EUR/JPY Daily Outlook

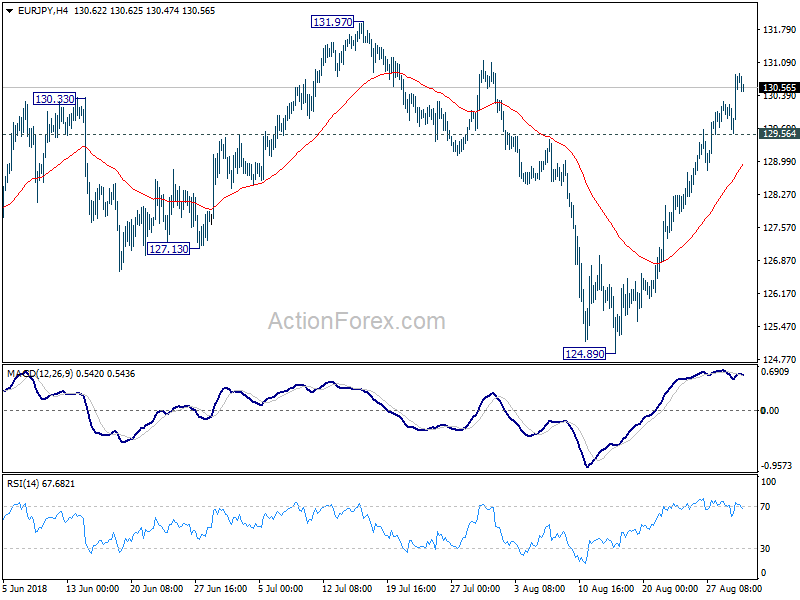

Daily Pivots: (S1) 129.94; (P) 130.40; (R1) 131.20;

EUR/JPY’s rally from 124.89 is still in progress and reaches as high as 130.86 so far. Intraday bias stays on the upside for resistance zone between 131.97 and 61.8% retracement of 137.49 to 124.61 at 132.56. On the downside, below 129.57 minor support will turn intraday bias neutral and bring consolidations first.

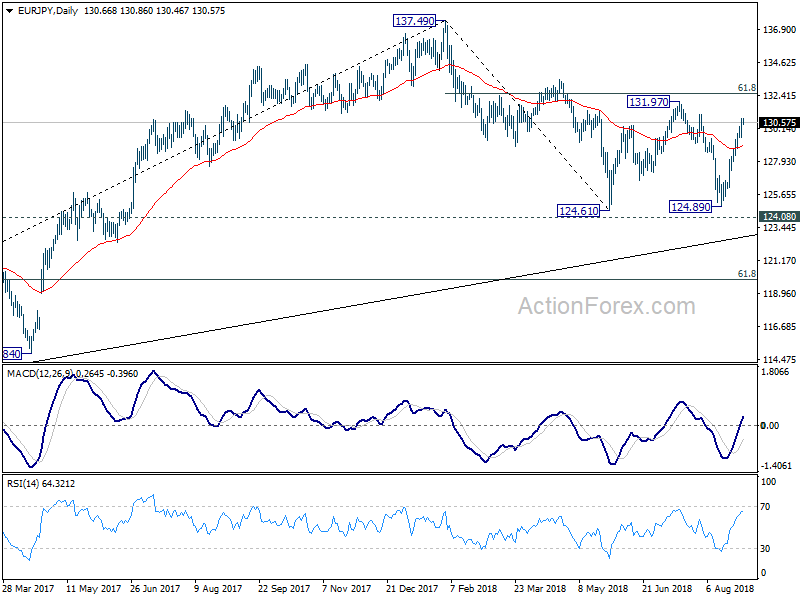

In the bigger picture, EUR/JPY once again rebounded ahead of 124.08 key resistance turned support. It’s also held above long term trend line from 109.03 (2016 low). The development argues that such rise from 109.03 might now be over yet. Decisive break of 61.8% retracement of 137.49 to 124.61 at 132.56 will pave the way to retest 137.49 high. But, firm break of 124.08 will argue that whole rise from 109.03 (2016 low) has completed at 137.49. Deeper decline would be seen to 61.8% retracement of 109.03 to 137.49 at 119.90 next.

GBP/JPY Daily Outlook

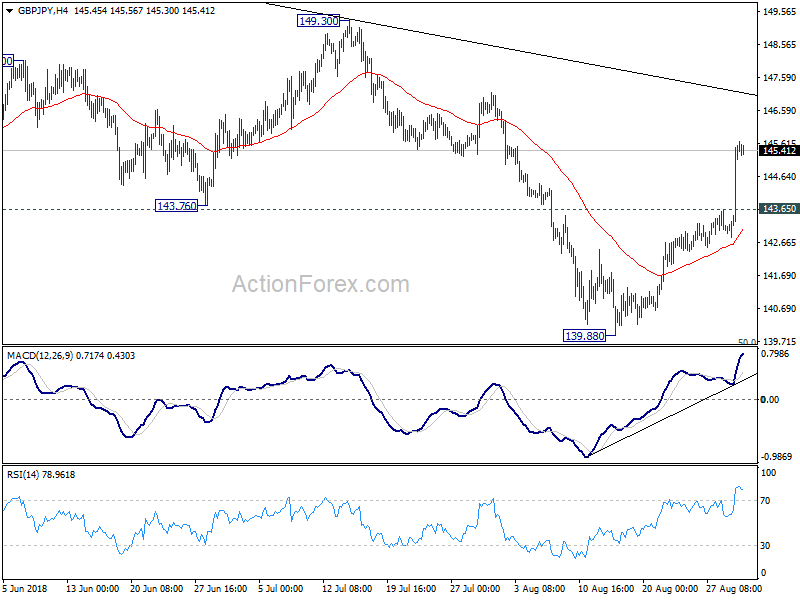

Daily Pivots: (S1) 143.69; (P) 144.64; (R1) 146.44;

GBP/JPY’s rebound from 139.88 is still in progress and reaches as high as 145.67 so far. Intraday bias stays on the upside for trend line resistance (now at 147.04). Firm break there will be a signal of bullish reversal and should target 149.30 resistance for confirmation. On the downside, below 143.65 minor support will turn intraday bias neutral first.

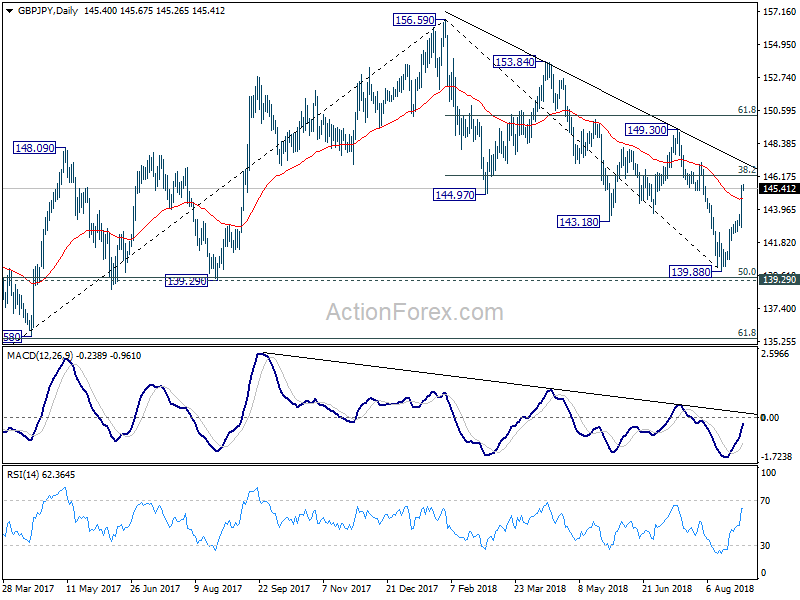

In the bigger picture, at this point decline from 156.59 is still seen as a corrective move. Focus remains on 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47). Strong rebound from there will re-affirm the bullish case that rise from 122.36 is still to extend through 156.59 high. However, sustained break of 139.29/47 should confirm medium term reversal. GBP/JPY would then target a retest on 122.26 (2016 low).