EUR/JPY Daily Outlook

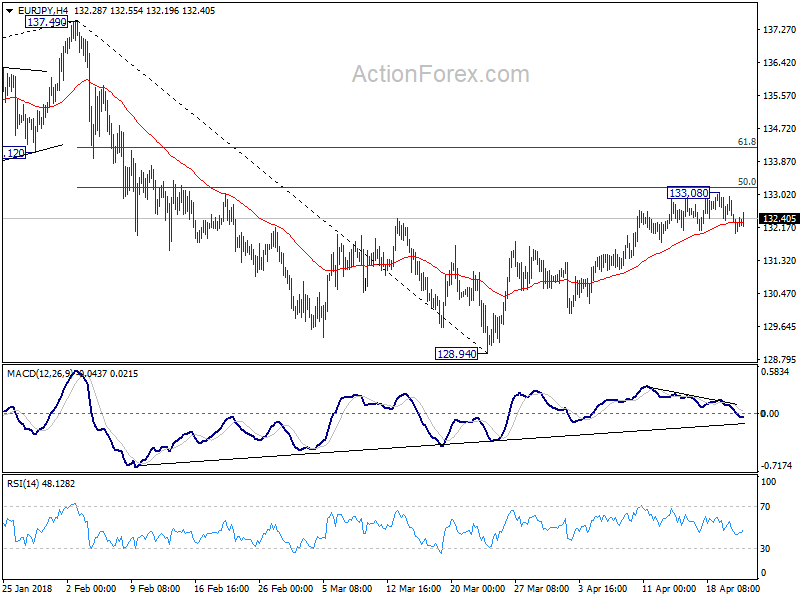

Daily Pivots: (S1) 131.86; (P) 132.41; (R1) 132.80;

The corrective rise from 128.94 is likely completed at 133.08, on bearish divergence condition in 4 hour MACD. Intraday bias is mildly on the downside for retesting 128.95 low. On the upside, above 133.08 will extend such rebound. But even in that case, upside will likely be limited by 61.8% retracement of 137.49 to 128.94 at 134.22 and below.

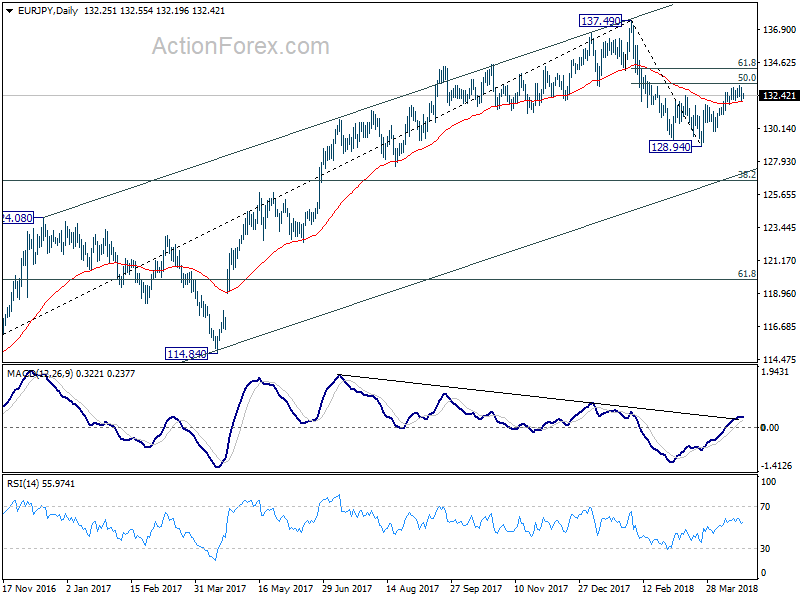

In the bigger picture, price action from 137.49 medium term top are developing into a corrective pattern. Strong support from 55 week EMA (now at 129.91) suggests that the first leg has completed at 128.94 already. Nonetheless, break of 137.49 is needed to confirm resumption of the rise from 109.03 (2016 low). Otherwise, we’d expect more corrective range trading, with risk of another fall to 38.2% retracement of 109.03 to 137.49 at 126.61 before completion.

GBP/JPY Daily Outlook

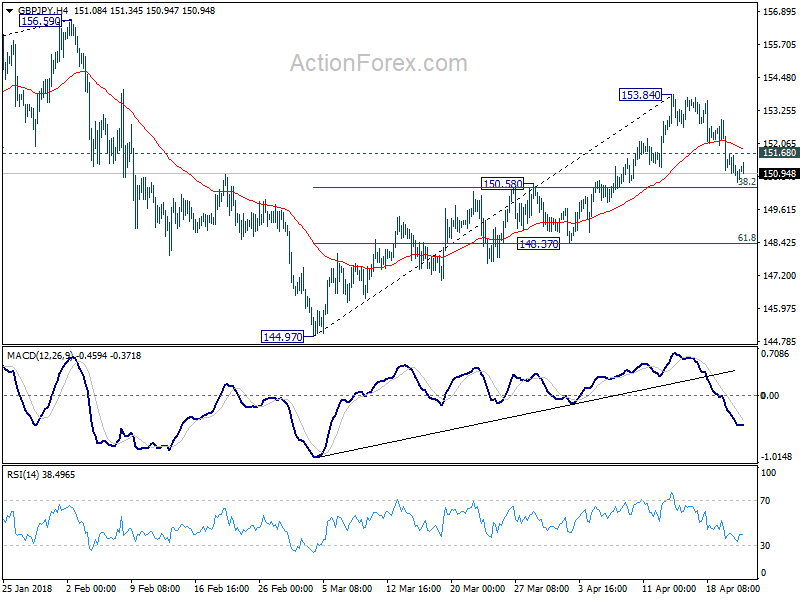

Daily Pivots: (S1) 150.30; (P) 151.00; (R1) 151.34;

Intraday bias in GBP/JPY remains on the downside for the moment. As noted before, corrective rise from 144.97 should have completed at 153.84 already. Deeper fall should be seen to 148.37 support first. Break will bring retest of 144.97 low. On the upside, above 151.68 minor resistance will turn intraday bias neutral first. But near term risk will now stay on the downside as long as 153.84 holds.

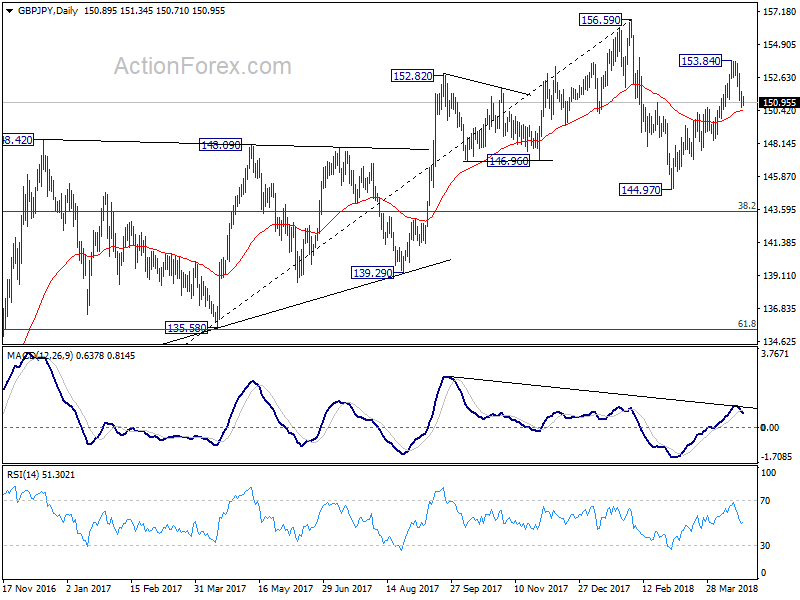

In the bigger picture, price actions from 156.59 are viewed as a corrective pattern. For now, we’d expect at least one more fall for 38.2% retracement of 122.36 to 156.59 at 143.51 before the consolidation completed. Though, firm break of 156.59 will resume whole up trend from 122.36 (2016 low) to 50% retracement of 195.86 (2015high) to 122.36 at 159.11 next.