EUR/JPY Daily Outlook

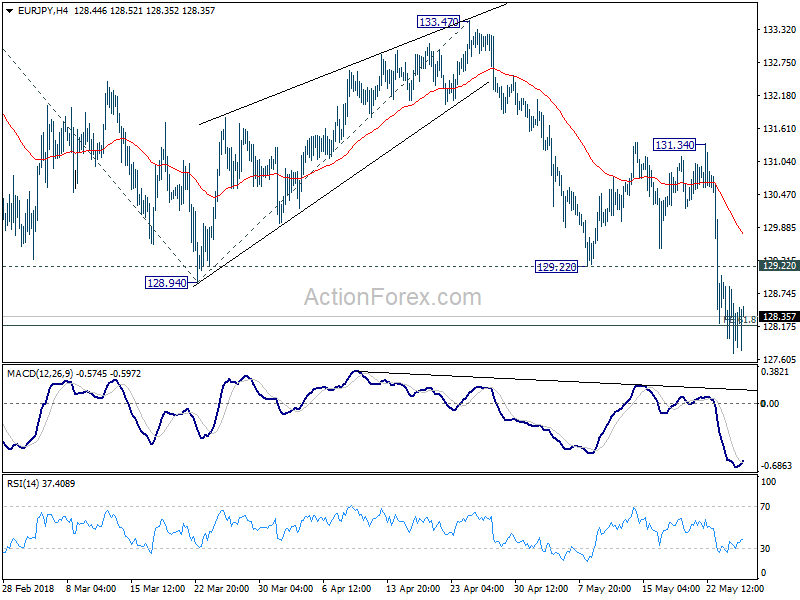

Daily Pivots: (S1) 127.55; (P) 128.21; (R1) 128.71;

With 129.05 minor resistance intact, deeper fall is expected in EUR/JPY for 126.61 medium term fibonacci level. We’ll be looking for strong support from 126.61 to contain downside and bring rebound. On the upside, above 129.22 support turned resistance is the first sign of short term bottoming. In that case, bias will be turned back to the upside for 131.34 resistance first.

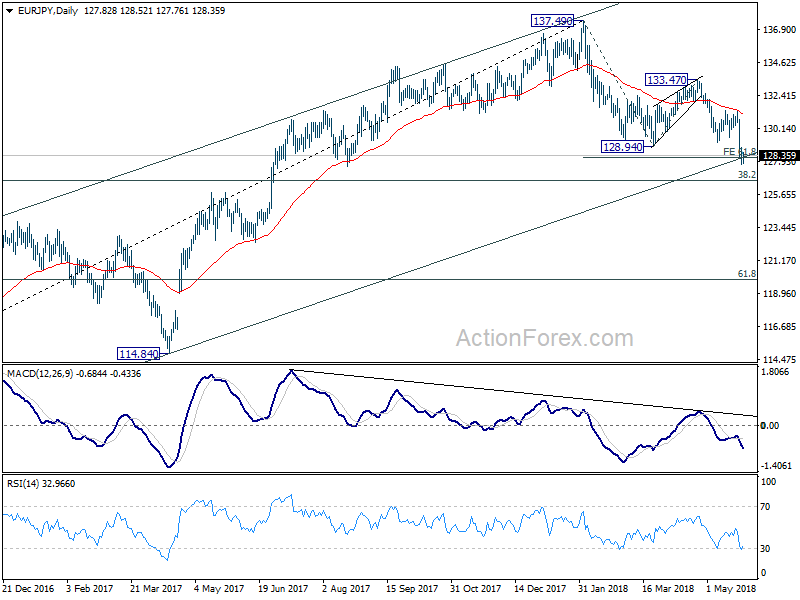

In the bigger picture, for now, price actions from 137.49 are viewed as a corrective pattern only. Hence, while deeper decline would be seen, strong support is expected at 38.2% retracement of 109.03 to 137.49 at 126.61 to contain downside and bring rebound. Up trend from 109.03 (2016 low) is expected to resume afterwards. Though, sustained break of 126.61 will be an important sign of trend reversal and will turn focus to 124.08 resistance turned support.

GBP/JPY Daily Outlook

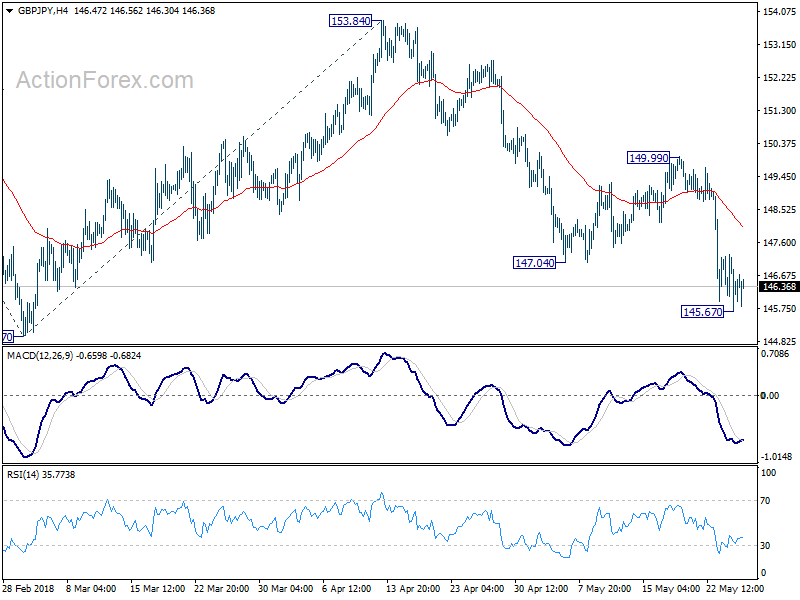

Daily Pivots: (S1) 145.50; (P) 146.38; (R1) 147.08;

GBP/JPY edged lower to 145.67 but there was no follow through selling yet. Intraday bias stays neutral first and some more consolidative trading could be seen. Upside of recovery should be limited well below 149.99 resistance to bring fall resumption. Below 145.93 will target 144.97 low first. Break there will resume the fall from 156.59 and target 100% projection of 156.59 to 144.97 from 153.84 at 142.22 next.

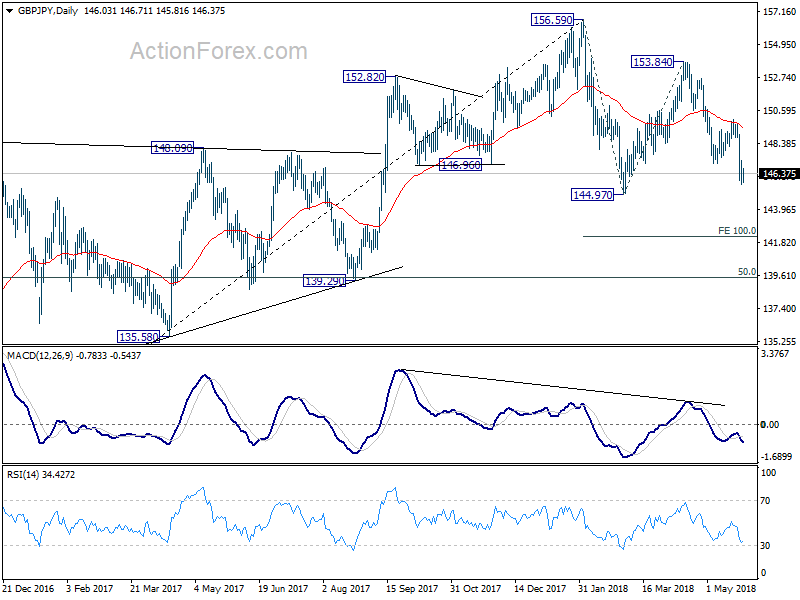

In the bigger picture, for now, we’re treating price actions from 156.59 as a corrective move. Therefore, while deeper fall is expected, strong support should be seen above 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) to contain downside and bring rebound. There is still prospect of extending the rise from 122.36. However, considering that GBP/JPY failed to sustain above 55 month EMA (now at 153.94), firm break of 139.29 will confirm trend reversal and turn outlook bearish.