EUR/JPY Daily Outlook

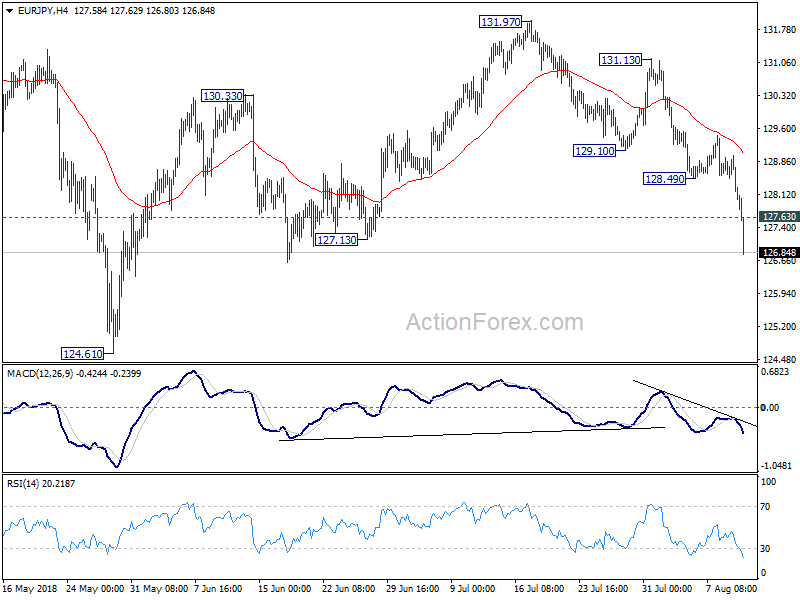

Daily Pivots: (S1) 127.72; (P) 128.36; (R1) 128.70;

EUR/JPY drops to as low as 126.80 so far as the fall from 131.79 resumed after brief consolidation. The break of 127.13 support confirms our bearish view. That is corrective rebound from 124.61 has completed with three waves up to 131.97 already. Also, the larger fall from 137.49 could be resuming. Intraday bias is now on the downside for retesting 124.61 first. On the upside, above 127.63 minor resistance will turn intraday bias neutral first. But recovery should be limited below 128.49 support turned resistance to bring another fall.

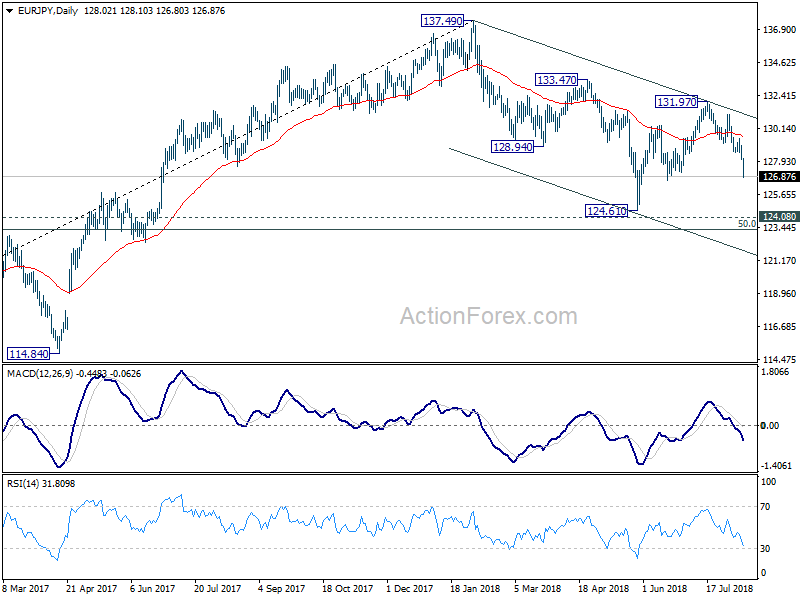

In the bigger picture, for now, EUR/JPY is still holding above 124.08 key support turned resistance. And the larger rise from 109.03 (2016 low) mildly in favor to resume. Break of 133.47 should send the cross through 137.49 high. However, decisive break of 124.08 will confirm medium term reversal and could then pave the way back to 109.03 low and below.

GBP/JPY Daily Outlook

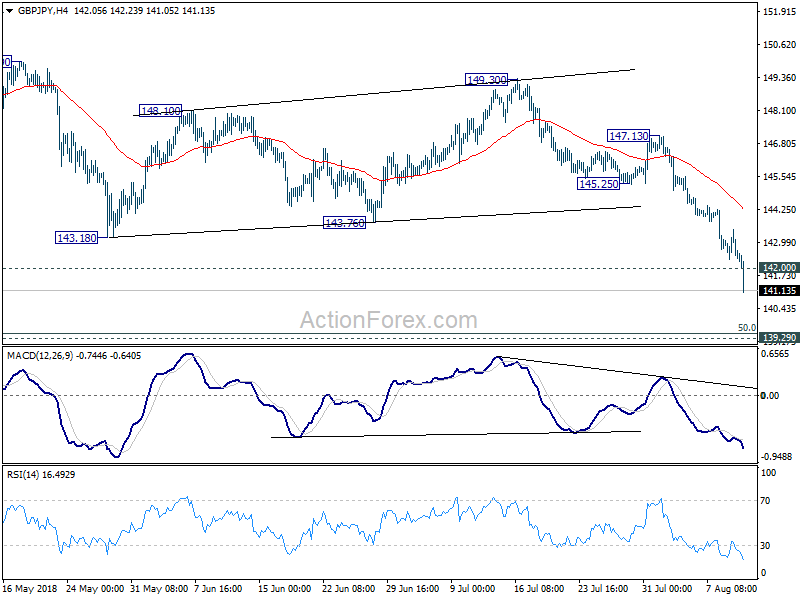

Daily Pivots: (S1) 142.07; (P) 142.79; (R1) 143.17;

GBP/JPY’s fall continues to as low as 141.05 so far and intraday bias remains on the downside. Decline from 156.59 is in progress for 139.29/47 key support level. On the upside, above 142.00 minor resistance will turn bias neutral and bring consolidation. But recovery should be limited well below 145.25 support turned resistance to bring fall resumption.

In the bigger picture, decline from 156.59 is seen as a corrective move. In case of deeper fall, strong support should be seen above 139.29 cluster support (50% retracement of 122.36 to 156.59 at 139.47) to contain downside and bring rebound. However, sustained break of 139.29/47 will confirm medium term reversal and turn outlook bearish for 122.36 (2016 low) again.