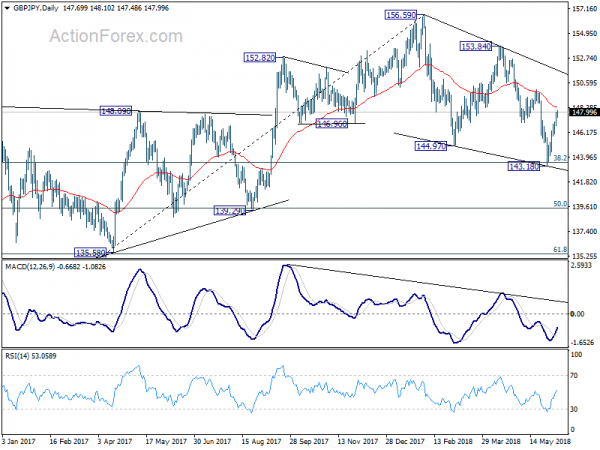

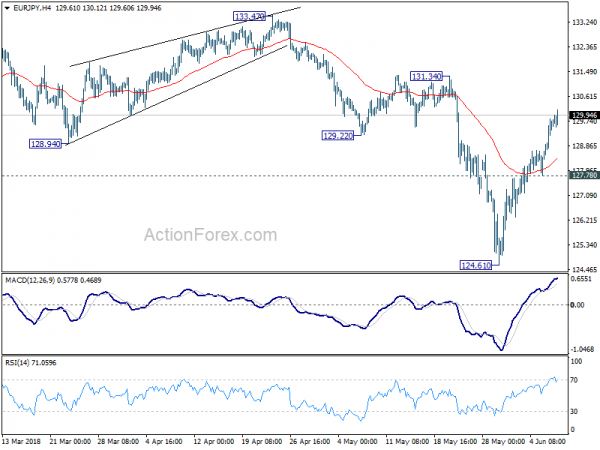

EUR/JPY Daily Outlook

Daily Pivots: (S1) 128.86; (P) 129.35; (R1) 130.22;

EUR/JPY’s rebound from 124.61 extends to as high as 130.12 so far today and intraday bias remains on the upside. As noted, the three wave structure of the fall from 133.47 to 124.61 suggests it’s a correction. And larger rally is not completed. Break of 131.34 resistance will pave the way to retest 133.47 high next. On the downside, break of 127.78 support is now needed to indicate completion of the rebound. Otherwise, outlook will stay cautiously bullish in case of retreat.

In the bigger picture, as long as 124.08 resistance turned support holds, medium term rise from 109.03 (2016 low) is still in progress and another high above 137.49 would be seen. Nonetheless, considering bearish divergence condition in daily MACD, decisive break of 124.08 will confirm medium term reversal and target 61.8% retracement of 109.03 to 137.49 at 119.90 and below.

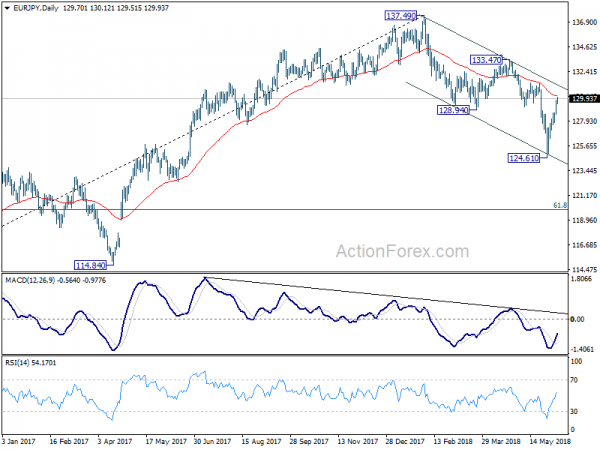

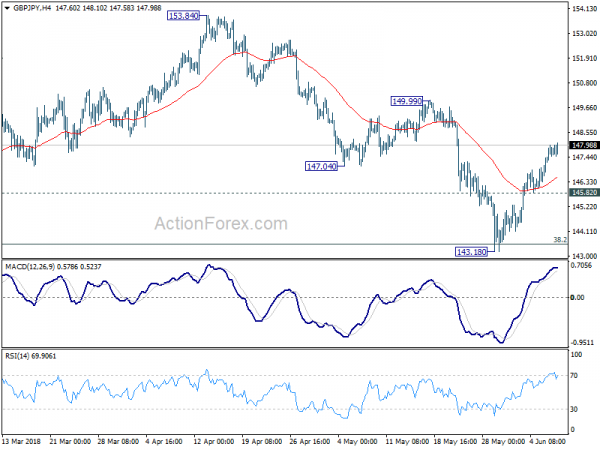

GBP/JPY Daily Outlook

Daily Pivots: (S1) 147.15; (P) 147.58; (R1) 148.22;

Intraday bias in GBP/JPY remains on the upside as rebound from 143.18 is in progress. 149.99 resistance is the next target and break there will pave the way to retest 153.84 high. On the downside, break of 145.82 minor support will argue that the rebound is completed and bring retest of 143.18 low.

In the bigger picture, no change in the view that decline from 156.59 is a corrective move. In case of another fall, strong support should be seen above 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) to contain downside and bring rebound. Meanwhile, break of 153.84 should confirm that the correction is completed and target 156.59 and above to resume the medium term up trend.