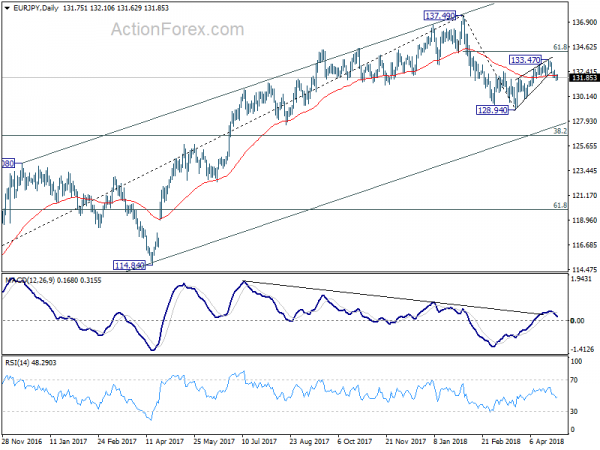

EUR/JPY Daily Outlook

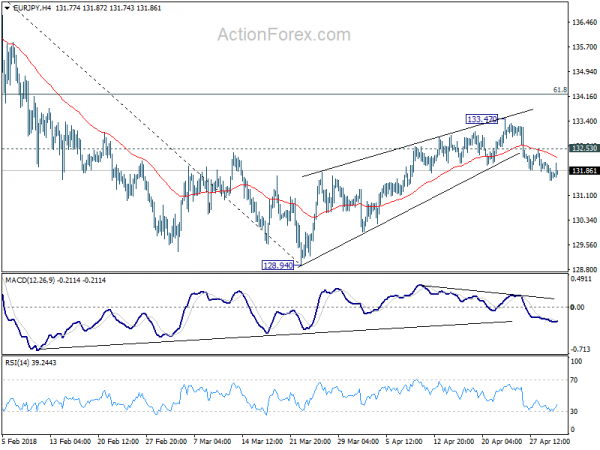

Daily Pivots: (S1) 131.52; (P) 131.82; (R1) 132.08;

Outlook in EUR/JPY remains unchanged. Corrective rise from 128.94 has completed at 133.47 already. Deeper decline should be seen back to retest 128.94 low. Break there will resume whole decline from 137.49. On the upside, above 132.53 minor resistance will delay the bearish case. Intraday bias would be turned to the upside to extend the rebound from 128.94. Still, we expect strong resistance from 61.8% retracement of 137.49 to 128.94 at 134.22 to limit upside and bring near term reversal eventually.

In the bigger picture, price action from 137.49 medium term top are developing into a corrective pattern. The first leg has completed at 128.94. The second leg might be finished at 133.47 or it might extend. But after all, we’d expect another decline through 128.94 to 38.2% retracement of 109.03 to 137.49 at 126.61 before completing the correction.

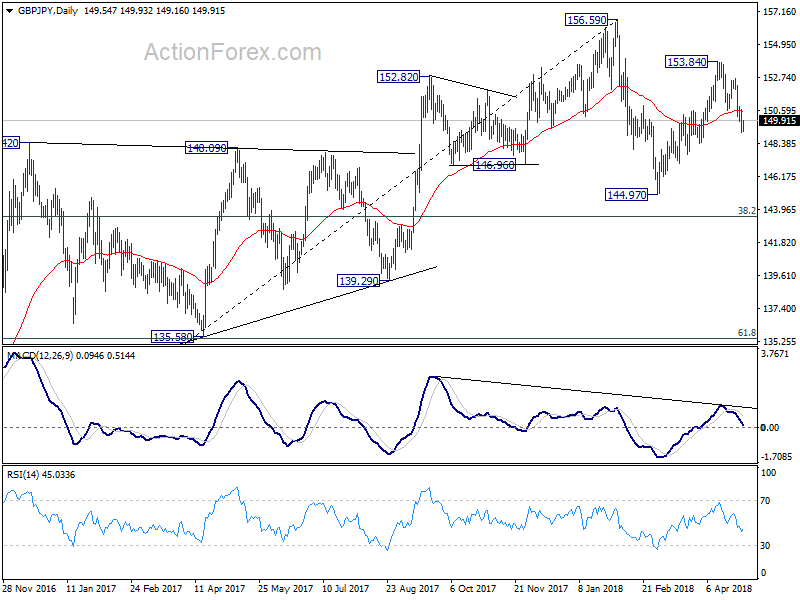

GBP/JPY Daily Outlook

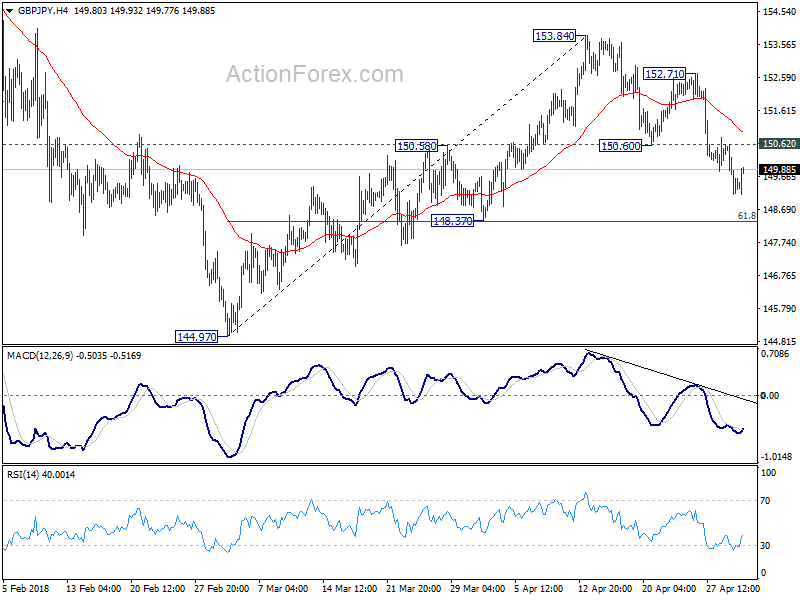

Daily Pivots: (S1) 148.93; (P) 149.78; (R1) 150.42;

With 150.62 minor resistance intact, intraday bias in GBP/JPY remains on the downside for 148.37 support. Current fall from 153.84 is seen as the third leg of the corrective pattern from 156.59. Break of 148.37 will pave the way to 144.97 and below. On the upside, above 150.62 minor support will turn intraday bias neutral first. But outlook will remain cautiously bearish as long as 152.71 resistance holds.

In the bigger picture, price actions from 156.59 are viewed as a corrective pattern. For now, we’d expect at least one more fall for 38.2% retracement of 122.36 to 156.59 at 143.51 before the consolidation completed. Though, firm break of 156.59 will resume whole up trend from 122.36 (2016 low) to 50% retracement of 195.86 (2015high) to 122.36 at 159.11 next.