EUR/GBP Daily Outlook

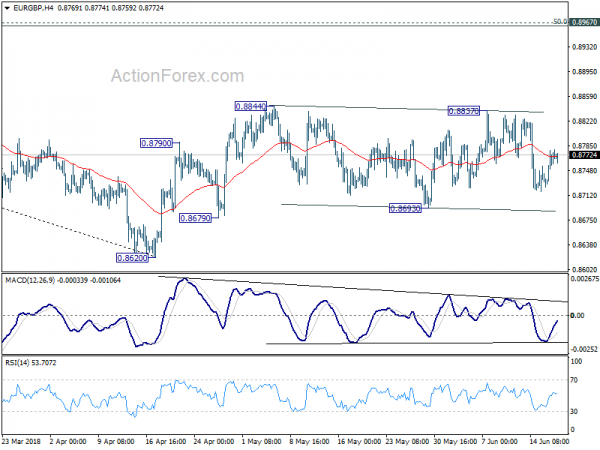

Daily Pivots: (S1) 0.8741; (P) 0.8761; (R1) 0.8793;

EUR/GBP is still bounded in range of 0.8693/8844 and intraday bias remains neutral. Outlook is unchanged that with .8693 minor support intact, we’d favor another rise. On the upside, break of 0.8844 will resume the rebound from 0.8620 for 0.8967 cluster resistance (50% retracement of 0.9305 to 0.8620 at 0.8963). However, break of 0.8693 will bring deeper fall back to retest 0.8620 low.

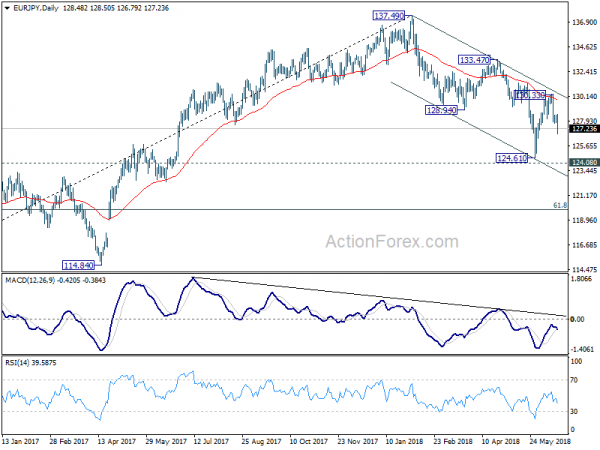

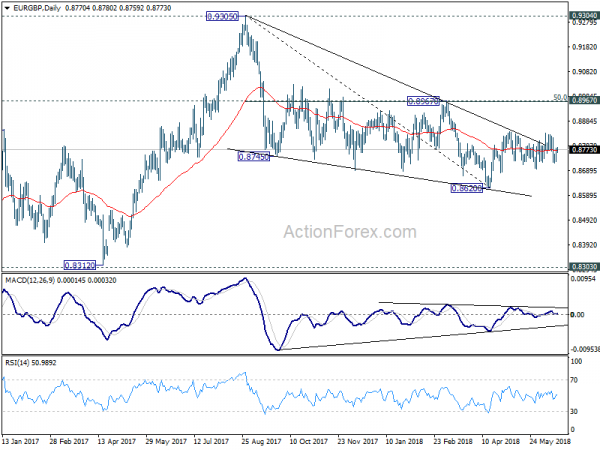

In the bigger picture, for now, the decline from 0.9305 is seen as a leg inside the long term consolidation pattern from 0.9304 (2016 high). Such consolidation pattern could extend further. Hence, in case of strong rally, we’d be cautious on strong resistance by 0.9304/5 to limit upside. Meanwhile, in another decline attempt, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.

EUR/JPY Daily Outlook

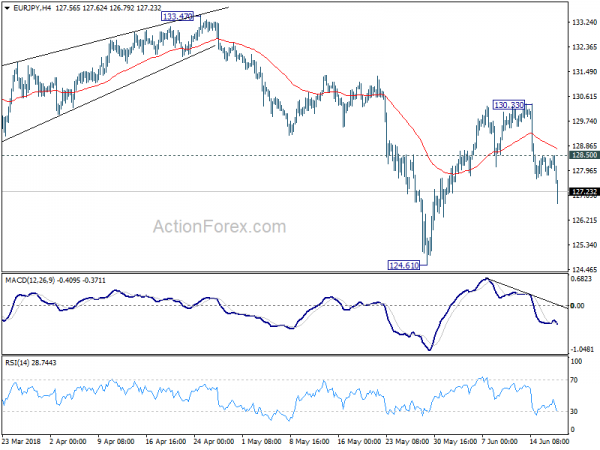

Daily Pivots: (S1) 127.99; (P) 128.30; (R1) 128.80;

EUR/JPY’s decline from 130.33 accelerates to as low as 126.79 so far. Rebound from 124.61 should have completed at 130.33 after rejection by 55 day EMA. Intraday bias is now on the downside for 124.08/61 support zone. On the upside, break of 128.50 minor resistance is needed to indicate completion of the fall. Otherwise, deeper decline will remain in favor even in case of recovery.

In the bigger picture, despite rebounding strongly ahead of 124.08 resistance turned support, there was no clear follow through buying. Note again that there is bearish divergence in daily MACD. Firm break of 124.08 will confirm trend reversal. That is, whole rise from 109.03 (2016 low) has completed at 137.49 already. In that case, deeper fall should be seen back to 61.8% retracement of 109.03 to 137.49 at 119.90 and below. Nonetheless, decisive break of 133.47 key resistance will likely extend the rise from 109.03 through 137.49 high.