EUR/JPY Daily Outlook

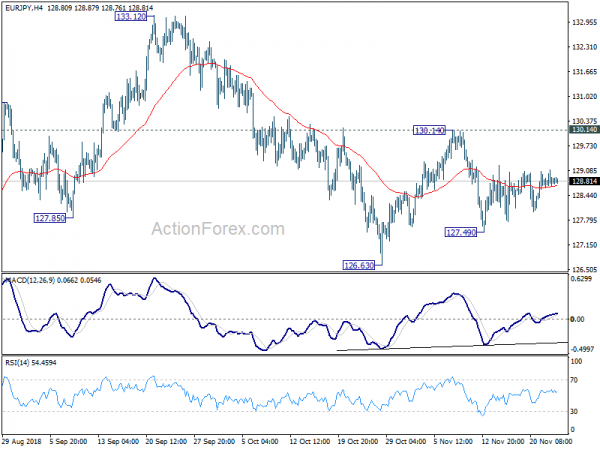

Daily Pivots: (S1) 128.61; (P) 128.86; (R1) 129.06;

EUR/JPY is staying in consolidation above 127.49 and intraday bias remains neutral for the moment. As long as 130.14 resistance holds, deeper decline is in favor in the cross. Below 127.49 will target 126.63 support first. Break there will resume whole fall from 133.12 and target 124.08/89 support zone. On the upside, however, break of 130.14 will resume the rebound from 126.63 towards 133.12 resistance.

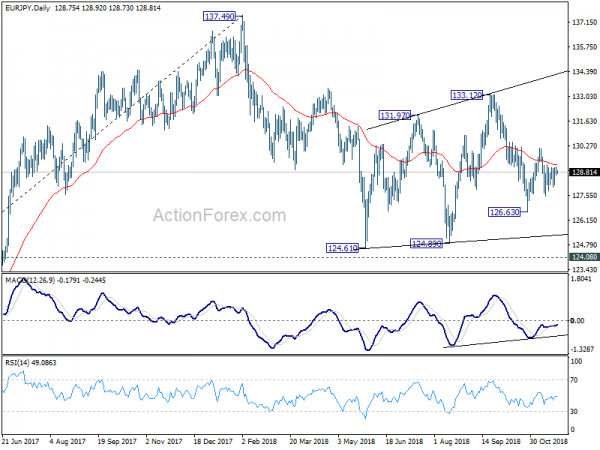

In the bigger picture, as long as 124.08 key resistance turn supported holds, larger up trend from 109.03 (2016 low) is still in progress. Firm break of 137.49 structural resistance will target 141.04/149.76 resistance zone next. However, decisive break of 124.08 will argue that such rise from 109.03 has completed and turn outlook bearish. In that case, deeper fall would be seen to 61.8% retracement of 109.03 to 137.49 at 119.90.

EUR/CHF Daily Outlook

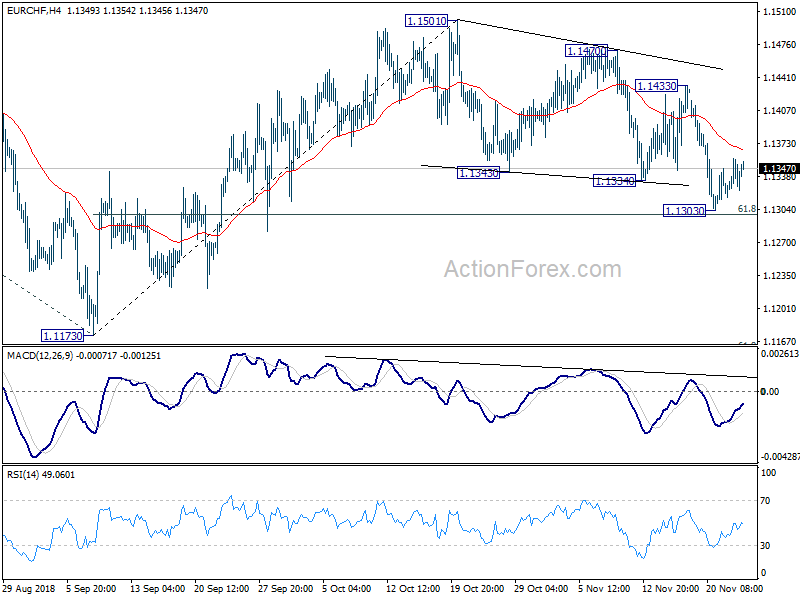

Daily Pivots: (S1) 1.1322; (P) 1.1340; (R1) 1.1364;

Intraday bias in EUR/CHF remains neutral at this point. Outlook is unchanged that price actions from 1.1501 are seen as a corrective pattern. Downside should be contained by 61.8% retracement of 1.1173 to 1.1501 at 1.1298 to bring rebound. On the upside, break of 1.1433 resistance will argue that the pull back has completed. Further rise should be seen back to 1.1501 resistance first. Break of 1.1501 will revive the case of bullish trend reversal. However, sustained break of 1.1298 will turn focus back to 1.1173 low.

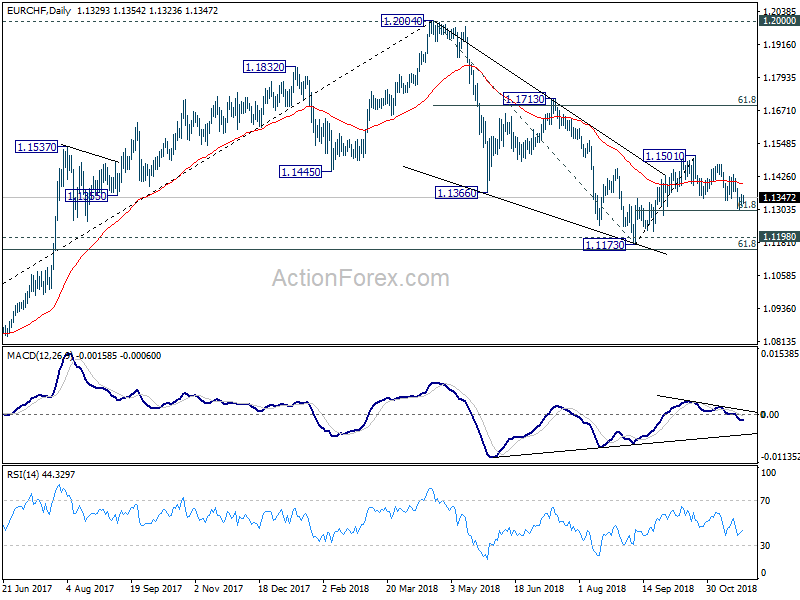

In the bigger picture, price actions from 1.2004 medium term top is seen as a correction only. Downside should be contained by support zone of 1.1198 (2016 high) and 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to complete it and bring rebound. This cluster level is in proximity to long term channel support (now at 1.1261) too. A break of 1.2 key resistance is still expected in the medium term long term. However, sustained break of the mentioned support zone will mark reversal of the long term trend. In that case, 1.0629 key support will be back into focus.