EUR/GBP Daily Outlook

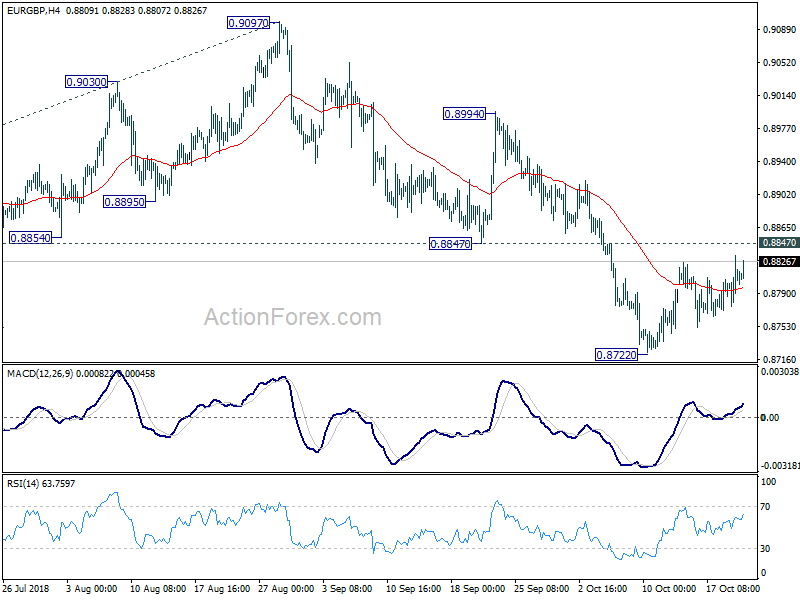

Daily Pivots: (S1) 0.8781; (P) 0.8808; (R1) 0.8840;

Intraday bias in EUR/GBP remains neutral first. Also, with 0.8847 support turned resistance intact, near term outlook stays bearish. . On the downside, break of 0.8772 will target 0.8620 low first. Decisive break there will resume whole down trend from 0.9304. In that case, next target will be 100% projection of 0.9305 to 0.8620 from 0.9097 at 0.8412. However, firm break of 0.8847 will indicate near term reversal and target 0.8994 resistance instead.

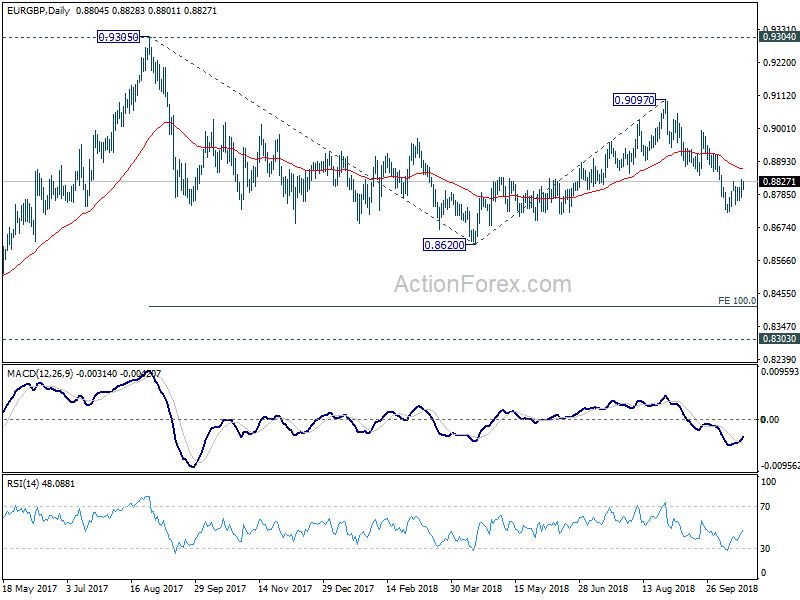

In the bigger picture, EUR/GBP is seen as staying in long term range pattern started at 0.9304 (2016 high). Current development suggests that fall from 0.9303, as a down leg in the pattern, is still in progress. But in case of deeper fall, downside should be contained by 0.8116 cluster support, 50% retracement of 0.6935 (2015 low) to 0.9304 at 0.8120, to bring rebound. On the upside, break of 0.9097 will target 0.9304 resistance instead.

EUR/JPY Daily Outlook

Daily Pivots: (S1) 128.80; (P) 129.24; (R1) 130.03;

EUR/JPY is staying below 130.29 minor resistance despite today’s rebound. Intraday bias remains neutral first. Considering bullish convergence condition in 4 hour MACD, break of 130.29 will in turn suggest completion of fall from 133.12. In this case, intraday bias will be turned back to the upside for retesting 133.12 high. On the downside, break of 128.32 will target 127.85 support first. Break will confirm completion of rebound from 124.89 at 133.12 and bring retest of this low.

In the bigger picture, current development suggests that EUR/JPY could have defended key support level of 124.08 key resistance turned support. And, the larger up trend from 109.03 (2016 low) is still in progress. Firm break of 137.49 structural resistance will target 141.04/149.76 resistance zone next. This will be the preferred case as long as 127.85 near term support holds. However, break of 127.85 will turn focus back to 124.08 key support level.