EUR/JPY Daily Outlook

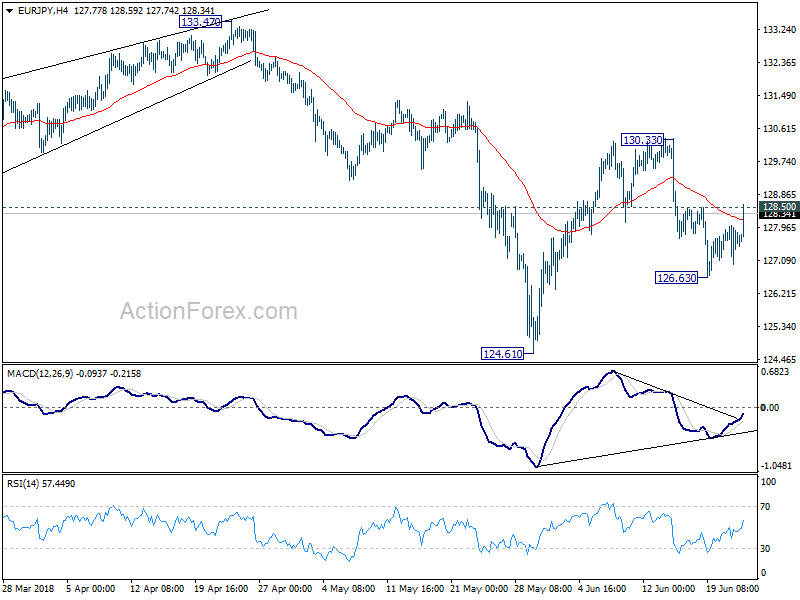

Daily Pivots: (S1) 127.04; (P) 127.55; (R1) 128.09;

EUR/JPY’s strong rebound and breach of 128.50 minor resistance argues that pull back from 130.33 is completed at 126.63. Intraday bias is back on the upside for 130.33 first. Break will resume the rebound from 124.61 and target 133.47 key resistance next. On the downside, though, below 126.63 will turn focus back to 124.61 low.

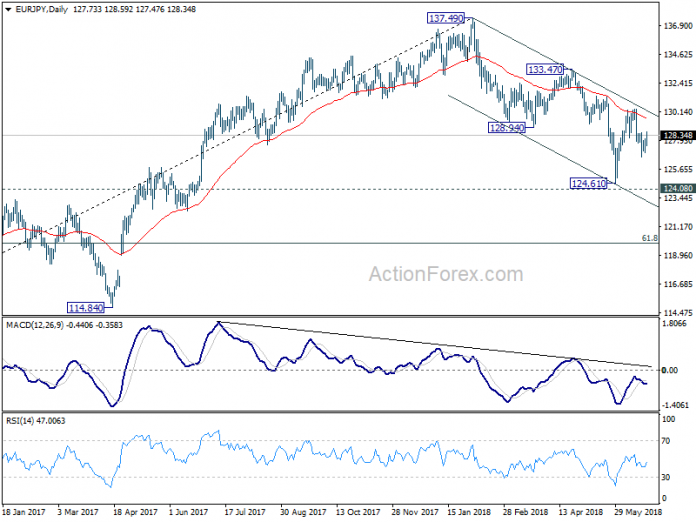

In the bigger picture, despite rebounding strongly ahead of 124.08 resistance turned support, there was no clear follow through buying. Note again that there is bearish divergence in daily MACD. Firm break of 124.08 will confirm trend reversal. That is, whole rise from 109.03 (2016 low) has completed at 137.49 already. In that case, deeper fall should be seen back to 61.8% retracement of 109.03 to 137.49 at 119.90 and below. Nonetheless, decisive break of 133.47 key resistance will likely extend the rise from 109.03 through 137.49 high.

GBP/JPY Daily Outlook

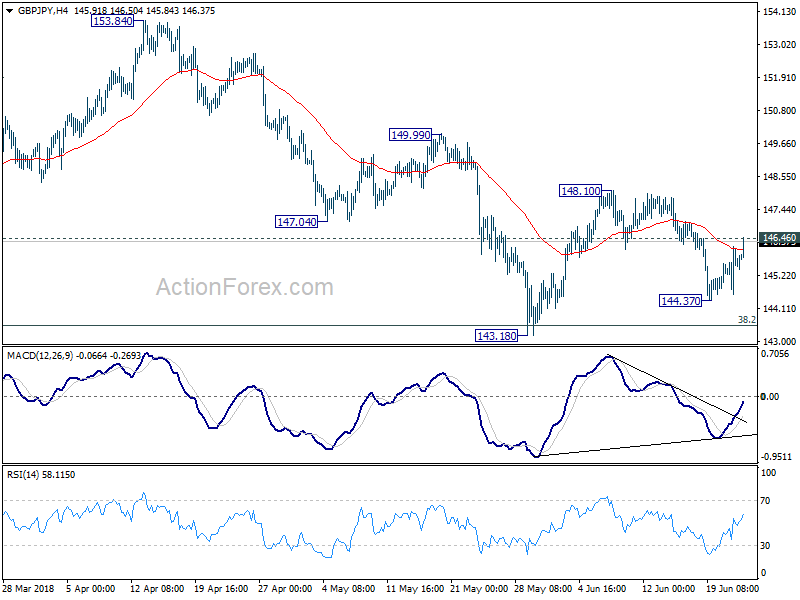

Daily Pivots: (S1) 144.73; (P) 145.48; (R1) 146.36;

GBP/JPY’s rebound from 144.37 continues today and focus is back on 146.46 minor resistance. Firm break will suggests that rebound from 143.18 is still in progress. Intraday bias will be turned to the upside for 148.10 resistance and above. On the downside, below 144.37 will target 143.18 first. Break will resume larger decline from 156.59 and target 139.25/47 cluster support level.

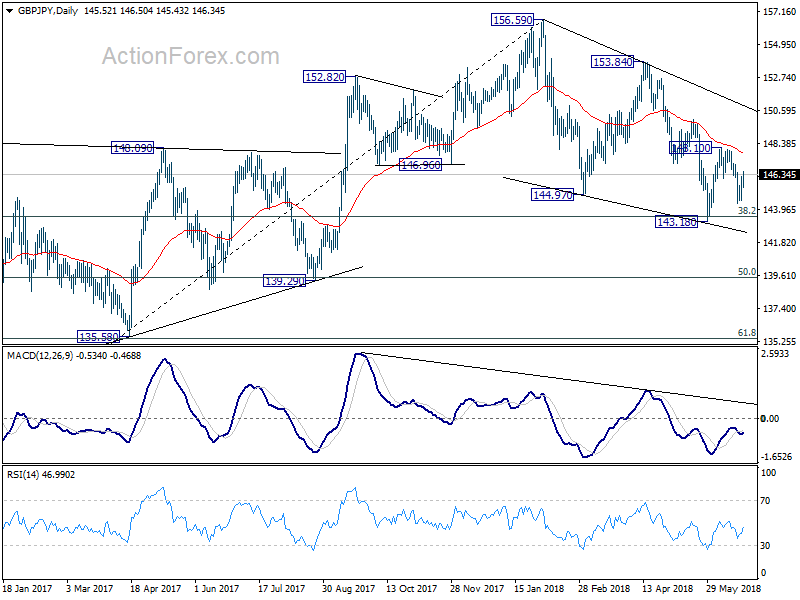

In the bigger picture, no change in the view that decline from 156.59 is a corrective move. In case of another fall, strong support should be seen above 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) to contain downside and bring rebound. Meanwhile, break of 153.84 should confirm that the correction is completed and target 156.59 and above to resume the medium term up trend.