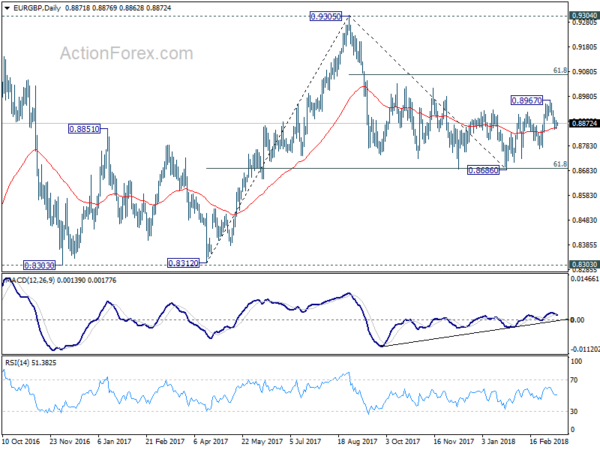

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8855; (P) 0.8870; (R1) 0.8890;

With 0.8896 minor resistance intact, intraday bias in EUR/GBP remains on the downside. Fall from 0.8967 should target 0.8871 support first. Break there will confirm completion of rebound from 0.8686 and target a retest of this low. On the upside, above 0.8896 minor resistance will turn bias neutral first. Further break of 0.8967 will resume the rebound from 0.8686 to 61.8% retracement of 0.9305 to 0.8686 at 0.9069.

In the bigger picture, there are various ways to interpret price actions from 0.9304 high. But after all, firm break of 0.9304/5 is needed to confirm up trend resumption. Otherwise, range trading will continue with risk of deeper fall. And in that case, EUR/GBP could have a retest on 0.8303. But we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.

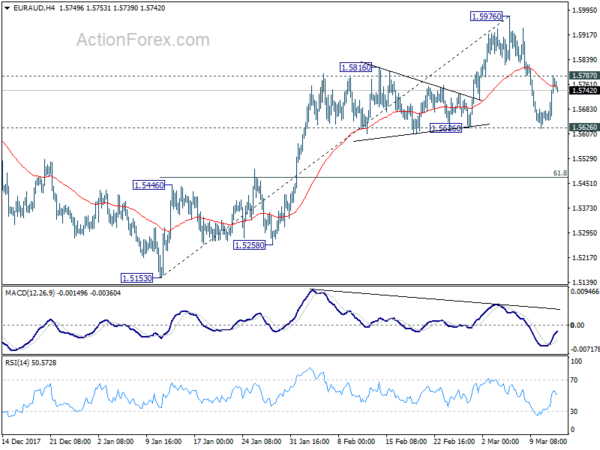

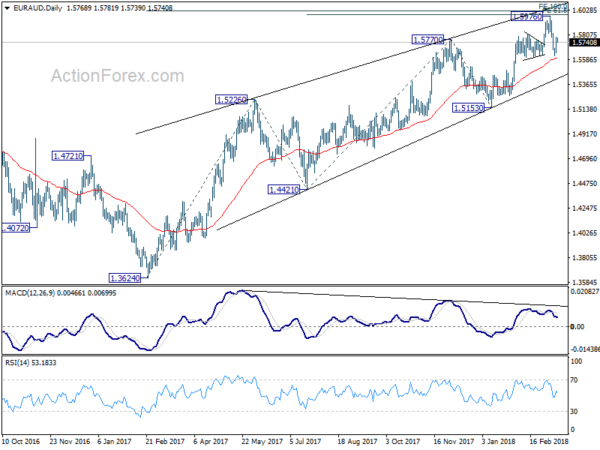

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5676; (P) 1.5733; (R1) 1.5820;

EUR/AUD rebounded after drawing support from 1.5626. Intraday bias is turned neutral first. On the upside, break of 1.5787 minor resistance will indicate completion of the pull back from 1.5976. And, intraday bias will be turned back to the upside for retesting 1.5976 high. ON the downside, decisive break of 1.5626 will target 61.8% retracement of 1.5153 to 1.5976 at 1.5467 and below.

In the bigger picture, change of medium term reversal is increasing with EUR/AUD just missing double projection target. They are 61.8% projection of 1.4421 to 1.5770 from 1.5153 at 1.5987, and 100% projection of 1.3624 to 1.5226 from 1.4421at 1.6023. Also, bearish divergence condition remains in daily MACD. Break of 1.5626 support will add to this bearish case and target 1.5153 key support for confirmation. Nonetheless, before that happens, as long as 1.5153 support holds, medium term rise from 1.3624 could still extend to retest 1.6587 high.