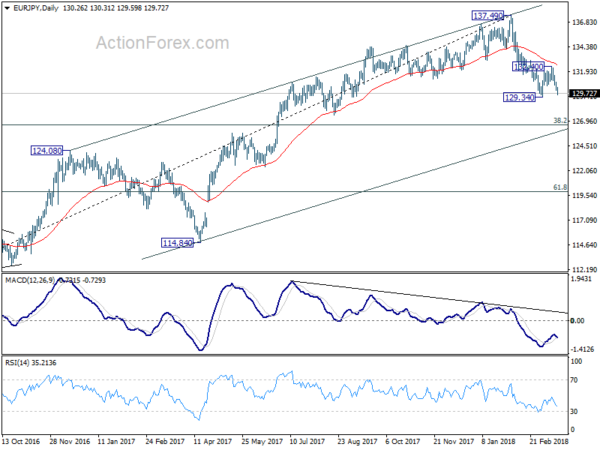

EUR/JPY Daily Outlook

Daily Pivots: (S1) 129.88; (P) 130.39; (R1) 130.71;

Intraday bias in EUR/JPY remains on the downside for 129.34 low. Decisive break there will confirm resumption of whole fall 137.49 and target 126.61 medium term fibonacci level. In case the corrective pattern from 129.34 extends with one more rise. we’d continue to expect strong resistance from 38.2% retracement of 137.49 to 129.34 at 132.45 to limit upside.

In the bigger picture, current development argues that rise from 109.03 (2016 low) has completed at 137.49, on bearish divergence condition in weekly MACD. Deeper fall should be seen to 38.2% retracement of 109.03 to 137.49 at 126.61 first. On the upside, break of 137.49 is needed to confirm medium term rise resumption. Otherwise, risk will now stay on the downside even in case of strong rebound.

<a href='https://ads.actionforex.com/www/delivery/ck.php?n=a68562b1' target='_blank'><img src='https://ads.actionforex.com/www/delivery/avw.php?zoneid=39&n=a68562b1' border='0' alt='' /></a>

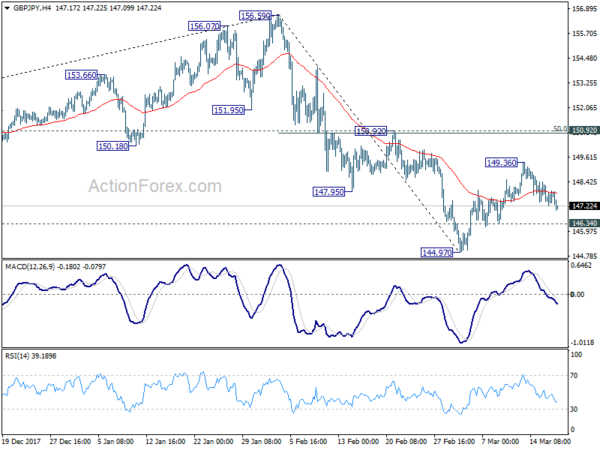

GBP/JPY Daily Outlook

Daily Pivots: (S1) 147.23; (P) 147.73; (R1) 148.22;

Intraday bias in GBP/JPY remains neutral for the moment. Corrective rise from 144.97 might extend. But in that case, upside should be limited by 150.92 (50% retracement of 156.59 to 144.97 at 150.78 to bring fall resumption. On the downside, below 146.34 minor support will suggest that the recovery has completed. Intraday bias will then be turned back to the downside for 144.97 first. Break will extend the decline from 156.59 to 143.51 medium term fibonacci level next.

In the bigger picture, the case for medium term reversal continues to build up. There is bearish divergence condition in daily MACD. 146.96 support was taken out. And GBP/JPY was rejected by 55 month EMA. Break of 38.2% retracement of 122.36 to 156.59 at 143.51 will pave the way to 61.8% retracement at 135.43 and below. This will now be the preferred case as long as 150.92 resistance holds.