EUR/JPY Daily Outlook

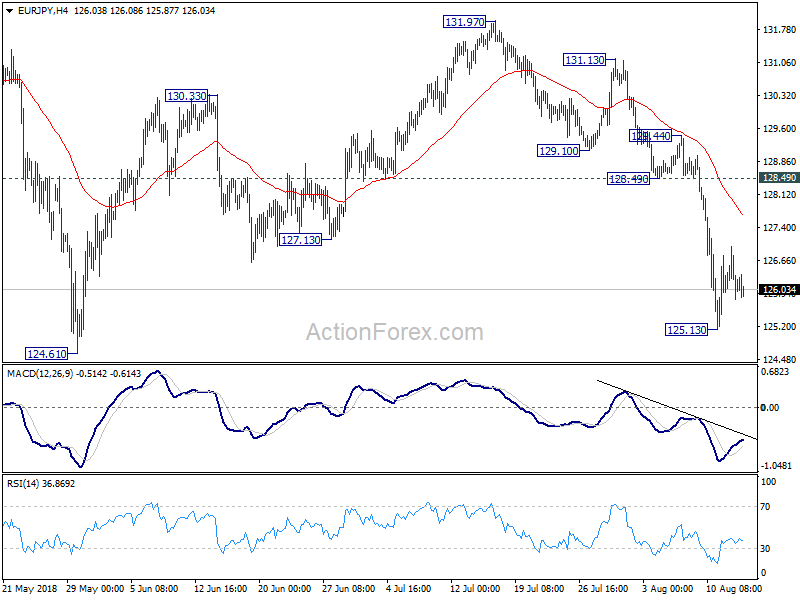

Daily Pivots: (S1) 125.58; (P) 126.29; (R1) 126.76;

EUR/JPY is staying in consolidation from 125.13 and intraday bias remains neutral first. More corrective trading could be seen and stronger recovery cannot be ruled out. But upside should be limited well below 128.49 support turned resistance to bring fall resumption. On the downside, break of 125.13 will target 124.61 key support next.

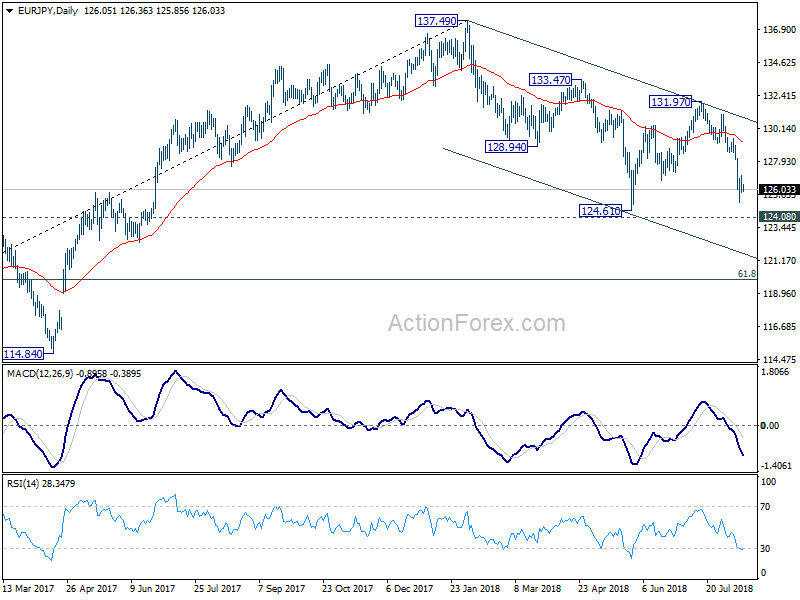

In the bigger picture, focus is back on 124.08 key resistance turned support. Decisive break there will argue that whole rise from 109.03 (2016 low) has completed at 137.49. Deeper decline would be seen to 61.8% retracement of 109.03 to 137.49 at 119.90 next. Sustained break there will pave the way to 109.03 and below. Meanwhile, rebound from 124.08 will keep medium term bullishness intact for another high above 137.49.

GBP/JPY Daily Outlook

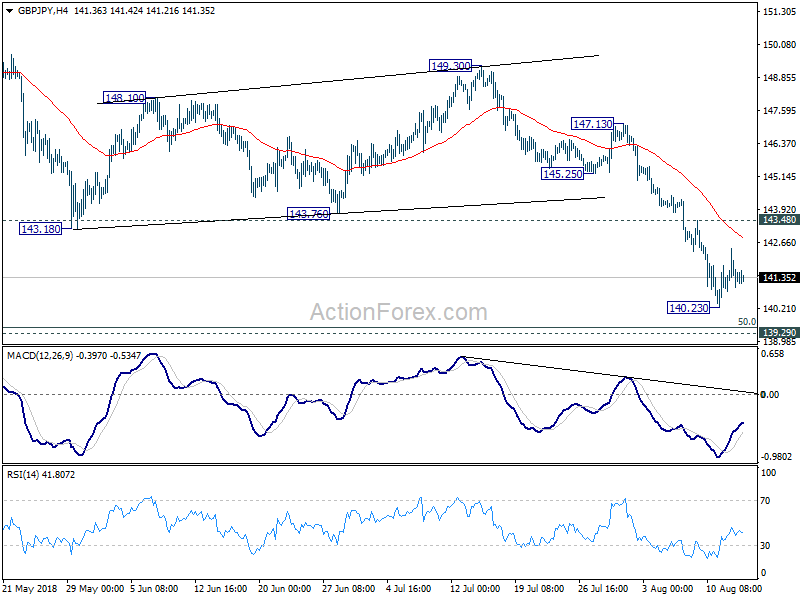

Daily Pivots: (S1) 140.77; (P) 141.58; (R1) 142.17;

GBP/JPY is staying in consolidation from 140.23 and intraday bias remains neutral at this point. Stronger recovery cannot be ruled out. But outlook will remain bearish as long as 143.48 minor resistance holds. On the downside, break of 140.23 will extend the down trend from 156.59 to 139.29/47 key support level. We’ll pay attention to bottoming signal around there.

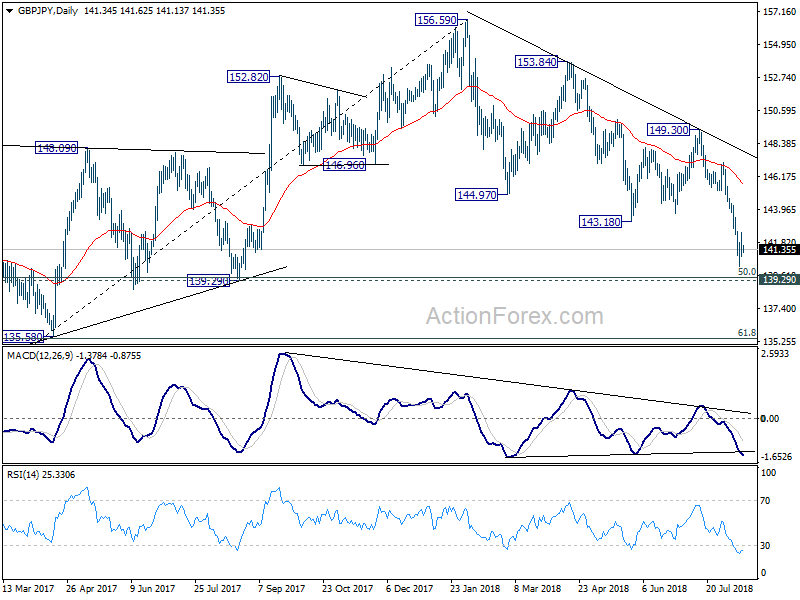

In the bigger picture, at this point decline from 156.59 is still seen as a corrective move. But the current downside accelerate makes this view shaky. Focus will be on 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47). Strong rebound from there will re-affirm the bullish case that rise from 122.36 is still to extend through 156.59 high. However, sustained break of 139.29/47 should confirm medium term reversal. GBP/JPY would then target a retest on 122.26 (2016 low).