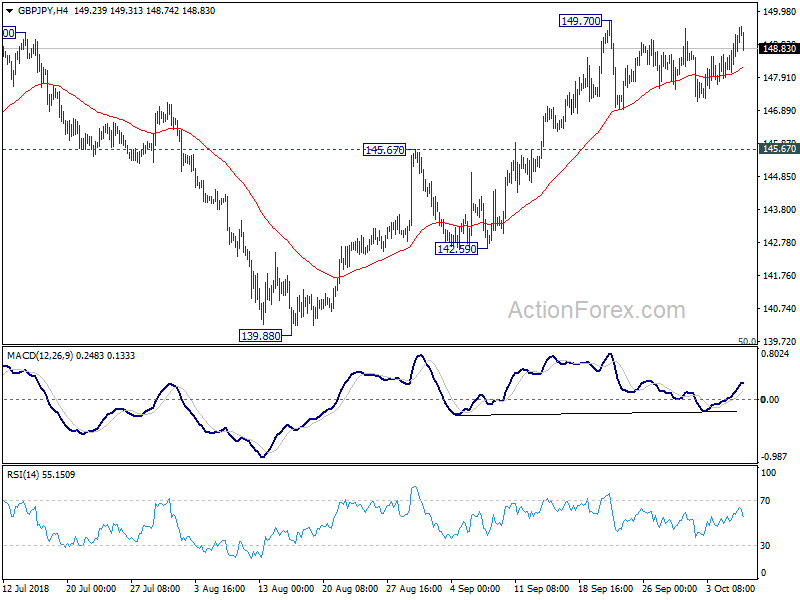

Daily Pivots: (S1) 147.83; (P) 148.24; (R1) 148.77;

Intraday bias in GBP/JPY remains neutral as consolidation from 149.70 is still in progress. In case of deeper fall, outlook will stay remain bullish as long as 145.67 resistance turned support holds. On the upside, above 149.70 will target 153.84/156.69 resistance zone next. However, break of 145.67 will suggest that the rebound from 139.88 has completed and turn near term outlook bearish again.

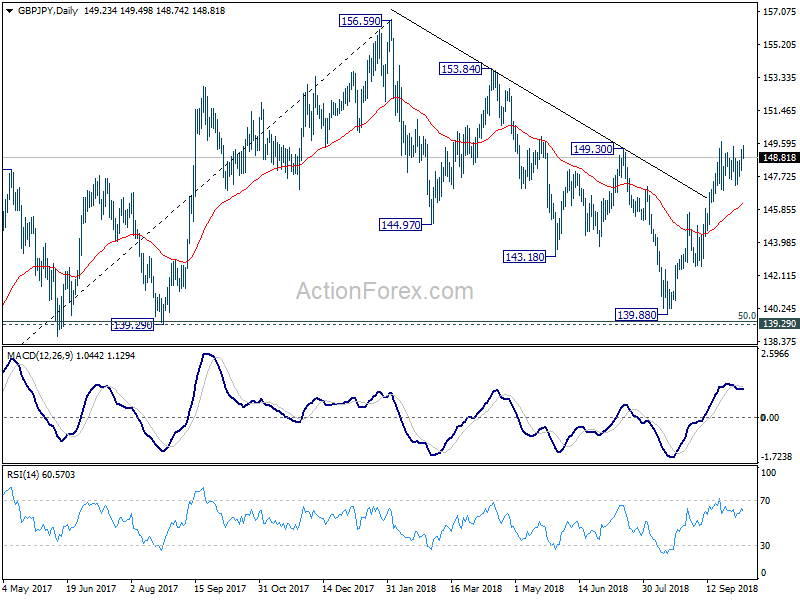

In the bigger picture, current development suggests that GBP/JPY has successfully defended 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47). And, the rally from 122.36 (2016 low) is still intact. Such medium to long term rise would extend through 156.96 high. This will now be the preferred case as long as 145.67 near term support holds. However, break of 145.67 will turn focus back to 139.29/47 key support zone.