EUR/GBP Daily Outlook

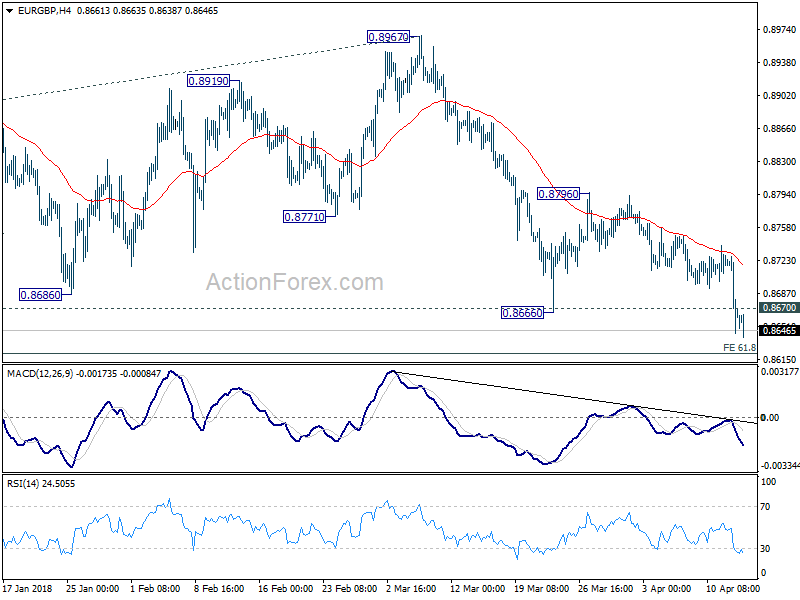

Daily Pivots: (S1) 0.8700; (P) 0.8677; (R1) 0.8712;

Intraday bias in EUR/GBP remains on the downside as fall from 0.8967 is in progress. 61.8% projection of 0.9305 to 0.8745 from 0.8967 at 0.8621 is first target. Sustained break there will pave the way to 100% projection at 0.8407. On the upside, above 0.8670 minor resistance will turn intraday bias neutral first. But outlook will now stay bearish as long as 0.8796 resistance holds.

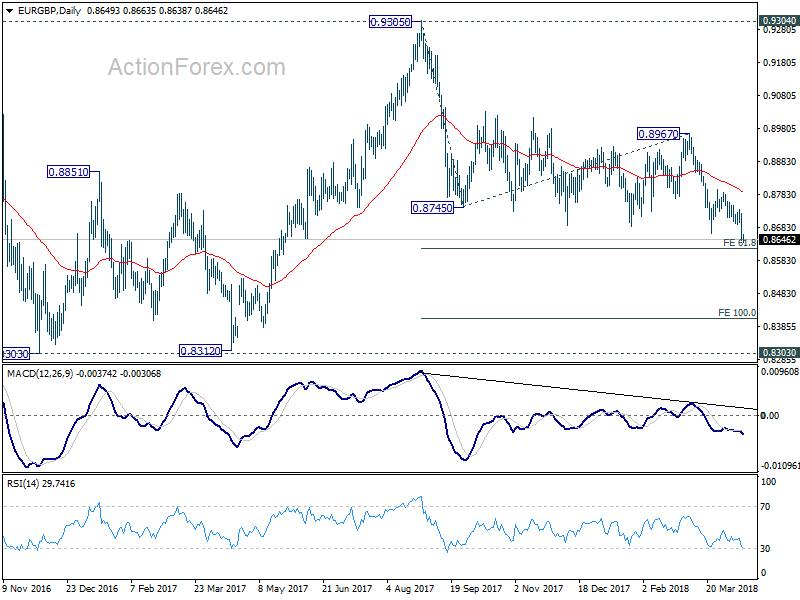

In the bigger picture, there are various ways to interpret price actions from 0.9304 high. But after all, firm break of 0.9304/5 is needed to confirm up trend resumption. Otherwise, range trading will continue with risk of deeper fall. And in that case, EUR/GBP could have a retest on 0.8303. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.

EUR/CHF Daily Outlook

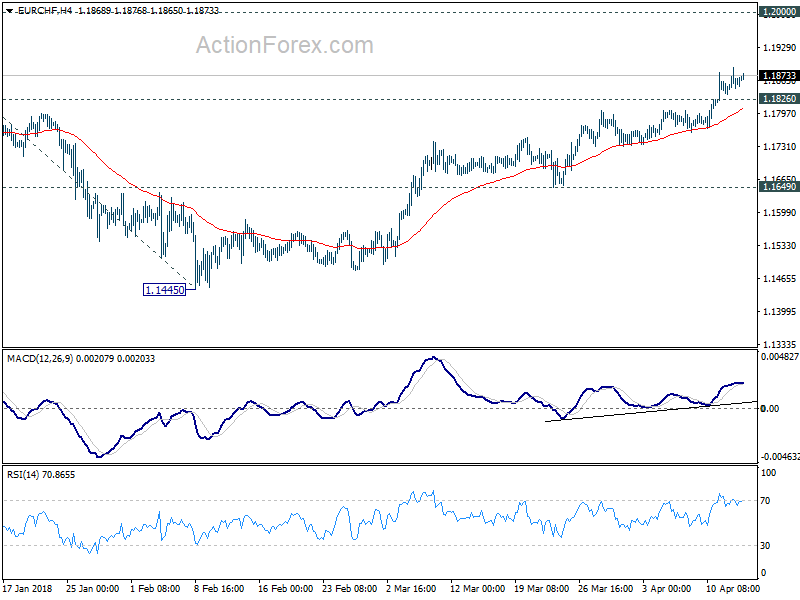

Daily Pivots: (S1) 1.1834; (P) 1.1862; (R1) 1.1887;

Intraday bias in EUR/CHF remains on the upside and further rally is expected to 1.2 handle first. Break will target 61.8% projection of 1.0629 to 1.1832 from 1.1445 at 1.2188 next. On the downside, below 1.1826 minor support will turn intraday bias neutral first. But retreat should be contained well above 1.1649 support to bring another rise.

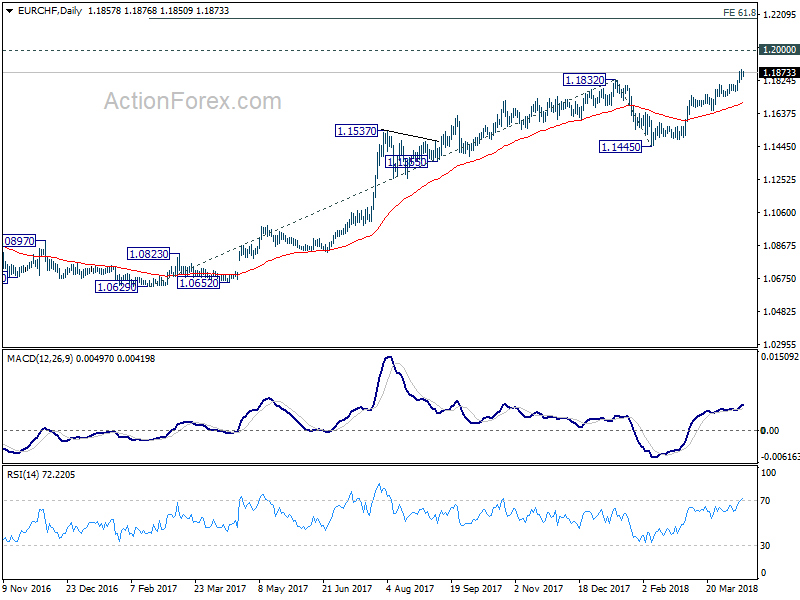

In the bigger picture, decisive break of 1.1832 should now extend the medium term up trend through prior SNB imposed floor at 1.2000. 2013 high at 1.2649should be the next target. Outlook will remain bullish as long as 1.1445 support holds, even in case of deep pull back.