EUR/JPY Daily Outlook

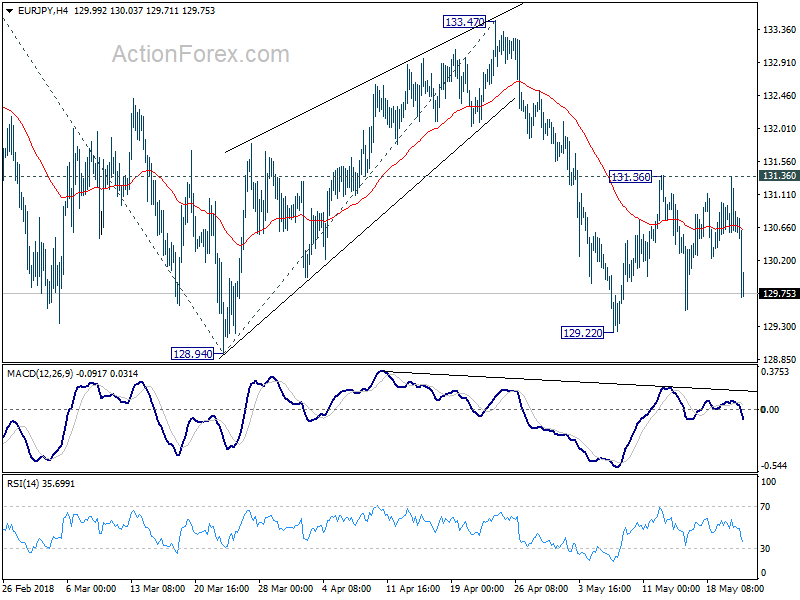

Daily Pivots: (S1) 130.36; (P) 130.85; (R1) 131.12;

EUR/JPY’s is staying in range of 129.22/131.36 and intraday bias remains neutral first. With 131.36 resistance intact, outlook remains bearish and further decline is expected. Break of 1.29.22 will target 128.94 first. Break will resume whole fall from 137.49 and target 61.8% projection of 137.49 to 128.94 from 133.47 at 128.18, and possibly further to 126.61 medium term fibonacci level. Nonetheless, break of 131.36 will dampen our bearish view and turn focus back to 133.47 resistance instead.

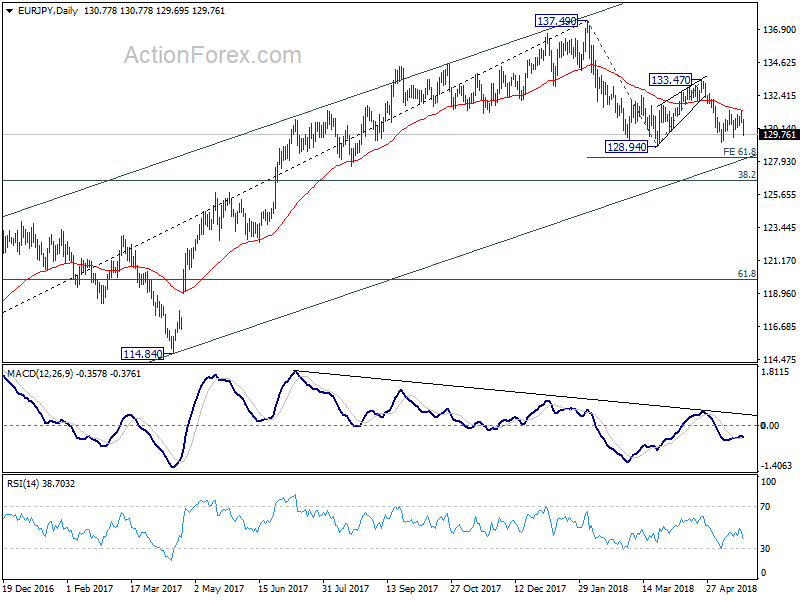

In the bigger picture, for now, price actions from 137.49 are viewed as a corrective pattern only. Hence, while deeper decline would be seen, strong support is expected at 38.2% retracement of 109.03 to 137.49 at 126.61 to contain downside and bring rebound. Up trend from 109.03 (2016 low) is expected to resume afterwards. Though, sustained break of 126.61 will be an important sign of trend reversal and will turn focus to 124.08 resistance turned support.

EUR/CHF Daily Outlook

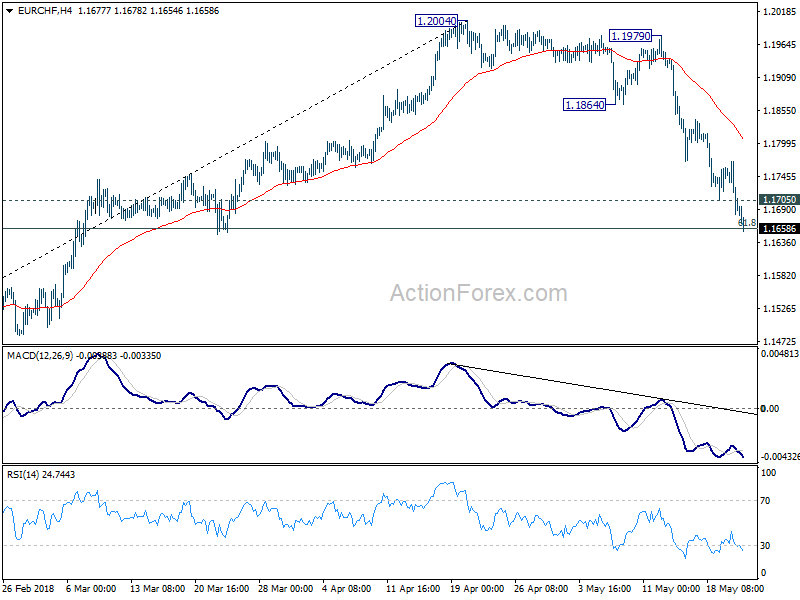

Daily Pivots: (S1) 1.1721; (P) 1.1743; (R1) 1.1781;

EUR/CHF’s decline resumed after brief consolidation and reaches as low as 1.1654 so far. Intraday bias is back on the downside. Sustained break of 61.8% retracement of 1.1445 to 1.2004 at 1.1659 will pave to way to key support level at 1.1445. We’d expect strong support from here to bring rebound, at least, on first attempt. On the upside, above 1.1705 minor resistance will turn bias neutral and bring consolidations first, before staying another fall.

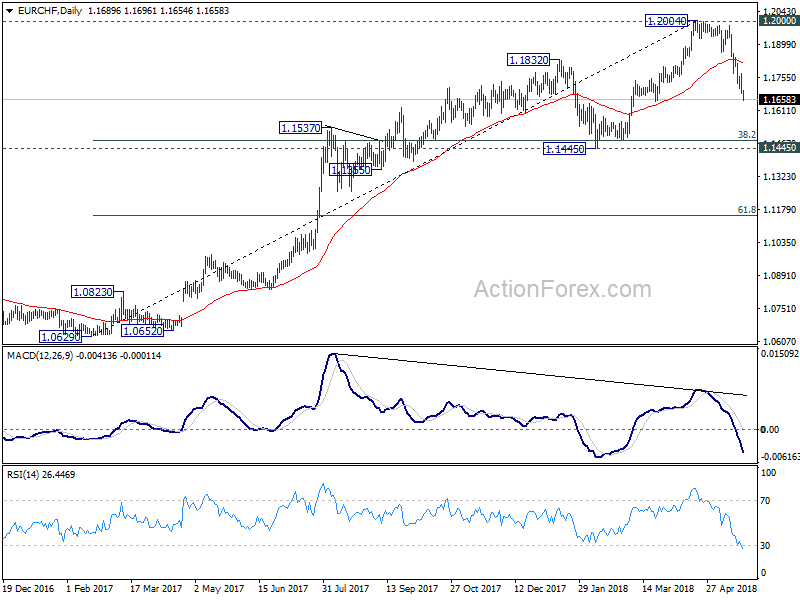

In the bigger picture, current development suggests solid rejection by prior SNB imposed floor at 1.2000. Considering bearish divergence condition in daily MACD, 1.2004 could be a medium term top. And price action from 1.2004 is correcting the up trend from 1.0629. Hence, for now, deeper fall could be seen back to 1.1445, which is close to 38.2% retracement of 1.0629 to 1.2004 at 1.1479. We’d expect strong support from there to bring rebound to extend the medium term corrective pattern.