EUR/GBP Daily Outlook

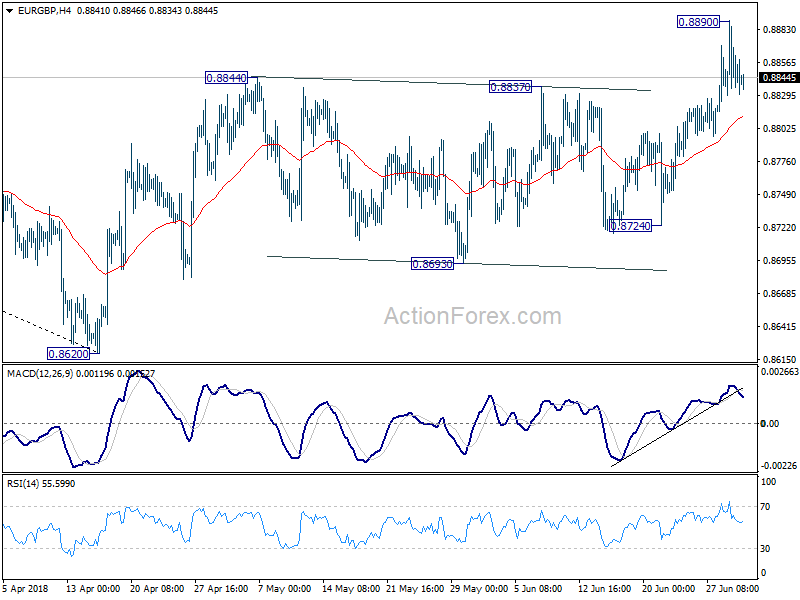

Daily Pivots: (S1) 0.8825; (P) 0.8858; (R1) 0.8879

Intraday bias in EUR/GBP remains neutral for consolidation below 0.8890 temporary top. Downside of retreat should be contained well above 0.8724 support to bring rise resumption. Above 0.8890 will target 0.8967 cluster resistance (50% retracement of 0.9305 to 0.8620 at 0.8963).

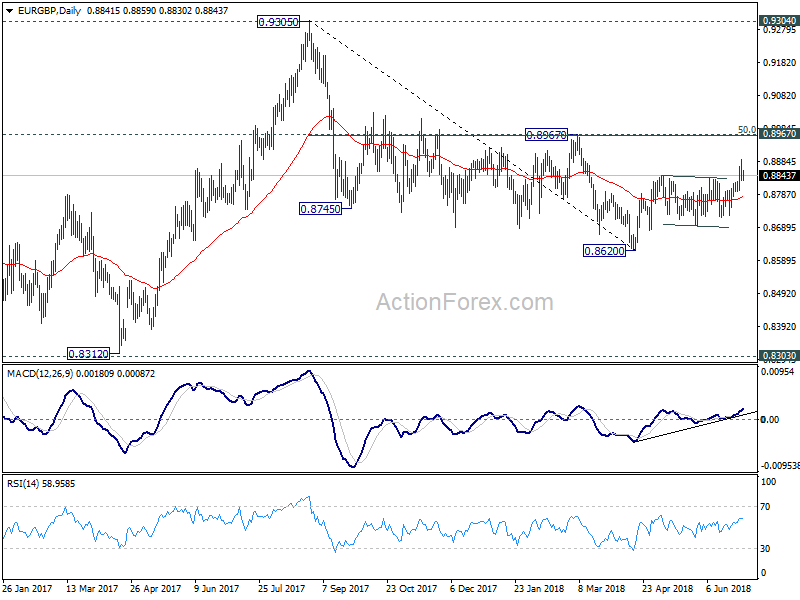

In the bigger picture, EUR/GBP is staying in long term consolidation pattern from 0.9304 (2016 high). Such consolidation pattern could extend further. Hence, in case of strong rally, we’d be cautious on strong resistance by 0.9304/5 to limit upside. Meanwhile, in another decline attempt, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.

EUR/CHF Daily Outlook

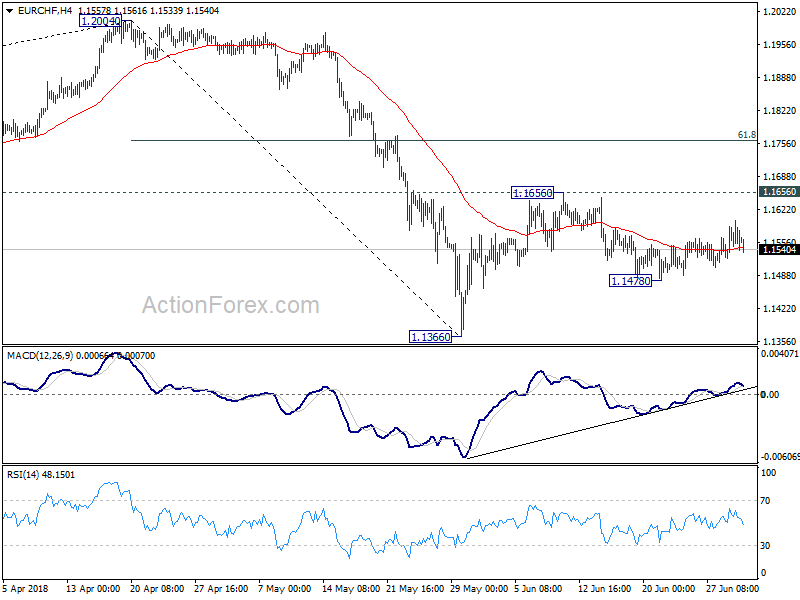

Daily Pivots: (S1) 1.1534; (P) 1.1568; (R1) 1.1605

Intraday bias in EUR/CHF remains neutral at this point. On the upside, break of 1.1656 will resume the rebound from 1.1366 to 61.8% retracement of 1.2004 to 1.1366 at 1.1760. But we would expect strong resistance from there to limit upside. For now, we’d expect at least one more falling leg before the correction from 1.2004 completes. Below 1.1478 will turn bias to the downside for 1.1366 and below.

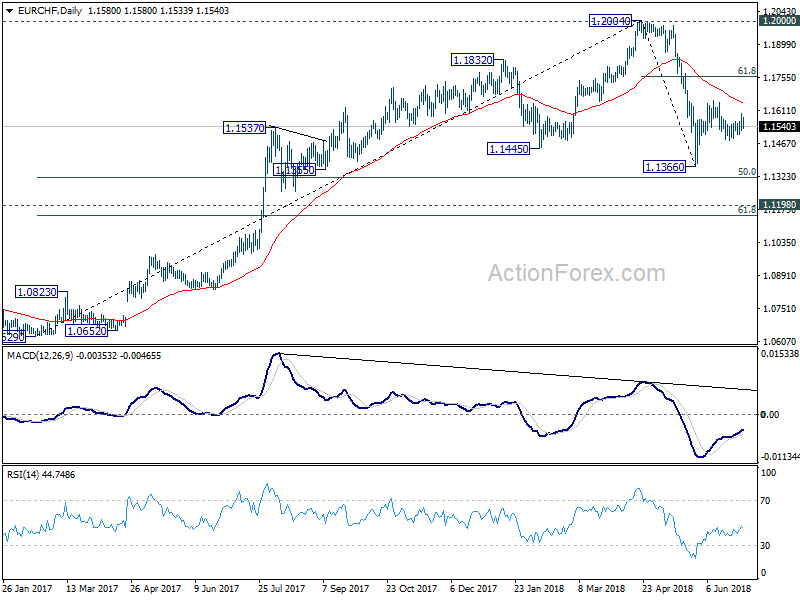

In the bigger picture, EUR/CHF was solidly rejected by prior SNB imposed floor at 1.2000. Considering bearish divergence condition in daily and weekly MACD, 1.2004 should be a medium term top. And price action from 1.2004 is correcting the up trend from 1.0629. Such correction is expected to extend for a while and therefore, we’re not anticipating a break of 1.2004 in near term. Another decline cannot be ruled out yet. But in that case, strong support should be seen at 1.1198 (2016 high), 61.8% retracement of 1.0629 to 1.2004 at 1.1154 to contain downside.