EUR/JPY Daily Outlook

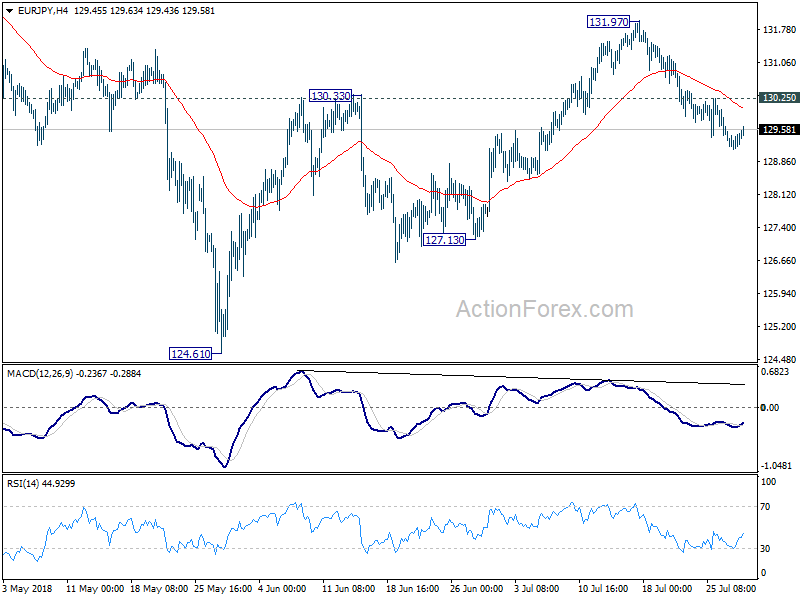

Daily Pivots: (S1) 129.17; (P) 129.37; (R1) 129.62;

No change in EUR/JPY’s outlook. With 130.25 minor resistance intact, deeper decline is expected to 127.13 support. The rebound from 124.61 should have completed with three waves up to 131.97 already. Break of 127.13 will confirm this bearish case and target a test on 124.61 low. On the upside, though, above 130.25 will bring retest of 131.97 instead.

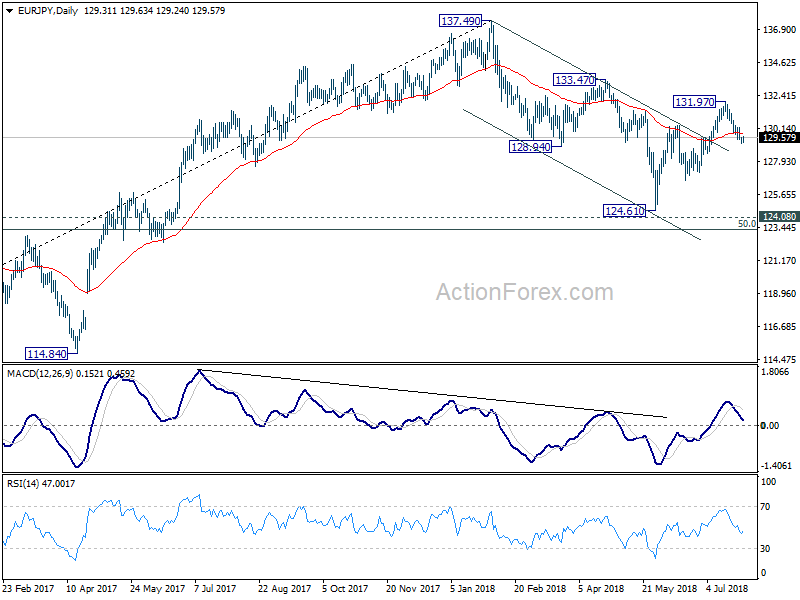

In the bigger picture, for now, medium outlook remains cautiously bullish. the three wave structure of the fall from 137.49 to 124.61 argues that it’s a correction. Also, 124.08 key resistance turned support was defended. Break of 133.47 resistance will affirm the bullish case that rise from 109.03 (2016 low) is still in progress for another high above 137.49. And this will remain the favored case as long as 127.13 support holds.

GBP/JPY Daily Outlook

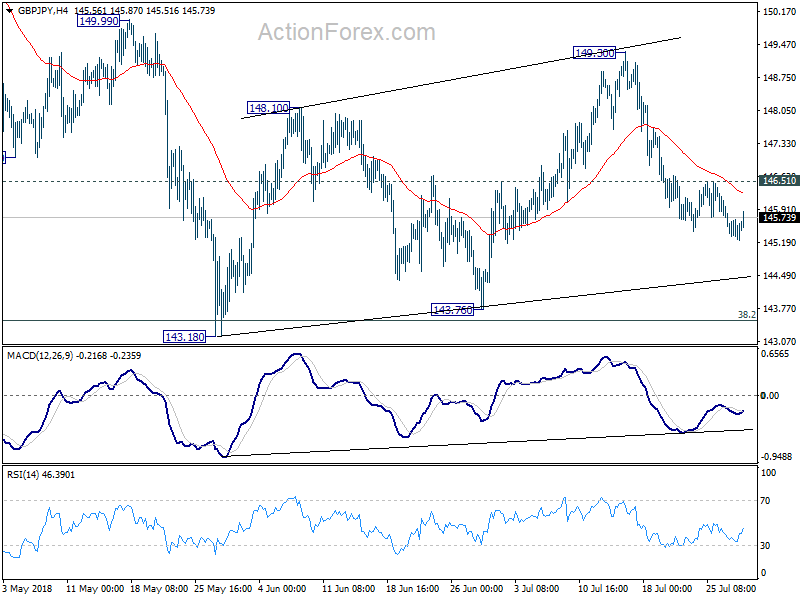

Daily Pivots: (S1) 145.22; (P) 145.53; (R1) 145.79;

No change in GBP/JPY’s outlook. With 14651 minor resistance intact, deeper fall is expected to 143.18/76 support zone. Break will resume larger decline from 156.59. On the upside, though, above 146.51 minor resistance will turn bias back to the upside for 149.30/99 resistance zone instead.

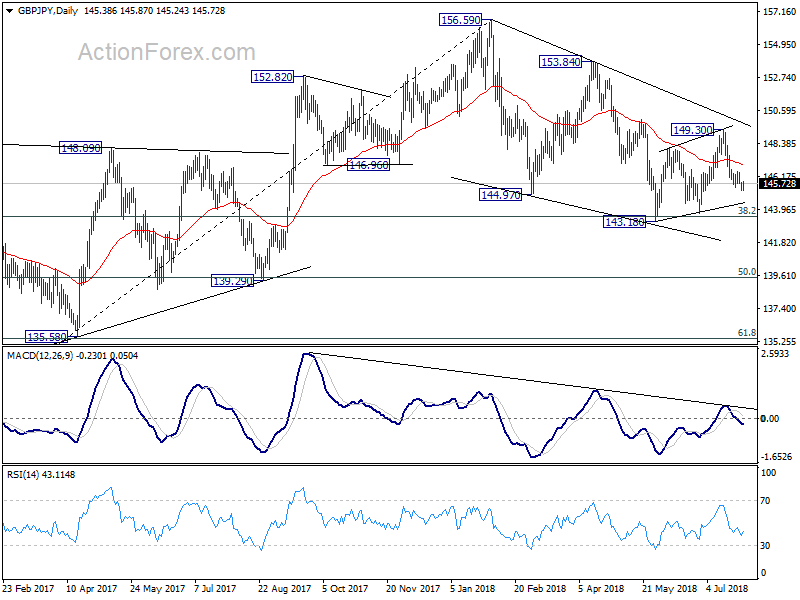

In the bigger picture, decline from 156.59 is seen as a corrective move. In case of another fall, strong support should be seen above 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) to contain downside and bring rebound. Meanwhile, break of 153.84 should confirm that the correction is completed and target 156.59 and above to resume the medium term up trend.